How to Automate Your Accounts Receivable Process

Managing accounts receivable (AR) involves collecting customer payments for goods and services. For many businesses, AR involves a time-consuming, manual process of generating invoices, tracking them, and managing collections. However, automating your accounts receivable can save your business time and resources. This step-by-step guide will walk you through how to streamline your AR process through automation.

| Step | Action |

|---|---|

| 1 | Understand Current Workflow – Analyze the existing AR process, identifying areas for improvement and inefficiencies. |

| 2 | Define Automation Goals – Clearly define goals, such as reducing processing time, minimizing errors, and improving cash flow. |

| 3 | Select Automation Software – Research and choose cloud-based AR software that seamlessly integrates with the accounting system. Key features: invoice generation, approval workflows, reporting, payment processing, and integration with your accounting system. |

| 4 | Clean Up Customer Master File – Conduct an audit and standardize customer records in the database to ensure accurate invoice synchronization. |

| 5 | Configure Workflows and Rules – Set up rules for efficient invoice routing, approval criteria, reminders, and exception workflows. |

| 6 | Integrate Systems – Integrate the AR automation software with the accounting system, bank accounts, CRM system, and payment gateways. |

| 7 | Train Employees – Provide comprehensive training to employees on using the new AR system and understanding the revised workflows. |

| 8 | Roll Out and Iterate – Gradually transition departments to the new AR system, monitor progress, gather feedback, and make necessary adjustments for continuous enhancement. |

Why is Automating Accounts Receivables Important?

Inefficient manual handling of accounts receivable processes, from invoicing to payment collections can quickly overwhelm your business. Challenges from a lack of automation include manual data entry leading to errors, delays in invoice processing, and the potential for lost or incorrect documentation.

These manual inefficiencies strain cash flow and risk deteriorating customer relationships due to errors and frustrations. Moreover, the lack of automation results in high administrative costs and difficulty monitoring and managing the accounts receivable process effectively. TD Bank estimates that paper invoices cost a business about $1.17 each to produce for a highly efficient operation and as much as $39 for a smaller, less efficient company, while typical processing time can last several days.

The absence of accounts receivable automation can significantly impact a company’s cash flow, leading to delayed payments and increased sales outstanding. Manual processes are prone to human errors, making invoice generation repetitive and tedious. These processes also lack the efficiency and speed that automation can provide. Without payment automation, businesses struggle to gain real-time insights, face challenges in customer service, and grapple with high processing costs, hindering their ability to maximize revenue and growth opportunities.

Key Opportunities for Automation in Accounts Receivable

In the realm of modern financial management, automation emerges as a catalyst for transformation within Accounts Receivable. It replaces manual tasks with streamlined efficiency and accuracy. By automating a few key tasks, businesses can optimize their AR processes, reduce manual intervention, enhance accuracy, and accelerate the collection of payments, ultimately leading to improved financial efficiency and business growth.

Efficient Customer Communication

Automated software can intelligently generate and dispatch customized emails or text messages to customers, prompting payments a week before they are due and sending reminders when necessary. This automation enhances the overall customer experience.

Seamless Invoicing

Automation enables the automatic generation and swift delivery of invoices. Invoices can be swiftly generated and dispatched digitally, ensuring a prompt billing process. Additionally, an automated system can identify the applicable tax rate for transactions involving taxes like VAT or sales tax, ensuring accurate tax collection.

Streamlined Digital Payment Processing

Automation allows businesses to establish a digital payment process, facilitating faster payments and an improved cash flow. It offers various payment options for customers, including auto-recurring payments and diverse payment methods. The system can automatically send payment receipt notices to customers upon receiving payments, enhancing transparency and efficiency.

Selecting the Right Software for Accounts Receivable Automation

Selecting suitable software to automate accounts receivable processes is a critical decision. Consider the following factors when choosing the right software for your business:

- Functionality: Ensure the software can cater to your specific accounts receivable needs, such as integrating with existing systems and complying with regulatory requirements.

- User-friendliness: Opt for a user-friendly interface that requires minimal training, enabling swift employee adoption and reducing the learning curve.

- Vendor Reputation and Support: Look for software that comes with comprehensive support services, including training, implementation assistance, and ongoing technical support.

- Scalability: Consider your business’s growth plans and ensure the software can scale efficiently with increased transaction volumes and organizational expansion.

