QuickBooks Automation: A Comprehensive Guide

In today’s fast-paced world of business, time is a precious commodity. Small business owners in particular, often find themselves dedicating a significant portion of their week to managing their company’s finances. Research indicates that the average business owner spends about 3 hours per week on money management, with 21% devoting over six hours to these laborious tasks.

What if there was a way to significantly reduce this time investment without hiring additional accounting help? The solution lies in intelligently automating routine accounting processes.

Core Benefits of Accounting Automation

| Benefit | Key Points |

|---|---|

| Efficiency and Time Savings | – Automates manual tasks such as data entry, invoice processing, and payment matching. – Frees up employees’ time for more strategic activities, boosting productivity. |

| Improved Cash Flow Management | – Speeds up invoice generation, delivery, and payment processing, leading to faster cash flow. – Timely funds received are critical for business sustainability and growth. |

| Enhanced Accuracy and Reduced Errors | – Significantly reduces the risk of human errors associated with manual data entry and calculations. – Increases accuracy in invoicing, payments, and financial records, enhancing overall quality of financial information. |

| Better Customer Relationships | – Offers personalized communications, reminders, and self-service payment portals to customers. – Enhances customer experience by providing a convenient and seamless process, fostering stronger and more positive relationships. |

| Insightful Analytics and Reporting | – Generates real-time data and analytics, providing insights into AR performance, payment trends, and outstanding balances. – Enables informed decision-making to optimize AR strategies for better financial outcomes. |

Automating accounting processes offers a multitude of significant advantages for businesses. Whether you are hoping to save time, or improve your cashflow, there are a few notable benefits that you should consider when exploring AR automation:

- Efficiency and Time Savings: Automating accounts receivable (AR) processes eliminates manual, time-consuming tasks such as data entry, invoice processing, and payment matching. This efficiency allows employees to focus on more strategic activities, ultimately saving time and increasing productivity.

- Improved Cash Flow Management: Automation expedites invoice generation, delivery, and payment processing. This speed in operations accelerates cash flow, ensuring that funds are received in a timely manner, which is crucial for business sustainability and growth.

- Enhanced Accuracy and Reduced Errors: Automation significantly reduces the risk of human errors associated with manual data entry and calculations. This leads to higher accuracy in invoicing, payments, and financial records, ultimately improving the overall quality of financial information.

- Better Customer Relationships: Automated AR systems often come with features like personalized communications, reminders, and self-service payment portals. This enhances the customer experience by providing a convenient and seamless process, fostering stronger and more positive client relationships.

- Insightful Analytics and Reporting: Automation generates real-time data and analytics, offering insights into AR performance, payment trends, outstanding balances, and more. These insights enable informed decision-making, helping businesses optimize their AR strategies for better financial outcomes.

Automating Accounts Receivable with QuickBooks

QuickBooks is a standout AR automation option for small businesses in 2023. Whether you’re aiming to shift from manual bookkeeping, grappling with intricate spreadsheets, or are looking for an upgrade from your current software, QuickBooks is a dependable solution for an affordable price. The software offers a range of robust features to automate key accounts receivable procedures, and we’ve listed some of its core capabilities below:

1. Recurring Invoice Generation

Generating invoices consistently is the first step in accounts receivable management. QuickBooks allows users to schedule recurring invoices automatically created on fixed dates or set intervals.

For example, a subscription-based SaaS company can configure invoices to be sent to customers on the 1st of every month without any manual work. This ensures a predictable cash inflow.

2. Payment Reminders for Overdue Invoices

With busy customers, invoices can slip through the cracks resulting in late payments. QuickBooks enables automating email or SMS reminders to customers with unpaid past-due invoices.

The reminders can be scheduled at different intervals based on days past due. Customers are prompted to clear outstanding dues, accelerating cash flow.

3. Flexible Recurring Payments

For customers who prefer to pay in installments, flexible recurring payment schedules can be set up in QuickBooks based on their preferences.

Along with automated reminders before the scheduled payment dates, this significantly improves the likelihood of on-time installments from customers.

