How to Collect Money from Late Paying Clients: Tips and Strategies for SMBs

Unpaid invoices can deal a devastating blow to a small business’s cash flow, presenting a significant challenge for owners and managers. To mitigate the detrimental effects of overdue client payments, implementing effective accounts receivable strategies is crucial.

Proactive measures like sending invoices promptly, applying late fees, offering payment plans, and taking appropriate collection actions can help ensure timely payment. This comprehensive guide outlines key techniques to efficiently handle non-payments and maintain healthy cash flow.

The Impacts of Unpaid Invoices

Before diving into any solutions, it’s important to understand the impact that late and unpaid invoices can have on small and medium businesses:

- Cash flow disruption – Outstanding invoices severely restrict cash availability, making it difficult to cover operating expenses like payroll, supplies and rent. This strains business finances and impedes growth.

- Increased costs – Efforts to collect unpaid debts take time and resources away from core business activities. Collection costs further reduce net revenue.

- Damaged relationships – Delayed payments strain client relationships and may cause reputational damage if disputes arise. This can reduce future business opportunities.

- Higher insolvency risk – Persistent cash flow problems increase bankruptcy risk, especially for newer companies with limited reserves. Unpaid invoices may be the difference between survival and failure.

Clearly, prompt invoice payment is mission-critical for SMBs. Implementing robust AR management best practices can help avoid these detrimental scenarios.

Encouraging Timely Invoice Payment

Send Invoices Quickly – Issue invoices as soon as work is completed, clearly specifying payment terms. Prompt invoicing prevents billing disputes and keeps payments top of mind for clients.

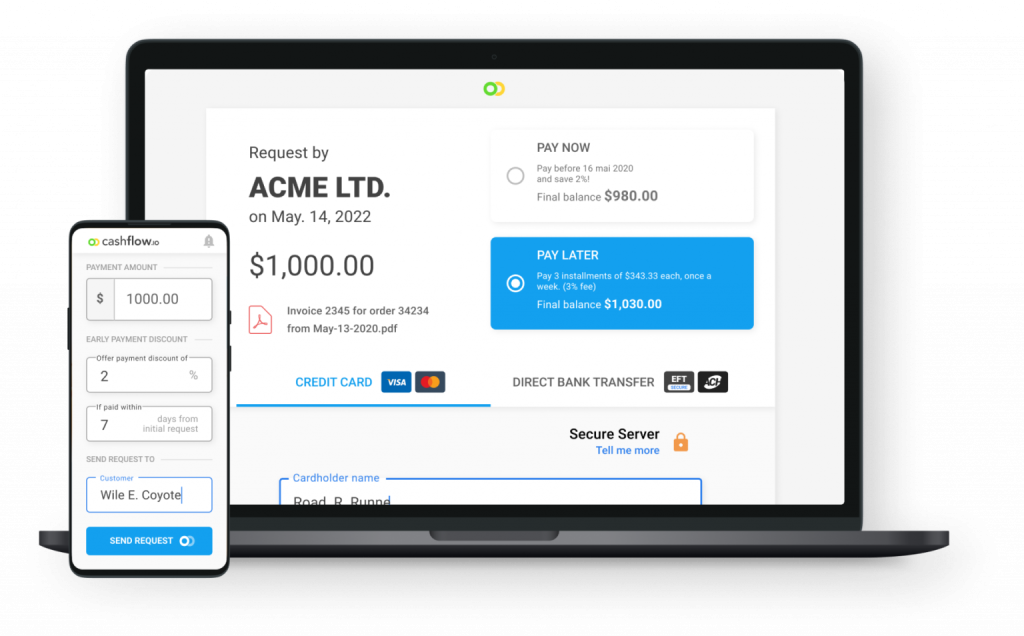

Offer Early Payment Discounts – Offering small discounts, like 2% off for a payment within 7 days, can incentivize early payment. This costs little but boosts cash flow. Make discount offers clear on invoices.

Build Rapport – Maintain positive relationships with clients and address any concerns quickly. Good communication and service foster collaboration, making clients more inclined to pay on time.

