Custom Billing Software: How to Transform Your AR Process

Managing accounts receivable can be overwhelming, especially when relying on manual processes. From generating invoices to chasing down payments, it’s easy for things to slip through the cracks, resulting in delayed payments and frustrated customers. However, custom billing software offers a game-changing solution that can optimize your entire accounts receivable workflow.

This guide will explore how custom billing software transforms accounts receivable, from automating repetitive tasks to providing real-time insights. We’ll also look at key features to look for when selecting software. With the right custom billing solution, you can reduce costs, accelerate payments, improve accuracy and take your accounts receivable to the next level.

What Exactly is Custom Billing Software?

Custom billing software is designed to automate and streamline the invoice-to-payment process. It provides customizable features tailored to your business’s specific needs and goals. With great billing software, your business should be able to:

- Automatically generate invoices based on custom templates

- Send invoices via email, text or mail

- Send online payments through integrated gateways

- Create flexible billing rules and workflows

- Sync billing data with accounting software

- Gain real-time visibility into AR metrics

The level of customization allows the software to align precisely with your processes, rules and systems. This eliminates the need for manual workarounds or changed behaviors to fit off-the-shelf software limitations. Custom billing software delivers flexibility that empowers your accounts receivable processes, rather than restricts them.

Key Benefits of Custom Billing Software for Accounts Receivable

Implementing custom billing software can help you receive payments faster. Here are some of the most significant benefits:

1. Optimized Workflows

With manual billing processes, your AR team likely spends significant time on repetitive administrative tasks like generating invoices, logging payments and chasing down late invoices. Custom software automates these repetitive workflows based on configurable rules.

Invoices can automatically be generated when a sales order is fulfilled. Overdue invoices can trigger automated reminders and follow-ups. Payments can instantly sync with accounting systems.

This workflow automation frees up your employees from mindless administrative work. Instead of churning through paperwork, they have time to build customer relationships, tackle complex billing issues and work on more strategic initiatives.

According to one survey, businesses using billing automation reduced time spent on manual tasks by over 50%. That’s time that can now be redirected to value-added activities.

2. Accelerated Cash Flow

Waiting 30, 60 or 90 days for customers to pay invoices hurts cash flow. Unfortunately, delays are inevitable when you mail invoices and rely on customers to pay on time. Custom billing software speeds up your payment cycles through:

- eInvoicing – Invoices are delivered instantly via email or text.

- Online payments – Customers can easily pay through integrated payment gateways.

- Payment reminders – Automatic notifications ensure customers pay on time.

- Sync to accounting – Payments automatically sync, eliminating manual entry delays.

Together this reduces the time between invoicing and collecting payments. One study found that businesses using AR automation improved invoice-to-cash cycles by over 25% on average.

Faster payments mean you reinvest revenues quicker and reduce reliance on external financing. Efficient cash flow management is critical, and custom software enables it.

3. Enhanced Visibility & Reporting

Understanding what is happening across accounts receivable is difficult with manual processes. Your team uses spreadsheets, paper files and multiple systems just to get a fragmented view. Custom billing software centralizes all accounts receivable data in one cloud-based system. This gives you real-time visibility into metrics like:

- Days sales outstanding

- Past due invoices

- Payments received

- Customer balances

- Credit usage

Most solutions also include custom reporting and analytics to uncover trends and insights. You gain unprecedented visibility to make informed decisions to continuously refine operations.

4. Reduced Processing Costs

Manual billing comes with significant processing costs. Costs add up quickly from materials like paper and postage to accounting and AR staff. Custom software reduces expenses through:

- eInvoicing – Slashes printing, postage and delivery costs

- Payment automation – Minimizes time spent on manual payment entry

- Workflow automation – Reduces time staff spends on repetitive tasks

- Error reduction – Cuts rework and write-offs from mistakes

According to Ardent Partners, the average cost to process an invoice manually is $11 compared to just $2.50 with automation. That’s over 75% in potential savings!

5. Heightened Accuracy & Compliance

Human error is inevitable with manual billing processes. From transposed numbers to misapplied payments, mistakes easily occur. Custom billing software minimizes errors by removing manual work. Invoice amounts autofill from sales orders, reducing incorrect entries. Payments automatically apply to invoices, avoiding miscoding. Workflows route invoices through proper approval chains.