4. Online Payment Integration

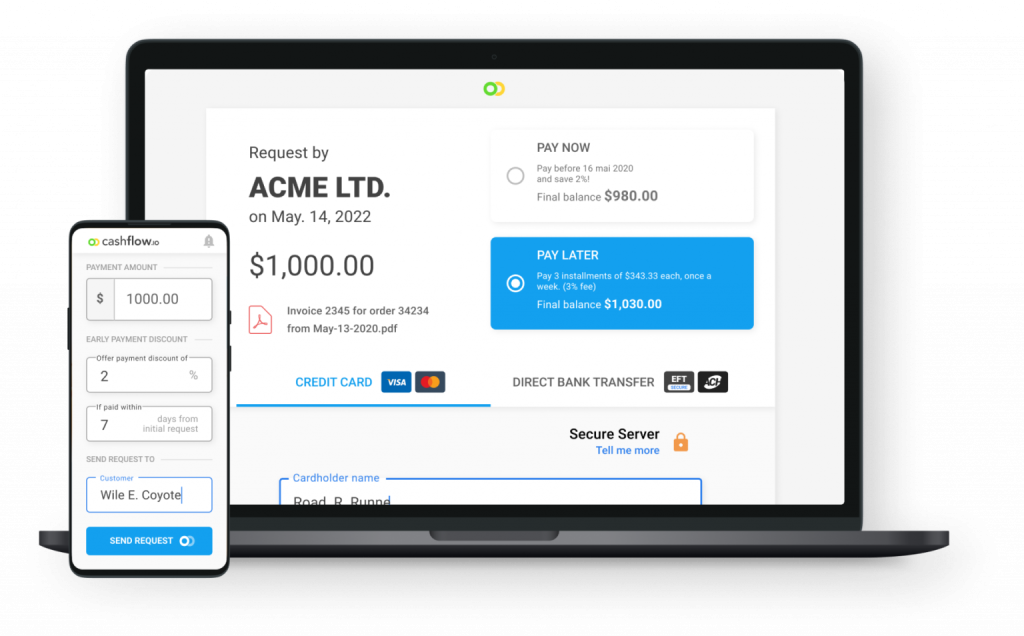

Accepting payments digitally is vital for accounts receivable automation. QuickBooks allows seamless integration with payment gateways like Cashflow.io, Stripe and PayPal using plugins.

As customers pay invoices online, the payments get automatically reconciled without manual intervention, reducing the cost of collections.

5. Rules for Partial & Late Payments

Inevitably, some customers may make partial or late payments. QuickBooks enables creating rules to automatically apply partial payments to open invoices. Late fees can also be configured to be levied based on days past due once an invoice becomes overdue.

6. AR Analytics & Reporting

You can Sync QuickBooks with Cashflow.io to provide real-time visibility into key AR metrics through its dashboard and built-in reports. Metrics like aging summaries, past-due invoices, and collection trends can be tracked. These data-driven insights can help you make informed decisions to optimize your accounts receivable.

7. Credit Term Management

Tracking invoices and payments against customer credit limits set in QuickBooks can automate compliance with credit terms. Exceeding credit limits triggers automated alerts to avoid risky credit exposure. Workflows help track promise-to-pay agreements.

8. Sales Tax Automation

Tax calculations are automated by applying sales tax rates as per customer location. This prevents errors in manual tax computations. Sales tax payments are also automated based on liabilities, saving you from manually reconciling taxes at the month’s end.

9. Banking Rules for Reconciliation

Configurable rules can match transactions from bank feeds to auto-reconcile customer payments in QuickBooks. This reduces the time required for reconciliation, saving you time, money and headaches.

10. Cash Flow Forecasting

With expected future invoice generation dates and payment due dates visible, QuickBooks enables businesses to accurately forecast cash inflow. Ultimately, an accounts receivable automation tool will allow you to optimize your cash flow, giving you access to more capital quickly. A business that can make the most of its capital is bound to be more successful.

What is the Best Way to Automate Quickbooks?

Cashflow.io emerges as the top Quickbooks plugin to automate accounts receivable. The platform excels in efficiently overseeing AR processes, ensuring a streamlined approach to invoicing, payment plans, reminders, and financing. It has a few standout features that give you a leg up when partnering with Quickbooks:

- Automated AR Management: Cashflow.io provides an all-encompassing solution, automating the entire AR process, from generating invoices to securing payments.

