Let's make cashflow the easiest part of running a business.

SEND. RECEIVE. FINANCE. It should be easy.

After all, payment is the benefit of a successfully executed business transaction. Settling up shouldn't cost us time, and it certainly shouldn't cost us money.

But for many small and medium-sized businesses, moving money is more than just a headache. Cash flow problems are all too often the causal agents in the demise of an otherwise promising business. So, what gives?

The B2B payments system is broken.

You wouldn't walk out of a store without paying for your groceries. And yet, paying late for services rendered or products delivered has become such an accepted practice between business partners that it now kills as many as 50,000 small businesses every year.

In addition to this, industry stats have revealed the following:

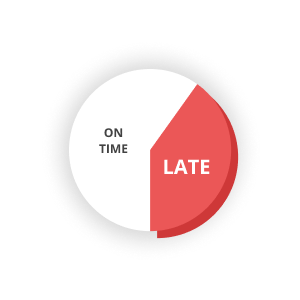

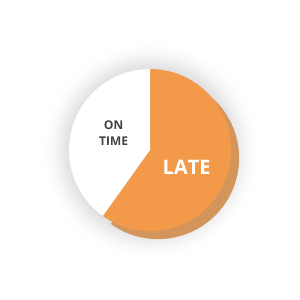

60% is the minimum percentage of small businesses that regularly have invoices paid late. *

43% is the share of companies that have reported a rise in the number of late payments. *

37 is the average number of days that businesses are being paid past the due date. *

It's clear that the outdated, paper-driven process of submitting invoices after work has been completed does not work. It leaves businesses at the mercy of their customers, even once they've fulfilled the terms of an agreement. And the time and money that businesses continue to sink into processing invoices and chasing payments undoubtedly threatens their growth.

We believe in a better way.

We asked ourselves three questions:

Do we really need invoices in a digital payments world?

Why do we have to ask to get paid after delivering?

Shouldn’t payment be due exactly according to the payment terms?

It's time to change the way we think about business transactions. By improving the process as a whole, from quote to cash, instead of treating payments as an afterthought, we can completely transform the prospects of SMEs across multiple industries.

This is the future we're building with Cashflow.io. By automating payments as part of an initial agreement, we're able to prevent late payments completely and alleviate this unnecessary pressure on SMEs. This allows them not only to navigate turbulence, but also to seize every growth opportunity that comes their way.

We empower SMEs with the cash flow and confidence to grow.

We see a future in which no payment is sent or received late ever again.

By embracing the digital payments revolution, automating business transactions and allowing businesses to actually earn money from their payment process, we believe we can usher in a new era of possibilities for SMEs.

Prevent late payments

Automate receivables using smartPOs and make billing part of your purchase order agreements.

Boost your cash flow

With automated receivables within your agreements, get short-term loans to help deliver orders.

Win more business

Offer more flexible payment terms to win purchase orders knowing that your receivables will be automated.