The 15 Key Benefits of AR Automation

For any business that offers credit terms to customers, managing accounts receivable (AR) is a crucial process. However, handling AR manually can be incredibly tedious, time-consuming, and error-prone.

Automating accounts receivable can help businesses streamline operations, reduce costs, improve cash flow, and enhance the overall customer experience. Here are some of the key benefits of AR automation:

Key Points to Remember:

- AR automation streamlines manual tasks in accounts receivable, improving processes from invoicing to collections.

- Main advantages encompass cost reduction and quicker cash flow, benefiting most businesses.

- Enhanced customer service, improved security, and better management insights are added advantages.

- Integration of AR systems with order management and accounting software maximizes the benefits of automation.

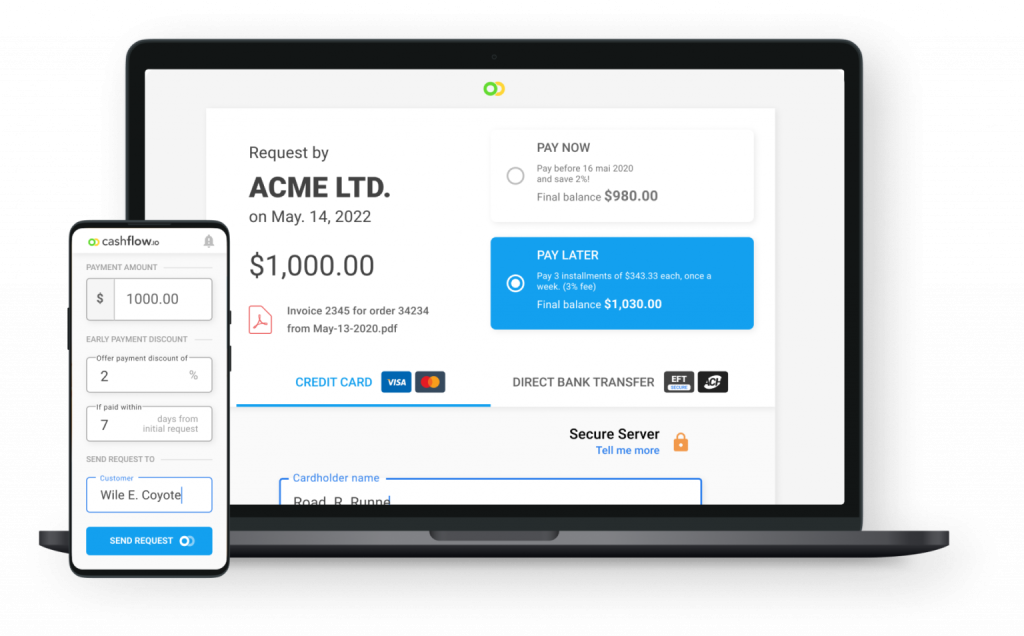

- You can leverage powerful accounts receivable automation tools like Cashflow.io to help automate everything from collections to sending payments.

1. Reduced Processing Costs

Manually processing invoices and collecting payments is labor-intensive. Employees have to spend significant time sending invoices, logging payments, updating customer accounts, and chasing down late payments. This repetitive work ties up employee time that could be better spent on more strategic tasks.

With AR automation software, much of the manual work is eliminated. Automated payment reminders and follow-ups reduce the need for employees to call customers about late or missing payments. Rules-based workflows automatically route invoices after issuance and payments after receipt, saving employees from an endless cycle of data entry.

According to research from Ardent Partners, the average cost to process an invoice manually is over $11 versus just $2.50 with automation. That’s a 77% reduction in processing costs, saving valuable time and dollars.

2. Faster Cash Flow

When AR is handled manually, invoices and payments can get lost or delayed, slowing down cash flow. Mailing paper invoices extends the time for customers to receive and pay them. Payments received have to be manually entered into accounting systems to update receivables. These lags mean businesses have to wait longer for revenue.