- Smooth Payment Integration: Seamlessly link your preferred payment processor to start receiving digital payments without disruptions.

- Zero Setup Costs for Integration: Begin swiftly without incurring any integration costs. Pay for the service as your business grows and begins to reap the benefits.

- Remote Accessibility: Manage your AR from any location using powerful cloud-based tools, providing operational flexibility.

- Tailored for Collaborative Work: Assign specific permissions to each user in your team, ensuring controlled access to designated AR features.

Streamlined AR Handling for Improved Cash Flow

Efficient AR management is crucial for optimizing cash flow, and Cashflow.io simplifies this aspect. It centralizes and automates AR through a user-friendly platform, eliminating the need to access multiple systems for manual handling. With Cashflow.io, you can manage invoicing, payment plans, and reminders, saving valuable time and effort.

Responsive Customer Support for Financial Confidence

Cashflow.io ensures dedicated customer support, with knowledgeable representatives promptly addressing queries via phone, chat, or email. This dedication to exceptional customer service ensures timely and effective assistance for a worry-free financial management experience.

Enhance Cash Flow with Personalized Payment Plans

Improving cash flow is a priority, and Cashflow.io empowers you to achieve this by creating tailored recurring payment plans for each client. Additionally, automated payment reminders and pre-authorized debits ensure clients adhere to the agreed payment schedule, significantly enhancing cash flow and allowing you to concentrate on business growth.

Effortless Access to Financing for Outstanding Invoices

Swift access to financing is vital for effective AR management, especially for substantial customer invoices. Cashflow.io simplifies this process by offering near-instant approval and same-day funding directly through the platform, eliminating the inconvenience of lengthy applications and traditional banking channels. This integrated financing enables you to confidently accept new business opportunities without worrying about cash flow constraints.

Simple Onboarding, Customization, and Scalability

Cashflow.io ensures a smooth onboarding experience, enabling you to connect your business bank accounts and payment processors seamlessly and at no cost. Moreover, the platform is highly customizable, allowing you to tailor its features to align with your evolving business requirements. It grows in tandem with your company, providing convenient access to financing as your business expands.

Intuitive Tools for Time-Efficient AR Management

Cashflow.io simplifies AR management with its intuitive, user-friendly tools. Centralized dashboards consolidate financial data into an accessible format on any device, offering a comprehensive view of invoicing, payment plans, and financing. This centralized hub saves valuable time, and the user-friendly interface allows seamless work from your phone or tablet, ensuring efficient AR management on the move.

Robust Security for Financial Assurance

Cashflow.io prioritizes the security of your financial data, employing the highest standards such as AES-256-bit encryption and adhering to PCI and SOC compliance guidelines. Sensitive information is not stored directly, ensuring utmost data protection. The platform operates via certified Level 1 PCI payment processors, providing peace of mind regarding financial security.

QuickBooks vs Cashflow.io: A Comparison

When comparing QuickBooks and Cashflow.io, there are some notable differences:

- Pricing: Cashflow.io offers custom pricing based on the size of your business, compared to QuickBooks Online Advanced standard pricing which starts at at $140/month.

- AR Focus: Cashflow.io specializes in automating accounts receivable processes end-to-end. QuickBooks offers broader accounting capabilities.

- Payment Processing: Cashflow.io enables integrated payment acceptance via various gateways and bank transfers. QuickBooks requires you to use Intuit payments.

- Collections Automation: Cashflow.io provides customizable rules-based collections automation. This is highly limited in QuickBooks.

- Analytics: Cashflow.io has robust real-time AR analytics and forecasting. QuickBooks focuses more on accounting analytics, and has a limited ability to offer data-driven insights.

- Credit Risk Mitigation: Cashflow.io automates credit limit assignment and risk exposure tracking. QuickBooks lacks credit risk features.

For businesses seeking to maximize AR automation and cash flow efficiency, Cashflow.io emerges as a specialized yet affordable alternative to QuickBooks worth evaluating. However, the two tools can work together to cover accounting and AR aspects.