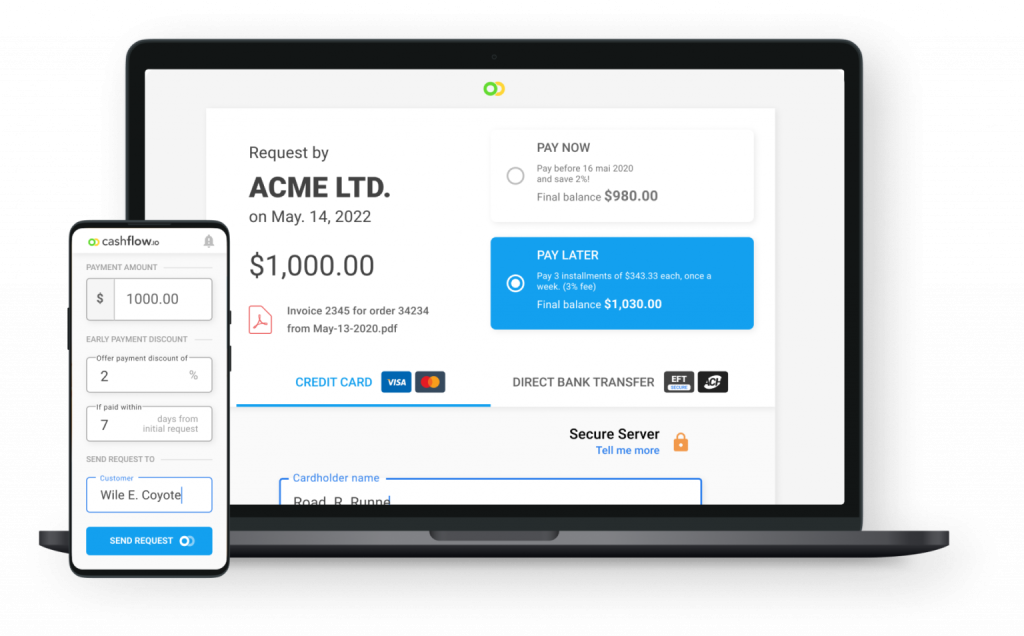

Choosing the appropriate accounts receivable automation software is essential for any business striving for financial efficiency and strategic growth. Cashflow.io shines as a comprehensive financial solution that simplifies receivables, automates payables, and provides instant financing options. Its flexible platform allows for automated customer invoicing and tailored payment schedules, significantly enhancing cash flow and reducing delays.

The software’s seamless integration capabilities mean you can swiftly integrate it without incurring additional costs. Moreover, its robust security measures guarantee complete financial safety. Backed by a dedicated customer support team and user-friendly, mobile-accessible dashboards, Cashflow.io streamlines your financial operations and adapts to your business’s changing needs. It is a comprehensive, secure, and scalable solution to empower your business’s financial management.

1. Understand Your Current AR Workflow

The first step is to fully map out your existing AR process. Document each step, from generating an invoice to receiving the final payment. Look for any bottlenecks or inefficiencies that may negatively impact your employees and customers. Some common pain points can include:

- Manual data entry of invoice details

- Difficulty tracking invoice status

- Delayed customer payments

- Double handling of invoices between departments

- High administrative costs

Understanding current workflows prepares you to build more efficient automated processes. You may find it helpful to create a flowchart diagramming each step.

2. Define Your AR Automation Goals

Next, clearly define the goals and benefits you want to achieve. Common goals of AR automation include:

- Reduced costs by eliminating manual tasks

- Faster processing and approvals

- Fewer errors from manual data entry

- Better visibility and control over outstanding payments

- Improved compliance with payment terms

- Enhanced customer relationships

Setting clear goals keeps all stakeholders aligned as you implement automation. Prioritize the areas of your process that need the most improvement.

3. Select Your AR Automation Software

With your goals in mind, research and select accounts receivable automation software. Look for a cloud-based platform that easily integrates with your accounting system. Key features to look for include:

- Invoice generation – Automatically creates and sends invoices with customizable templates.

- Payment tracking – Tracks customer payments and provides real-time payment status.

- Customer management – Maintains a database of customers to match payments to existing records.

- Reporting – Real-time dashboards and reports provide visibility into AR metrics.

- Payment processing – Supports various payment types like bank transfers, credit cards, and digital wallets.

- Accounting system integration – Seamlessly syncs invoice and payment data with your accounting platform.

When looking for an ideal solution, evaluate it against your must-have features, implementation options, and budget.

4. Clean Up Your Customer Master File

Before implementation, audit and clean up your customer master file. This database stores key customer information like contact details and payment preferences.

Having accurate, normalized customer records ensures payments easily sync up. Tackle duplicates, inconsistencies, and incorrect details. You may need to contact customers to validate information during this step, but it will only benefit both parties in the long run.

5. Configure Workflows and Rules

With your software selected, it’s time to configure your workflows and business rules. Set up rules determining:

- How invoices are sent to customers.

- Reminders for pending payments.

- Which invoices route to an exception workflow for manual review.

Start with basic rules and gradually build on your configuration. Work closely with your AR team to ensure the rules match your processes.

6. Integrate Systems

The integration with your accounting system is the cornerstone of efficient AR management. It facilitates seamless synchronization of approved invoice and payment data between your AR software and the accounting system. This synchronization ensures that all financial transactions are accurately recorded in your books, providing a comprehensive and up-to-date view of your financial health.

- Accounting system – Syncs approved invoice and payment data. Popular integrations include QuickBooks Online, Sage Intacct, and Microsoft Dynamics.