These automated checks and balances boost accuracy across the board. Fewer mistakes mean fewer problems with customers and compliant revenue recognition. This automation prevents revenue leakage while also maintaining customer satisfaction.

6. Improved Customer Experience

Between receiving invoices late and inefficient payment options, customers’ accounts receivable frustrations run high. These billing frustrations can tarnish your customer relationships.

Custom software provides a consumer-grade experience that today’s customers expect:

- Instant invoice delivery

- Online account dashboards

- One-click payments

- Automatic reminders

- Multiple payment methods

This empowers customers and makes it easy for them to fulfill payment obligations. Happier customers become loyal customers.

7. Scalability & Growth Support

Relying on manual processes limits the ability to scale operations without degrading quality or satisfaction. There’s an upper threshold for what your team can effectively handle. Because custom billing software automates workflows, it can easily scale to accommodate growing business volumes. Digital storage offers unlimited capacity. New customer onboarding and data inputs can be automated. Role-based access supports large teams.

This built-in scalability enables your accounts receivable to grow rapidly without compromising customer experience or B2B payment efficiency.

Key Features to Look For

With an understanding of the many potential benefits, choosing the right custom billing software becomes critical. Here are some key features to look for:

- Customizable invoice templates – Ensures your brand identity and information needs are reflected.

- Multiple delivery methods – A good system will support email, print, SMS text messages and even mail.

- Payment gateway integrations – Facilitates fast online payments from customers.

- Accounting software sync – Allows you to seamlessly push invoice and payment data.

- Customer database – Acts as a central repository of customer details and profiles.

- Payment reminders – Allows you to configure rules for automated reminders on due dates.

- Reporting and analytics – Real-time dashboards and custom reports for actionable insights.

- API and workflow connectors – Helps to smooth connections with other systems like your CRM.

- Role-based access – Will let you manage team permissions and access appropriate levels.

Prioritizing must-have features helps narrow down options so you can find the software that is right for you. A feature-rich solution provides long-term value and return on investment.

Steps for Implementing Custom Billing Software

| Step | Description |

|---|---|

| 1. Map Current Workflows | Document current billing processes from start to finish to serve as a basis for configuring future workflows in the software. |

| 2. Set Business Rules | Configure automated workflows and processes using defined business rules within the software, covering payment reminders, routing logic, approvals, and more. |

| 3. Integrate Systems | Ensure seamless data flow by tightly integrating billing software with other essential systems like accounting, CRM, and bank accounts. |

| 4. Clean Customer Data | Audit and clean up customer data in databases for smooth customer onboarding and accurate invoice generation. |

| 5. Develop Training Program | Create training resources and conduct hands-on training events to educate employees on effective software usage. |

| 6. Launch in Phases | Implement the software incrementally across teams over several weeks, addressing any adoption issues before a broader rollout. |

| 7. Refine Processes | Gather user feedback post-launch to identify process hiccups and refine workflows and business rules accordingly for enhanced efficiency. |

Once you’ve selected the ideal custom billing software, it’s time to tackle implementation. Follow these best practice steps for a successful rollout:

- Map Current Workflows: Document exactly how your billing processes work from end to end. This provides the baseline for configuring improved future workflows within the software.

- Set Business Rules: Configure the business rules that will drive automated workflows and processes within the software. This includes payment reminders, routing logic, approvals and more.

- Integrate Systems: Ensure tight integration between your billing software, accounting system, bank accounts, CRM and other platforms to enable seamless data flows.

- Clean Customer Data: Audit and clean up customer information in your databases. Normalized, accurate data helps ensure smooth customer onboarding and proper invoice generation.

- Develop Training Program: Create training resources and programs to educate employees on utilizing the software. Schedule hands-on training events before launch.

- Launch in Phases: Rollout the software incrementally across teams over a period of weeks. Resolve any adoption issues with early teams before a wider launch.

- Refine Processes: Continuously gather user feedback after launch to identify process hiccups. Refine workflows and business rules accordingly.

With diligent preparation and engagement across teams, custom billing software can transform accounts receivable to unlock new efficiencies.