Automating AR accelerates cash flow and gives your business access to capital sooner. eInvoicing shortens invoice delivery time, and automated payment reminders prompt customers to pay more quickly. Integrations with bank accounts and payment gateways allow electronic payments to automatically update AR. Rules-based workflows reduce time matching payments to invoices. When combined together, this reduces invoice-to-cash cycles and days sales outstanding (DSO).

For example, Cashflow.io was able to help customers reduce DSO by 3-12 days after implementing its AR automation solution. This resulted in a 10-20% improvement in cash flow for businesses using the platform.

3. Fewer Errors

Processing AR manually leaves ample room for human error at every step. Employees make simple mistakes, like entering incorrect client data on invoices. They may apply payments to the wrong customer accounts – leading to headaches for both your business and your customers.

AR automation minimizes these mistakes by standardizing and streamlining processes. Customer and product data can flow directly from your CRM and ERP systems into invoices, eliminating double entry. Automated payments match to accounts, avoiding misapplication of funds. Invoice templates ensure all required fields like due dates are included – which can prevent misapplication issues.

Implementing an automated AR tool improves overall AR accuracy and reduces costly issues with invoice reworking. Finance teams will spend less time fixing errors and answering customer complaints, and help your business recoup revenue lost from mistakes.

3. Better Reporting and Insights

With manual processes, gathering AR data is difficult. Employees can generate endless reports that clog up databases and lead to useless duplication. Sales, accounting, and credit teams will often maintain separate spreadsheet records. Consolidating information across sources to gain a complete picture takes a significant amount of time, money and effort.

AR automation centralizes all AR data in one cloud-based system, while APIs easily connect to other business applications. Customizable dashboards provide real-time visibility into AR metrics like past due invoices, days sales outstanding, and cash flow forecasts. This gives executives, managers, and staff self-service access to insights. No more chasing down reports!

Enhanced reporting and analytics help continuously improve AR operations. Teams can identify issues requiring attention like high customer balances. Managers can track employee productivity and workload. Business leaders gain greater visibility into future cash flow and revenue recognition.

4. Improved Customer Experience

Lack of payment visibility and inefficient collection practices with manual AR take a toll on the customer experience. Customers get frustrated if they have no online portal to view balances and transaction history. Tedious payment options like mailing checks create extra work for them. Excessive collections calls from the finance team anger customers.

Self-service customer portals provide 24/7 account visibility and allow your customers to pay outstanding balances conveniently with minimal interaction from your AR team. Electronic payment options like payment gateways, eChecks, and credit cards offer convenient ways to pay. Rules-driven contact strategies with email, text, phone avoid badgering customers about unpaid invoices.

This customer-centric approach increases loyalty and retention as clients feel empowered, not hassled. Leading businesses recognize customer experience is now a competitive advantage when done right.

5. Improved Compliance

Managing AR manually makes it difficult to stay compliant with accounting regulations and revenue recognition standards. Policies like GAAP provide strict guidelines surrounding revenue recording that can be hard to achieve without automation.

AR software centralizes information and integrates systems to support compliance. Revenue recognition rules can be configured to automatically book revenue correctly as invoices are issued. Journals are automatically created upon payment receipt. Compliance requirements like ASC 606 become seamless with automation.

6. Enhanced Security

Traditional paper-based AR depends heavily on physical documents being passed around and stored securely. This leaves ample opportunity for invoices, contracts, and payment information to get lost or end up in the wrong hands. Digitizing this information only helps so much if records are scattered across emails, file servers, and desktops.

AR automation stores all customer and transaction data in a single, secure, cloud-based platform. Advanced encryption protects sensitive information. Role-based access controls restrict visibility of confidential documents. Automating AR minimizes vulnerabilities of physical security while offering visibility into who accessed and modified records.

7. Improved Scalability

Relying on manual processes handicaps the ability of AR teams to grow and take on more volume. There is a ceiling to how many transactions and customers an employee can handle effectively when everything is done by hand. At a certain point, quality, speed, and satisfaction deteriorate.