- Bank account – Enables real-time updating of payment statuses.

- CRM system – Imports customer data and interactions to personalize communications.

- Payment gateways – Can directly receive payments through integrated gateways.

- Financing – A great tool will allow access to financing.

Thoroughly test your integrations before you launch your new AR automation tool. Smooth system handshakes ensure that you can maintain business continuity and have a seamless launch.

7. Train Employees

Training employees is crucial to seamlessly implementing Accounts Receivable (AR) automation within your organization. Beyond the AR team, it’s vital to extend comprehensive training to various departments involved in the AR process. They need to become proficient in managing the AR automation software, mastering its features, and effectively utilizing automation tools to optimize workflows.

Employees should also grasp the new workflows and policies associated with AR automation, aligning their roles with the revamped processes. Combining training guides with hands-on practice ensures practical understanding, and swiftly addressing knowledge gaps is essential for a smooth transition.

8. Roll Out and Iterate

With training complete, you’re ready to launch! Gradually transition departments one by one onto the new system. Closely track results and gather feedback during the rollout to ensure that your launch has made a measurable impact on your business. Some of the most commonly tracked key performance indicators for accounts receivables are:

- DSO (Days Sales Outstanding): Time to collect payments.

- Average Days Delinquent: Invoice payment delays.

- Turnover Ratio: Receivables turnover frequency.

- CEI (Collection Effectiveness Index): Efficient collections measure.

- Number of Revised Invoices: Invoice correction frequency.

- Staff Productivity: Team efficiency in collections.

- Bad Debt to Sales Ratio: Uncollectible accounts ratio.

- Percentage of Credit Available: Credit utilization ratio.

Stay open to adjusting settings and processes based on what you learn along the way. Monitor how quickly invoices are processed and if payments are on time. Always strive to make things better, so you get the most out of using AR automation.

What are the Key Benefits of AR Automation?

Automating the management of accounts receivable (AR) processes yields significant advantages, profoundly streamlining workflows and presenting several benefits:

1. Optimized Workflow

Automation substantially reduces processing time for paperwork and payments, resulting in a highly efficient workflow. This empowers the AR team to redirect their efforts towards strategic initiatives, propelling the business towards its goals.

2. Improved Cash Flow

Efficiency gains, especially in invoicing, translate to faster payments, ultimately boosting cash flow. Automation can lead to a reduction in Days Sales Outstanding (DSO), a pivotal metric reflecting payment collection time. Recent research indicated that 62% of businesses witnessed an improvement in DSO after implementing AR automation.

3. Cost Savings

Automation, notably through e-invoicing, substantially trims the expenses associated with traditional invoicing. It curtails costs related to paper usage, ink, storage, postage, and delivery. Moreover, automation decreases labor costs and minimizes the number of write-offs due to unpaid invoices, making it a cost-effective solution.

4. Enhanced Precision

By minimizing human involvement, automation significantly reduces the occurrence of human errors, resulting in improved data consistency. This translates to fewer duplicated invoices, reduced billing disputes, and ultimately, heightened customer satisfaction.

5. Robust Reporting

Automated AR dashboards offer real-time reporting on customer payment statuses and facilitate AR aging tracking. The software accurately monitors the status of outstanding receivables, empowering business managers to take timely actions for better cash flow management and increased chances of successful payments.

6. Elevated Customer Relations

Automation’s precision and reduction in billing errors contribute to smoother customer relations. Satisfied customers tend to place more trust in the company, enhancing overall customer experience and potentially leading to increased customer loyalty.

7. Facilitating Compliance

As businesses expand and operate in diverse markets, managing region-specific compliance requirements becomes intricate. Automation software manages these complexities, ensuring compliance with regional laws and regulations.

However, while automation offers numerous advantages, some businesses may express concerns, including:

8. Ease of Adoption

Shifting to automation may pose initial challenges, especially for businesses deeply entrenched in manual processes. Employees may require time to acclimate to new software. However, with appropriate training and support, the automated process gradually becomes second nature, substantially reducing the workload on the AR team.

9. Control Enhancement

Contrary to concerns, automation often enhances control. Businesses can tailor automation software to align with their policies and procedures. Automation enables predefined events, such as payment reminders, without manual intervention, providing increased control over the AR process.

10. Implementation Costs

Implementing automation incurs initial costs for software acquisition and employee training. However, efficiency and productivity gains usually offset these costs, resulting in long-term cost savings. Platforms such as Cashflow.io offer a pay-as-you-grow approach. This lets you experiment without significant upfront investment.

In Conclusion

In summary, automating your accounts receivable process takes careful planning and execution. If you want to reduce costs and improve your AR team’s efficiency, consider looking into Cashflow.io. These eight steps will help you streamline AR workflows, reduce costs, and unlock new efficiencies. Partnering with internal teams and your chosen software vendor is important throughout implementation. Maintain open communication and be ready to iteratively improve over time. Your organization can readily embrace AR automation with the right preparation and software.