Pitfalls to Avoid with Billing Software Implementation

While custom billing software offers clear benefits, avoiding common pitfalls is crucial for a successful implementation. We’ve listed a few of the common pitfalls and what you can do to avoid them below:

1. Fragmented Systems: Using a mix of incompatible software systems can lead to process breakdowns. Opt for unified, end-to-end software covering the full invoice-to-payment lifecycle.

2. Lack of Payment Options: Inadequate payment options can delay payments. Ensure your billing software supports popular online payment choices for swift transactions.

3. Minimal Workflow Customization: Predefined workflows that don’t align with your accounts receivable process won’t optimize automation benefits. Choose software with customizable workflows that fit your needs.

4. Poor Accounting Integration: Data discrepancies can occur without seamless integration between billing and accounting software. Thoroughly test integrations before launching the software.

5. Insufficient Training: Implementing new software without adequate training can lead to employee frustration and inefficiencies. Provide comprehensive training and resources to ensure a smooth transition for your teams.

Avoiding these missteps helps guarantee that your software implementation smoothes rather than disrupts accounts receivable.

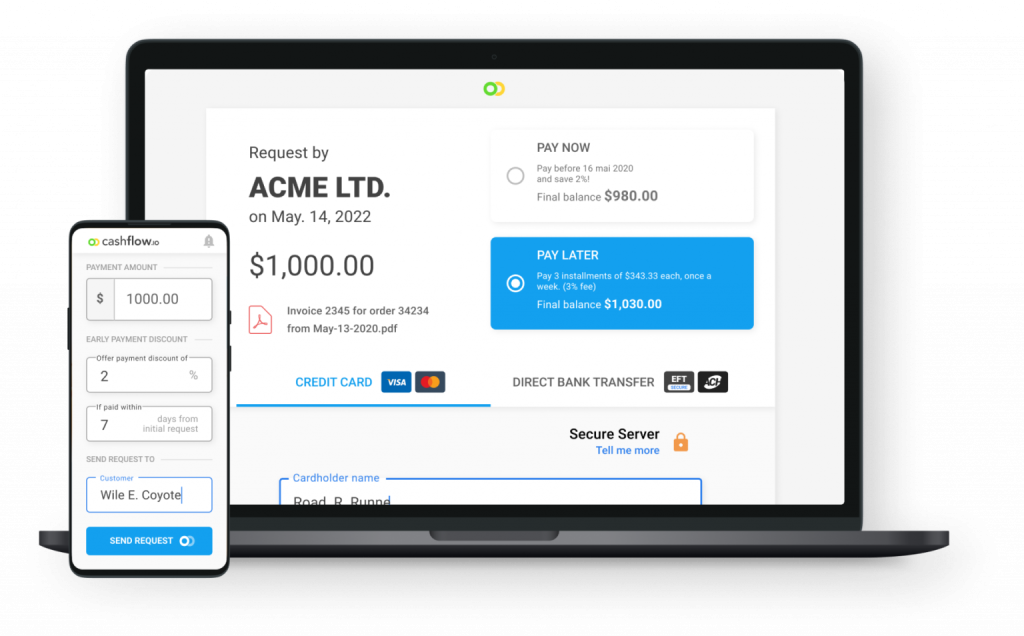

Why Cashflow.io is the Ideal Custom Billing Software

As we’ve explored, custom billing software delivers immense potential to optimize accounts receivable management. But you need the right solution that aligns to your specific needs. Cashflow.io stands out as an ideal custom billing software, giving you the flexibility and functionality to tailor automated workflows across your accounts receivable process.

Here’s how Cashflow.io empowers your billing and payments:

- Customizable Invoices: Will enable you to design and structure your invoices in a way that aligns with your brand identity and meets your specific requirements. This personalization enhances professionalism, brand consistency, and customer engagement.

- Payment Automation: Allows you to accept and reconcile payments from various sources seamlessly. It expedites the payment process, reduces manual effort, minimizes errors, and ensures a steady and efficient cash flow.

- Automated Reminders: Assists in ensuring timely payments from customers. By automating this process, you prompt customers to settle their invoices on time, improving cash flow and reducing outstanding receivables.

- Tight Accounting Integrations: Integration with accounting software like QuickBooks streamlines the invoicing and payment reconciliation process. It eliminates the need for manual data entry, reduces errors, and ensures financial data accuracy.

