20 Powerful Accounts Receivable Automation Best Practices for 2023

In the world of contemporary business, efficiency is crucial. Accounts receivable (AR) automation has emerged as a solution to the challenges posed by manual AR management, offering enhanced productivity, improved accuracy, better visibility, and cost savings. Manually managing accounts receivable (AR) is inefficient, risky, and costly for any business. The benefits of AR automation can help businesses realize major gains in productivity, accuracy, visibility and cost savings.

This article provides a detailed guide with 20 best practices to make the most of automating AR workflows. It covers steps like outlining the AR process, integrating billing systems, providing various payment options to customers, configuring email notifications and reminders, implementing online payment portals, automating cash applications, and utilizing analytics for continuous improvement.

Best Practices at a Glance

| Number | Best Practice | Key Points |

|---|---|---|

| 1 | Thoroughly Map Out Each Step in Your AR Process | Document detailed sequence of tasks in AR process for automation workflow |

| 2 | Integrate Billing System with Accounting Platform | Enable real-time data sync between billing and accounting systems |

| 3 | Give Customers Multiple Payment Options | Offer 5 or more payment options for faster on-time payments |

| 4 | Configure Customized Email Notifications and Reminders | Automate email notifications at various stages of invoicing and collections |

| 5 | Give Customers a Branded Online Payment Portal | Implement a branded online portal for convenient viewing and payments |

| 6 | Let Software Automatically Apply Cash | Automate matching of incoming payments to open invoices |

| 7 | Build Custom Interactive Dashboards for Real-Time Visibility | Create dashboards for key AR metrics and KPIs |

| 8 | Control System Data Access with Role-Based Permissions | Ensure data access control through customized role permissions |

| 9 | Automate Customer Credit Checks and Transaction Approvals | Integrate with credit bureaus for automated credit checks and approvals |

| 10 | Leverage Workflows to Smoothly Resolve Disputes | Use structured workflows for efficient dispute management |

| 11 | Integrate Bank Lockbox Services for Faster Deposits | Integrate with bank lockboxes to accelerate check processing and deposits |

| 12 | Uncover Actionable Insights from AR Data | Utilize analytics for continuous optimization of AR strategies |

| 13 | Proactively Survey Customers for Feedback | Gather customer feedback to enhance AR workflows and configurations |

| 14 | Monitor Key Performance Indicators (KPIs) | Display and analyze vital AR KPIs regularly for process improvement |

| 15 | Collaborate Across Teams to Improve Processes | Engage with cross-functional teams for holistic AR process enhancement |

| 16 | Gather Employee Feedback to Ensure Software Adoption | Incorporate employee feedback for successful AR software implementation |

| 17 | Evaluate Unified End-to-End Automation Platforms | Choose a unified AR software for consolidated data and streamlined workflow |

| 18 | Gradually Phase in Automation vs Going All at Once | Implement automation in phases for a smoother transition |

| 19 | Keep Customers Informed on Automation Changes | Communicate automation changes and benefits to customers |

| 20 | Continually Refine Strategies with Data and Feedback | Utilize data and feedback for ongoing optimization of AR strategies |

1. Thoroughly Map Out Each Step in Your AR Process

Initiate the process by thoroughly outlining every step involved in managing accounts receivable. This includes creating and sending invoices, collecting payments, issuing reminders for late or missing payments, managing disputes, reconciling cash applications, and generating AR reports and analytics.

Document each task and activity in detail for a comprehensive understanding. Configure your AR automation software to create streamlined workflows that align with this sequence. Automating this workflow enhances consistency, accuracy, efficiency, and transparency across your AR operations. For example, set up automated workflows to send email reminders to customers at 15, 30, and 60 days past the original invoice due date, ensuring timely payment reminders. Tools like Cashflow.io can handle this for you.

2. Integrate Billing System with Accounting Platform

Optimize efficiency by selecting an AR automation solution that enables seamless, real-time integration between your billing system and core accounting software. This integration automates the synchronization and transfer of invoice details, payment data, customer information, and more between these two vital systems.

By eliminating the need for duplicate data entry and manual reconciliation between billing and accounting, you streamline your AR process. For instance, a direct integration between the AR automation system and QuickBooks Online ensures instant syncing of invoices, customers, payments, cash balances, and accounting journal entries, reducing manual work.