Automating AR delivers the scalability that high-growth businesses need. Workflows handle large volumes without human intervention. Digital storage offers unlimited capacity. New customer onboarding and data inputs can be automated. Self-service portals allow AR teams to support more customers without extra staff. This elasticity enables businesses to scale rapidly when needed.

8. Improved Scalability

Relying on manual processes severely limits the ability of AR teams to grow and take on more volume. There is a hard ceiling to how many transactions and customers an employee can handle effectively when everything is done by hand. At a certain point, quality, speed, and satisfaction will deteriorate as volumes increase.

Automating AR provides the scalability and elasticity that high-growth businesses need. Digital workflows can handle large transaction volumes without human intervention. Cloud-based storage offers unlimited capacity as data needs expand. New customer onboarding and data inputs can be automated to handle growth. Customer self-service portals allow AR teams to support more accounts without extra staff. This flexibility enables companies to scale up or down rapidly as business needs change.

9. Increased Productivity

Automating repetitive, manual AR tasks like sending dunning notices and logging payments frees up employee time for more value-added work. Your AR staff is no longer bogged down chasing payments and doing data entry. Instead, they can focus on strategic initiatives like boosting collections through targeted outreach, improving credit policies, and refining processes.

According to research by Ardent Partners, AR automation increases employee productivity by over 20% on average. Staff hours formerly eaten up by manual data entry can be reallocated to forward-looking activities that directly impact the bottom line. Your team spends less time on the busy work of AR management and more time making an impact.

10. Lower Operating Expenses

There are a variety of costs associated with manual, paper-based AR processes that automation can optimize. These include expenses related to labor, materials, equipment, storage, postage, and general overhead. Converting from manual methods to automated AR systems reduces wasted spend in all these categories.

For example, automated invoice delivery alone cuts paper and mailing costs down to a fraction of manual methods. Cloud-based digital storage eliminates needs for filing cabinets, scanners, shredders, and dedicated back-office space to store records. Reductions in labor expenses were already covered. Altogether, AR automation meaningfully improves operating margins by optimizing variable and fixed costs.

11. Increased Cash Forecasting Accuracy

Creating accurate cash flow forecasts is difficult with fragmented, manual AR processes that lack real-time data visibility. Automating AR provides consolidated data and key metrics all in one system to enable precise forecasting models.

Executives gain clear insights into expected future cash inflows based on invoices issued, projected collections on past dues, and assumptions on bad debts. This allows for better-informed, strategic decision-making around growth opportunities. Automated forecasts also ensure proper cash reserves on hand to meet obligations.

12. Lower DSO

Days Sales Outstanding (DSO) is a crucial metric in understanding the efficiency of a company’s cash flow and accounts receivable. Automating accounts receivable processes significantly reduces DSO by expediting invoice delivery, payment reminders, collections follow-up, and cash application. By streamlining these processes, businesses can accelerate the payment cycle, ensuring that outstanding invoices are settled faster. This improvement in the cash conversion cycle directly enhances liquidity, providing the organization with access to capital that can be leveraged for both operational needs and growth initiatives.

Leading AR automation solutions, such as Cashflow.io, have demonstrated impressive reductions in customer DSO ranging from 10-20% or more. Even seemingly modest reductions in DSO translate to substantial improvements in cash flow, which can be instrumental in propelling the business forward. By harnessing the power of automation to optimize DSO, companies can better manage their financial resources, ultimately enhancing their ability to invest in innovation, expansion, and other strategic pursuits.

Efficient DSO management isn’t just about accelerating payments; it’s about maintaining a healthy cash flow that allows businesses to seize opportunities and navigate challenges with financial confidence. Automated systems play a critical role in this endeavor by not only reducing DSO but also providing insights and analytics that enable organizations to make informed decisions for further optimizing their cash conversion cycles.