- Customer Self-Service: Offering customers the ability to view their balances and make payments online enhances their experience. It provides convenience and autonomy, fostering positive relationships and encouraging prompt payments.

- Mobile Access: Mobile access to billing and payment processes allows you to manage your financial operations anywhere, anytime. This flexibility enhances efficiency, especially for businesses with a mobile workforce or those needing on-the-go access.

- Real-time Analytics: Real-time analytics provide immediate, actionable insights into your receivables. This data-driven approach helps make informed decisions, optimize financial strategies, and identifying areas for improvement.

- Purchase Order Financing: Purchase order financing accelerates cash flow by providing funding based on confirmed purchase orders. This financial assistance enables you to fulfill orders, manage inventory, and meet operational needs without depleting existing cash reserves.

Cashflow.io was built for accounts receivable automation from the ground up – not adapted from another application. This means the solution offers the flexibility and customization that legacy software lacks. The company also provides high-touch support and onboarding services to ensure your implementation succeeds. Their billing experts become an extension of your team to drive adoption and ROI.

In short, Cashflow.io provides the specialization in accounts receivable automation that delivers transformative results. The software seamlessly automates manual processes while uncovering powerful insights – the best of both efficiency and analytics. By implementing Cashflow.io’s custom billing solution, you can reduce costs, improve accuracy, strengthen customer loyalty and propel your accounts receivable performance into the future. Cashflow.io stands ready to help you thrive.

In Conclusion

Managing accounts receivable doesn’t have to be a painful manual process fraught with frustration. Modern custom billing software provides the solution to automate repetitive tasks, accelerate payments, prevent errors and gain insights into receivables. The benefits to cash flow, efficiency, visibility and the customer experience make building custom software well worth the investment. Just be sure to avoid common pitfalls during implementation for smooth adoption across teams.

Cashflow.io offers an ideal custom billing solution purpose-built for accounts receivable automation. The flexibility and integrations provide the foundation to optimize workflows while robust analytics uncover trends for continuous improvement. Now is the time to unlock the potential of your accounts receivable. Custom software delivers the tools to reduce costs, improve accuracy, strengthen customer loyalty and propel your receivables performance into the future. With the right solution in place, your accounts receivable can be transformed.

Frequently Asked Questions (FAQs)

1. What is custom billing software, and how does it differ from standard billing software?

Custom billing software is technology designed to automate and streamline the entire invoice-to-payment process, but with the added advantage of being highly customizable to fit a business’s specific needs and goals. Unlike standard billing software, custom billing software allows businesses to tailor features, workflows, and processes to align precisely with their unique requirements.

2. How can custom billing software benefit my business’s accounts receivable processes?

Custom billing software offers several key benefits for accounts receivable processes, including:

Optimized Workflows: Automating repetitive administrative tasks, freeing up employees to focus on customer relationships and strategic initiatives.

Accelerated Cash Flow: Speeding up payment cycles through eInvoicing, online payments, and automated reminders.

Enhanced Visibility & Reporting: Centralizing data for real-time metrics and analytics, enabling informed decision-making.

Reduced Processing Costs: Lowering expenses related to materials, manual work, and error corrections.

Heightened Accuracy & Compliance: Minimizing errors by removing manual entry, improving revenue recognition and customer satisfaction.

Improved Customer Experience: Providing a seamless and efficient billing experience for customers.

Scalability & Growth Support: Allowing for seamless scaling to accommodate business growth without compromising efficiency.

3. What key features should I look for when selecting custom billing software for my business?

When choosing custom billing software, prioritize software with the following essential features:

Customizable Invoice Templates: To match your brand identity and information needs.

Multiple Delivery Methods: Supporting email, print, SMS, and postal mail for flexible communication with customers.

Payment Gateway Integrations: Enabling fast online payments from customers through integrated payment options.

Accounting Software Sync: Seamless integration to push invoice and payment data to your accounting system.

Customer Database: A centralized repository for managing customer details and profiles.

Payment Reminders: Configurable rules for automated reminders to customers based on due dates.

Reporting and Analytics: Real-time dashboards and custom reports to gain actionable insights for informed decision-making.

API and Workflow Connectors: Facilitating smooth integration with other systems such as CRM for improved efficiency.

Role-Based Access: Providing the ability to manage team permissions and access levels for security and control.