3. Give Customers Multiple Payment Options

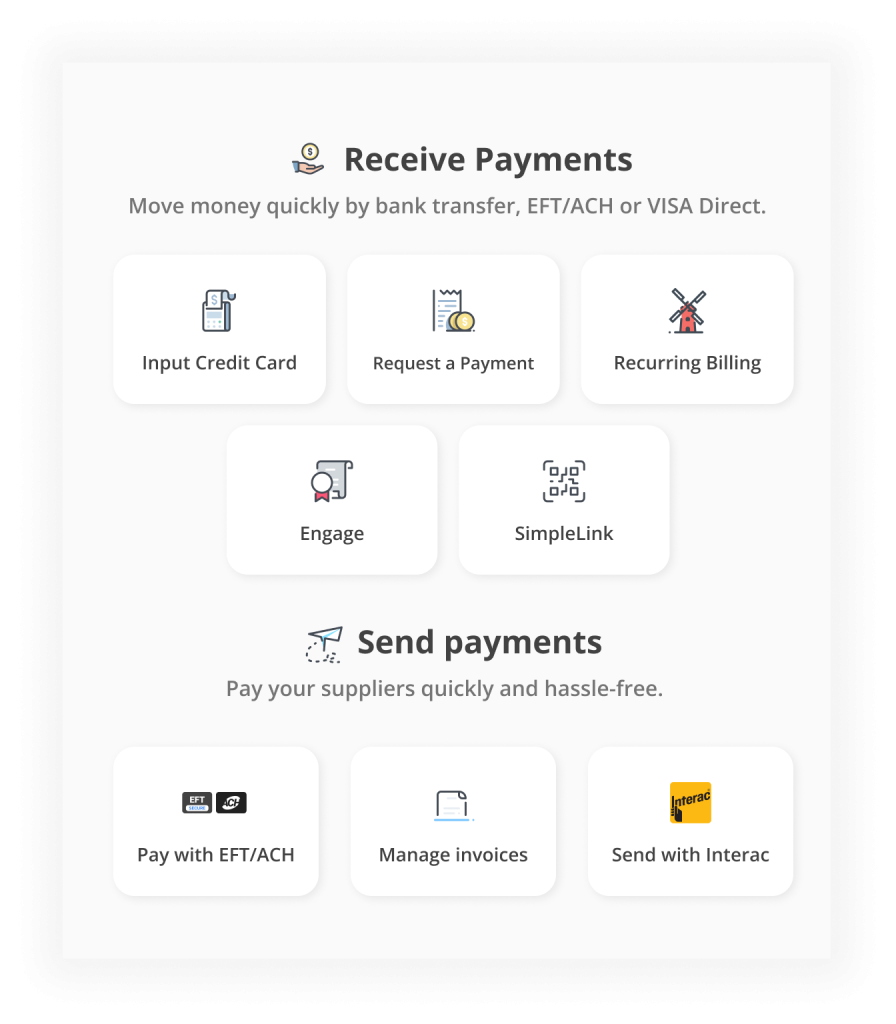

Enhance customer experience and expedite payments by offering a variety of payment options. Research shows that companies providing 5 or more payment alternatives witness an average 11% increase in on-time payments.

Your AR software should allow acceptance of payments through various gateways, channels, and methods based on customers’ preferences. These options can include credit cards, debit cards, ACH, eChecks, wire transfers, PayPal, and more. Offering this flexibility results in quicker payments into your bank account, as customers can choose their preferred payment method.

4. Configure Customized Email Notifications and Reminders

Leverage your AR tools to set up customized, automatically generated emails sent to customers throughout the invoicing, collections, and payment process. For instance, establish reminder emails to notify customers when invoices are created, when payments become overdue as per terms, when a payment is received, and in other relevant scenarios.

5. Give Customers a Branded Online Payment Portal

Improve customer convenience and expedite payments by implementing a branded, white-labeled online payment portal. This portal allows customers to easily view their outstanding invoices and current balances due in their account.

Personalize the content and dynamically insert customer details using merge fields for names, invoice numbers, amounts due, etc. These personalized notifications improve customer engagement and contribute to on-time payment rates.

Customers can initiate payments at any time of the day through the portal, reducing the need to contact your AR team regarding payments. Ensure that all payment activity is automatically synced back to your core AR system for real-time accuracy, enhancing efficiency and customer satisfaction.

6. Let Software Automatically Apply Cash

Eliminate the tedious and time-consuming manual process of matching customer payments to corresponding open invoices and customer accounts. Your AR automation software can achieve this by utilizing metadata such as amounts, dates and customer IDs to automatically match incoming payments to open invoices. Some software will offer an all in one approach, letting you automate payables and receivables.

This automation frees your team from repetitive manual tasks, enhancing productivity. Ensure that the software allows you to define rules and logic for handling partial payments or unapplied cash, further streamlining the process.