13. Audit-Ready System

Maintaining an audit-ready system is a paramount requirement for businesses to ensure compliance and data accuracy in their accounts receivable processes. Manual and fragmented AR processes can present challenges in achieving this level of readiness. Automating AR centralizes data and system access, creating a structured and organized environment that facilitates easy monitoring, tracking, and validation. Automated audit logs offer a detailed view of all AR transactions, including user activities and timestamps, enhancing transparency and accountability within the system.

Furthermore, automation introduces business rules and validations that ensure data accuracy and integrity. Role-based access controls restrict unauthorized changes to sensitive financial data, bolstering security and compliance measures. By incorporating these features, automated AR systems simplify the auditing process and significantly reduce the likelihood of errors or discrepancies that may arise from manual handling. This streamlines internal auditing procedures and ensures seamless compliance with external regulatory requirements.

14. Increased Collections

Efficient and timely collection of payments is vital to maintaining a healthy cash flow and optimizing accounts receivable. Automation significantly contributes to increased collections by employing automated payment reminders and intelligent retry rules. These automated reminders are systematic and consistent, ensuring that customers are reminded promptly of their payment obligations. By automating this follow-up process, businesses capture more missed or failed payments that might otherwise be overlooked, reducing revenue leakage and improving the company’s overall financial health.

Customizable dunning workflows are a key feature of AR automation. These workflows enable businesses to tailor the collection process to suit their needs, ensuring a personalized and effective collection approach. Automatic payment retries efficiently handle issues like expired cards or closed accounts, providing multiple opportunities to secure payment before considering write-offs. By leveraging these automated features, companies can optimize collections and ensure that outstanding payments are recovered, contributing to a more robust and reliable revenue stream.

15. Seamless Integration

The most effective AR automation solutions integrate seamlessly across your existing tech stack, from accounting software to CRMs and beyond. Tight integration prevents duplicate data entry and keeps all systems in sync.

Modern solutions offer open APIs, webhooks, and configurable connectors to enable integration. Look for platforms with pre-built integrations to popular business apps like QuickBooks, Sage, SAP, NetSuite and others. Avoid solutions that operate as an island.

Choosing the Right Accounts Receivable Automation Software

Opting for the right software to automate your accounts receivable processes is a crucial decision. Here are key considerations when making this choice:

- Functionality: Ensure the software aligns with your specific accounts receivable requirements, integrating smoothly with existing systems and meeting regulatory standards.

- User-friendliness: Prioritize a user-friendly interface to minimize training needs, enabling a quick adoption by employees and reducing the learning curve.

- Vendor Reputation and Support: Look for software that offers extensive support, encompassing training, implementation aid, and continuous technical assistance.

- Scalability: Consider your business growth plans and confirm that the software can efficiently scale to accommodate increased transaction volumes and organizational expansion.

Selecting the right accounts receivable automation software is fundamental for businesses aiming at financial efficiency and strategic growth. Cashflow.io is a holistic financial solution that simplifies receivables, optimizes payables, and provides instant financing options. Its adaptable platform facilitates automated customer invoicing and customized payment schedules, significantly improving cash flow and minimizing delays.

The software’s smooth integration capabilities ensure a cost-effective and swift onboarding process. Furthermore, its robust security measures assure complete financial safety. Supported by a dedicated customer support team and intuitive, mobile-accessible dashboards, Cashflow.io streamlines your financial operations and adjusts to your evolving business needs. It is a comprehensive, secure, and scalable solution that empowers your business’s financial management.

In Conclusion

Cashflow.io is the ideal choice for accounts receivable automation, delivering a comprehensive financial solution that simplifies processes, optimizes cash flow, and offers instant financing options. Its adaptability, seamless integration, robust security, and dedicated support make it a standout option, empowering businesses for efficient and secure financial management.

Manually managing AR leaves too much room for delays, errors, lack of visibility, and poor customer experiences. AR automation addresses these pain points through streamlined workflows, data centralization, and smarter customer engagement strategies. Handling AR no longer needs to be a tedious manual process. Automation delivers game-changing performance improvements that impact the bottom line.