Leverage Technology – Use AR automation software like Cashflow.io to instantly send invoice reminders when due dates are missed. This saves time while keeping invoices current.

Managing Overdue Invoices

Apply Late Fees – Ensure your terms and conditions include late fees, like 1.5% per month for overdue invoices. Charging these consistently holds clients accountable.

Offer Payment Plans – For struggling yet valued clients, propose installment payment plans to receive the full amount over an agreed schedule, if lump-sum payment is not currently feasible. You can offer buy-now-pay-later programs through platforms such as Cashflow.io.

Suspend Services – Make continuing services contingent on resolving any delinquent payments. Suspension conveys that non-payment is unacceptable.

Hire Collection Services – When amicable collection fails, use reputable collection agencies to recover severely late or written-off invoices. Fees apply, but results are often positive.

Litigation – Taking legal action through small claims court may be warranted for substantial unpaid invoices when other options have failed. Seek professional legal advice first.

Sell to Factoring Firms – Invoice factoring lets businesses sell B2B receivables to financing firms for immediate cash, often 70-90% of invoice value, minus fees. This provides urgent working capital when clients won’t pay.

Preventing Future Late and Non-Payment

Addressing potential payment issues before they occur is a smart business practice. Being proactive in this realm involves putting strategies in place that prevent problems before they can arise. These strategies can encompass a range of actions, from setting clear contract expectations to employing efficient invoicing processes and offering incentives for timely payments. Businesses can ensure a smoother financial flow and stronger client relationships by actively implementing measures to avoid payment hitches. We’ve listed a few of our top recommendations below, broken down into three key categories:

Contractual Clarity and Payment Assurance

- Formulate a Detailed Contract: Prior to the commencement of any work, establish a comprehensive written contract that outlines all essential aspects, particularly focusing on payment-related information. Include expectations, terms, the payment process, available options, a proposed payment plan, and the deadline. Clarity in contractual terms is the cornerstone of a successful business transaction, leaving no room for misunderstandings.

- Robust Contracts for Clear Terms: Contracts should serve as a clear guide for both parties involved. Lay out payment terms, timelines, potential late fees, and actions to be taken if terms aren’t met. A well-drafted contract protects the interests of all parties and eliminates ambiguity, ensuring a smooth and secure business arrangement.

Efficient Invoicing and Payment Handling

- Timely Invoicing: Dispatch invoices promptly upon completion of the work, showcasing your commitment to agreed payment terms. Accuracy in invoicing and facilitating easy payment processing for clients are vital aspects. Efficiently tracking invoices enables swift action in case of non-payment issues.

- Implement Late Payment Penalties: To motivate clients to adhere to payment timelines, incorporate a clause specifying late payment fees for overdue payments in your payment terms. Discussing these late fees during initial contract discussions avoids surprises on the invoice, fostering a transparent payment process.

Enhanced Payment Security and Client Management

- Secure Deposits or Payment Schedules: Strengthen protection against delayed payments by considering upfront deposits upon contract signing, typically ranging from 25% to 50% of the total contract value. Establish a structured payment schedule linked to project milestones or periodic intervals for long-term projects, ensuring a steady and predictable cash flow for your business.

- Rigorous Client Vetting to Mitigate Risks: Before engaging with a new client, thoroughly assess their credit history and trade references diligently. This risk mitigation strategy minimizes the chances of non-payment and helps establish secure and reliable financial partnerships.

- Implement Progress Payments for Cash Flow Optimization: Structure payments as progress payments linked to project milestones, particularly for projects involving significant scopes of work. This approach optimizes cash flow by ensuring a steady income stream throughout the project duration.

- Leverage AR Automation for Efficiency: Integrate advanced accounts receivable (AR) automation tools such as Cashflow.io into your operations. These tools streamline invoice creation, online payment collection, automated reminders for overdue payments, and recording, significantly enhancing on-time payment compliance and overall payment processing efficiency.