7. Build Custom Interactive Dashboards for Real-Time Visibility

Design intuitive AR dashboards to provide real-time visibility into key AR metrics and KPIs, such as average invoice aging, disputed invoices, days sales outstanding, bad debt ratio, and collector performance. These dynamic and interactive dashboards allow you to drill into transaction-level details on demand for any summary metric.

Additionally, set up scheduled email reports to automatically send data, including aging summaries, cash forecasting, and collector KPIs, to stakeholders on a defined cadence, ensuring they stay informed.

8. Control System Data Access with Role-Based Permissions

Maintain the security of sensitive customer information in your AR data by allowing granular control of data access through customizable role-based permissions. Different teams or individuals within your company should have specific access levels based on their roles.

For example, accounting staff may have full system access, while sales representatives can view details of their own customer invoices. These advanced permissions support privacy, improve security, and ensure compliance with data protection regulations.

9. Automate Customer Credit Checks and Transaction Approvals

Enhance efficiency and reduce risk by automating the process of checking customer credit and approving transactions. Manual credit checks and approvals are slow and prone to errors. AR automation tools can integrate with credit bureaus to instantly retrieve business/consumer credit data and auto-apply approval rules.

Automating credit checks during customer onboarding improves risk assessment, while real-time transaction approvals limit ongoing exposure. This preventive control occurs instantly without requiring manual intervention, improving overall operational efficiency.

10. Leverage Workflows to Smoothly Resolve Disputes

Efficiently manage and resolve customer disputes, which can severely impact cash flow and revenue recognition, by utilizing structured workflows. These workflows facilitate dispute submission, documentation, status tracking, reminders, escalation routing, and settlement.

Automation, transparency, and organization in this process lead to faster dispute resolution, resulting in improved customer satisfaction. Configure rules for auto-escalation based on dispute age, priority, or level, ensuring timely and effective dispute resolution.

11. Integrate Bank Lockbox Services for Faster Deposits

Accelerate the processing and deposit of customer check payments by integrating your AR tools directly with bank lockboxes. This integration allows automatic pulling and reconciliation of high-volume check payments, bypassing the internal mailroom.

Consequently, the time from receipt to deposit is significantly reduced, accelerating funds availability in your bank account. This improvement dramatically enhances the collection speed for checks and optimizes the overall AR process.

12. Uncover Actionable Insights from AR Data

Leverage the wealth of data, metrics, and analytics generated by your AR automation system to gain unprecedented visibility into your operations. This data provided by your cash management tool offers valuable insights into collection agent performance, dispute trends, the impact of process changes, customer behavior patterns, and more.

Utilize these insights to continuously refine and optimize your AR strategies, driving improved efficiency and effectiveness in your collections and cash management processes.

13. Proactively Survey Customers for Feedback

Acknowledge that your customers play a pivotal role in determining the real-world effectiveness of your AR processes and software. Periodically conduct surveys to gather candid feedback from customers regarding their experiences, pain points, and suggestions for improvements.

Let customer perspectives directly influence enhancements to your AR workflows, software configuration, payment options, and other aspects. Aligning your processes with customer needs and preferences enhances engagement, satisfaction, and timely payments.

14. Monitor Key Performance Indicators (KPIs)

Display key AR performance indicators (KPIs) prominently on your dashboards to monitor the health of your AR operations. KPIs such as Days Sales Outstanding, Bad Debt Ratio, Current AR Ratio, and more provide valuable insights into the efficiency of your AR processes.

Analyze these KPIs at least weekly to identify negative trends or process bottlenecks quickly. Drill into issues to diagnose root causes, identify problem accounts, and use the data to spot gaps in your processes. Focusing on the right KPIs helps optimize your AR strategies effectively, and we’ve included a list of the most critical KPIs below:

- Days Sales Outstanding (DSO): Measures how quickly customers pay their bills.

- Average Days Delinquent (ADD): Average number of days a customer takes to pay their invoice after it’s due.

- Accounts Receivable Turnover Ratio (ART): Shows how quickly your AR department is collecting payments and turning them into cash.

- Collections Effectiveness Index (CEI): Shows the efficiency of collecting payments and correlates to bad debts.

- Bad Debt to Sales Ratio: Measures the percentage of credit sales that go uncollected.

- Write-Off Ratio: Percentage of accounts receivable that is written off as bad debt.

- Right Party Contacted (RPC) Rate: Percentage of contact attempts made to the correct contact for payment.

- Operational Cost Per Collection: Amount of money spent to collect each payment.

- Deduction Days Outstanding (DDO): Indicates how quickly you’re collecting payments from customers.