- Maintain Updated Contact Information: Frequently update and maintain accurate contact details for all client accounts. This ensures effective communication and facilitates smoother payment transactions, underscoring the importance of client relationship management in the receivables process.

What is the Best Tool for Accounts Receivable Management?

In the realm of comprehensive accounts receivable (AR) management, Cashflow.io stands out as a go-to solution. Tailored especially for a wide variety of businesses, Cashflow.io excels in efficiently overseeing AR processes, offering a streamlined approach to invoicing, personalized payment plans, timely reminders, and even financing.

- Automated AR Management: Cashflow.io is an all-encompassing solution, automating the entire AR process, from generating invoices to securing payments. For small businesses struggling with non-paying clients, this means streamlined processes and more time to focus on growth.

- Seamless Payment Integration: Easily link your preferred payment processor to start receiving digital payments without any disruptions. This feature ensures a smoother payment collection process for small businesses dealing with non-paying clients.

- Zero Setup Costs for Integration: With no initial integration costs, Cashflow.io provides a cost-effective solution for small businesses dealing with non-paying clients. You pay for the service as your business grows and begins to reap the benefits.

- Remote Accessibility: Manage your AR from any location using powerful cloud-based tools, providing operational flexibility. This is especially beneficial for small businesses dealing with non-paying clients, as it facilitates easier communication and follow-ups.

- Tailored for Collaborative Work: Assign specific permissions to each user in your team, ensuring controlled access to designated AR features. This feature is valuable for small businesses handling non-paying clients, allowing precise monitoring and follow-up actions.

Solving Non-Payment Woes for Small Businesses

Efficient AR management is vital for optimizing cash management, especially for small businesses struggling with non-paying clients. Cashflow.io simplifies this aspect by centralizing and automating AR through a user-friendly platform. It eliminates the need to access multiple systems for manual handling, saving valuable time and effort.

Responsive Customer Support for Financial Confidence

Cashflow.io also ensures dedicated customer support, promptly addressing queries via phone, chat, or email. For small businesses dealing with non-paying clients, this support provides reassurance and guidance in navigating challenging payment scenarios.

Empowering Cash Flow with Client-Friendly Payment Plans

Improving cash flow is a priority, and Cashflow.io empowers you to achieve this by creating tailored recurring payment plans for each client. For small businesses struggling with non-paying clients, this feature ensures a structured approach to payment, encouraging compliance and enhancing cash flow.

Effortless Access to Financing for Outstanding Invoices

Swift access to financing is vital for effective AR management, especially for small businesses facing challenges with non-paying clients. Cashflow.io simplifies this process by offering near-instant approval and same-day funding directly through the platform, eliminating financial constraints caused by delayed payments.

Simple Onboarding, Customization, and Scalability

Cashflow.io ensures a smooth onboarding experience and is highly customizable, allowing alignment with the unique requirements of small businesses dealing with non-paying clients. It grows with your company, providing convenient access to financing as your business expands and enabling better management of challenging payment scenarios.

Intuitive Tools for Time-Efficient AR Management

Cashflow.io simplifies receiving payments with its intuitive, user-friendly tools. For small businesses handling non-paying clients, this translates to time-efficient processes, enabling smoother communication and follow-ups.

Robust Security for Financial Assurance

Cashflow.io prioritizes the security of your financial data, providing peace of mind for small businesses dealing with non-paying clients. The platform employs the highest standards of encryption and compliance, ensuring utmost data protection and financial security.

Conclusion

Relying on non-paying clients places SMBs in a precarious financial position. Implementing efficient accounts receivable management strategies can help avoid cash flow interruptions and maintain healthy business finances and client relationships.

Proactively sending professional invoices, applying late fees, structuring payment plans, suspending services, and using collection agencies or litigation as a last resort provides effective ways for small businesses to handle severely late or missing payments.

AR automation tools like Cashflow.io optimize invoicing and streamline payment tracking and reminders to improve on-time payment compliance. Paired with robust client vetting and contracts, SMBs can take control of accounts receivable to ensure steady cash flow and continued success.