- Number of Revised Invoices: Measures the frequency of invoice revisions, highlighting process effectiveness.

15. Collaborate Across Teams to Improve Processes

Engage closely with your sales, customer service, and customer experience teams when evaluating and optimizing AR workflows. These teams often possess unique insights into customer friction points and operational challenges.

Collaboration across functions provides a holistic view of areas for improvement, both internally and for customers. By incorporating valuable feedback from different teams, you can make informed enhancements to your processes, ensuring a seamless and efficient AR workflow.

16. Gather Employee Feedback to Ensure Software Adoption

Before finalizing the purchase of an AR automation system, seek honest feedback from the frontline accounting staff who will use the software daily. Understand their needs and pain points with the current workflows.

Incorporating employee perspectives leads to greater organizational buy-in during the system rollout. It also helps tailor training, customizations, and support to drive successful adoption of the AR automation software across your organization.

17. Evaluate Unified End-to-End Automation Platforms

Optimize efficiency gains by selecting AR software that consolidates the entire accounts receivable workflow into a single, consistent platform. Avoid the use of disparate tools and applications for billing, collections, payments, and other aspects of AR management.

A unified platform ensures consolidated data, workflows, analytics, and interfaces, providing transparency and a holistic, real-time view of your AR operations in one centralized location.

18. Gradually Phase in Automation vs Going All at Once

Ease the transition to AR automation by gradually phasing in its implementation, allowing your teams and customers to smoothly acclimate to the changes. Avoid attempting to enable all capabilities simultaneously, which could disrupt your operations.

Begin with a single module, such as invoicing, and progressively expand functionality over weeks and months. Focus on your receivables first, then consider automating payables or offering niche products like customer financing. This incremental rollout minimizes disruption, ensuring a successful and well-accepted transition to AR automation within your organization.

19. Keep Customers Informed on Automation Changes

Maintain transparency with your customers by proactively communicating changes resulting from the implementation of new AR automation capabilities. Utilize emails, portal announcements, and other communication channels to keep customers informed about how their experience is evolving.

Clearly explain the benefits of the changes and provide guidance on new payment options, automated reminders, redesigned invoices, and any other modifications. Effective communication facilitates easy adoption on the customer side and enhances their overall experience.

20. Continually Refine Strategies with Data and Feedback

Leverage the data, analytics, and metrics generated by your AR platform, combined with proactive customer feedback, to continuously refine your policies, procedures, workflows, and software configuration.

Implement ongoing, incremental improvements to ensure that your AR processes stay optimized over time, adapting to changes in your business and the market. By staying responsive to evolving needs and preferences, you can maintain efficiency and effectiveness in your AR operations.

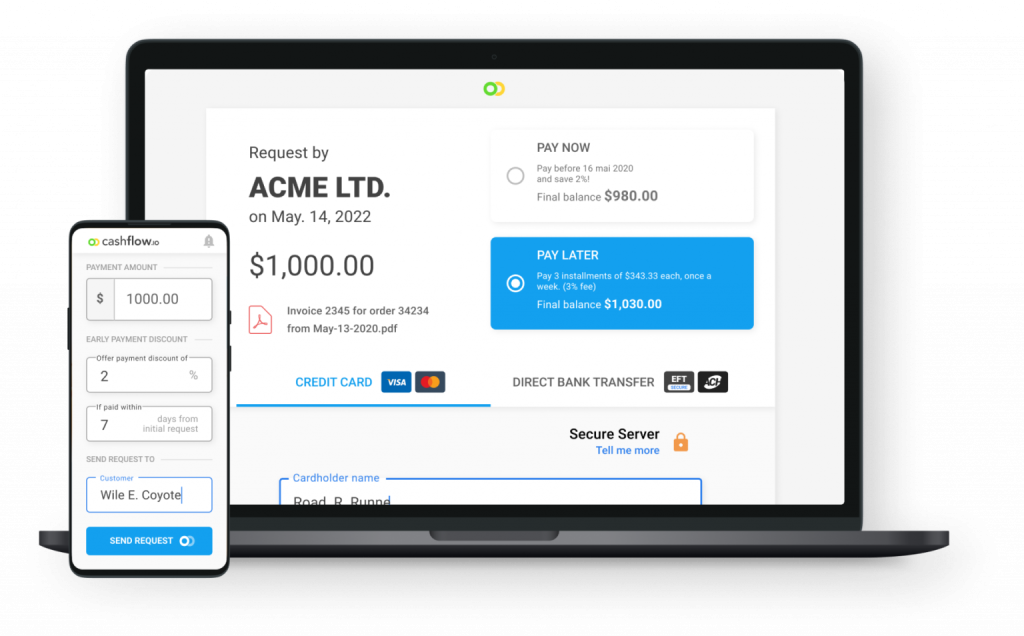

Cashflow.io: The All-In-One AR Automation Solution

The premier choice for comprehensive automated accounts receivable management in 2023 is Cashflow.io. This platform stands out in efficiently overseeing accounts receivable processes, ensuring a streamlined approach to invoicing, payment plans, reminders, and financing.

- Automated Accounts Receivable Management: Cashflow.io offers a comprehensive solution, automating the entire accounts receivable process, from invoice generation to securing payments.

- Seamless Payment Integration: Effortlessly link your preferred payment processor to start receiving digital payments seamlessly, without disruptions.

- No Setup Costs for Integration: Get started swiftly without incurring any integration costs. Pay for the service as your business grows and reaps the benefits.

- Remote Accessibility: Effectively manage your accounts receivable from any location using powerful cloud-based tools, providing operational flexibility.

- Tailored for Collaborative Work: Assign specific permissions to each user in your team, ensuring controlled access to designated accounts receivable features.

Efficient Accounts Receivable Handling for Enhanced Cash Flow

Effective management of accounts receivable is essential for optimizing cash flow, and Cashflow.io excels in simplifying this aspect. It centralizes and automates accounts receivable through a user-friendly platform, eliminating the need to access multiple systems for manual handling. With Cashflow.io, effortlessly manage invoicing, payment plans, and reminders, saving valuable time and effort.

Responsive Customer Support for Financial Assurance

Cashflow.io guarantees dedicated customer support, with knowledgeable representatives promptly addressing queries via phone, chat, or email. This dedication to exceptional customer service ensures timely and effective assistance for a worry-free financial management experience.

Enhance Cash Flow with Personalized Payment Plans

Improving cash flow is a priority, and Cashflow.io empowers you to achieve this by creating tailored recurring payment plans for each client. Additionally, automated payment reminders and pre-authorized debits ensure clients adhere to the agreed payment schedule, significantly enhancing cash flow and allowing you to concentrate on business growth.

Effortless Access to Financing for Outstanding Invoices

Swift access to financing is vital for effective accounts receivable management, especially for substantial customer invoices. Cashflow.io simplifies this process by offering near-instant approval and same-day funding directly through the platform, eliminating the inconvenience of lengthy applications and traditional banking channels. This integrated financing enables you to confidently accept new business opportunities without worrying about cash flow constraints.

Simple Onboarding, Customization, and Scalability

Cashflow.io ensures a smooth onboarding experience, enabling you to connect your business bank accounts and payment processors seamlessly and at no cost. Moreover, the platform is highly customizable, allowing you to tailor its features to align with your evolving business requirements. It grows in tandem with your company, providing convenient access to financing as your business expands.

Intuitive Tools for Time-Efficient Accounts Receivable Management

Cashflow.io simplifies accounts receivable management with its intuitive, user-friendly tools. Centralized dashboards consolidate financial data into an accessible format on any device, offering a comprehensive view of invoicing, payment plans, and financing. This centralized hub saves valuable time, and the user-friendly interface allows seamless work from your phone or tablet, ensuring efficient accounts receivable management on the move.

Robust Security for Financial Security

Cashflow.io prioritizes the security of your financial data, employing the highest standards such as AES-256-bit encryption and adhering to PCI and SOC compliance guidelines. Sensitive information is not stored directly, ensuring utmost data protection. The platform operates via certified Level 1 PCI payment processors, providing peace of mind regarding financial security.

In Conclusion

Automating your accounts receivable (AR) process is no longer a luxury but a necessity for modern businesses aiming to streamline operations and enhance financial efficiency. These 20 best practices are a comprehensive guide to optimizing your AR workflow through automation. From mapping out your process steps to integrating payment gateways and utilizing interactive dashboards for insights, each practice contributes to improved efficiency, accuracy, and customer satisfaction.

Choosing a robust AR automation platform like Cashflow.io can be transformative. It offers a unified solution, seamlessly connecting the entire AR lifecycle. From flexible invoicing to payment automation, cash application, analytics, and more, Cashflow.io empowers businesses to manage AR effortlessly and maximize financial outcomes.

By implementing these practices and adopting a holistic AR automation solution, businesses can reduce manual efforts and errors, accelerate payments, enhance reporting, and proactively manage credit risks. The result is a more agile, efficient, and competitive financial operation that positions your business for sustained growth and success.