Choosing the Right AR Automation Solution

When searching for the ideal AR automation solution, it’s crucial to look beyond the comprehensive features of platforms like QuickBooks and explore specialized AR automation solutions such as Cashflow.io, Tipalti, BILL.com, Melio, and others. These platforms offer advanced functionalities essential for streamlined AR management. Here’s a detailed expansion on key criteria to consider when you are evaluating and AR automation tool:

1. End-to-End Workflow Automation

Efficiency in AR processes is crucial. Look for a platform that seamlessly automates the entire AR process, from invoicing and extending to efficient cash allocation. Automation should cover invoice generation, payment tracking, reminders, and allocation to optimize the workflow.

2. Flexible Payment Integration

Integration with various payment gateways, bank transfers, and debit collections is paramount. The chosen solution should ensure automated and efficient handling of cash receipts from multiple sources, enhancing the payment experience for both businesses and customers.

3. Rules-Based Collections

Efficient collections management is vital. The selected solution should allow you to configure rules that trigger automatic reminders, emails, calls, or letters based on the number of days past due. This ensures timely follow-ups and helps in maintaining healthy AR cycles.

4. Customizable Payment Plans

Every customer is unique, and so are their payment preferences. Look for a platform that supports the creation of tailored recurring customer payment plans. Customization is key to accommodating diverse and unique customer needs, fostering better customer relationships.

5. Data Integration Capabilities

Integration with other systems is a critical factor. Ensure that the solution offers robust data integration capabilities, including APIs that seamlessly connect with accounting software, CRMs, and other crucial business systems. This integration streamlines data flow and improves overall operational efficiency.

6. Reporting & Analytics

Insightful reporting and analytics are pivotal for making informed decisions. Look for a solution that provides robust AR analytics and intuitive dashboards. These tools offer valuable insights into AR performance, payment trends, outstanding balances, and more, supporting data-driven forecasting and strategic decision-making.

7. Credit Risk Management

Mitigating credit risk is essential for financial stability. Opt for a solution that provides automated tools to define credit limits, track risk exposure, and initiate necessary collection actions. This automated risk management minimizes bad debt and ensures a healthier AR portfolio.

8. Scalability

Businesses evolve, and so do their AR needs. Consider a platform that can effortlessly scale to handle increasing invoice and customer volumes as your business expands. Scalability ensures sustained efficiency and effectiveness even during periods of rapid growth.

Steps to Implement Accounting Automation

| Step | Key Points |

|---|---|

| Identify Automation Opportunities | Analyze tasks like data entry, report generation, etc., for automation potential, saving time and resources. |

| Select the Right Automation Tools | Evaluate current software and explore platforms like QuickBooks for robust automation. |

| Design Optimal Workflows | Document steps, triggers, and validation for efficient, accurate automation. |

| Assign Process Owners | Appoint dedicated owners to oversee and resolve automation issues. |

| Test Extensively | Conduct thorough tests to ensure flawless automation functionality. |

| Roll Out Gradually | Start with critical workflows, validate effectiveness, and extend gradually to minimize disruptions. |

| Regularly Optimize Workflows | Continuously monitor and optimize for efficiency gains and error reduction. |

Automating accounting processes can streamline operations and enhance productivity. Here’s a structured approach to implementing accounting automation:

1. Identify Automation Opportunities: Begin by thoroughly analyzing existing accounting tasks within your organization. Pinpoint processes with high automation potential, such as repetitive data entry, report generation, bank reconciliations, and invoice generation. Identify tasks that can be made more efficient through automation, leading to time and resource savings.

2. Select the Right Automation Tools: Evaluate the automation capabilities within your current accounting software. For instance, platforms like QuickBooks Online Advanced offer robust automation features for critical workflows like invoicing, reporting, and banking.

3. Design Optimal Workflows: After identifying potential areas for automation, proceed to document and map out each step in the identified workflows. Define appropriate triggers, validation mechanisms, and exception-handling logic to ensure a seamless automation process. Aim to design workflows prioritizing maximum efficiency and accuracy, aligning with your organization’s objectives.

4. Assign Process Owners: Allocate dedicated process owners for each automated workflow. These individuals will play a pivotal role in overseeing and ensuring the successful functioning of the automation. They will handle exceptions, resolve issues that may arise during the process, and act as key points of contact, streamlining the automation implementation and maintenance.

5. Test Extensively: Conduct comprehensive testing of the automated workflows through trial runs before full-scale implementation. Test under various scenarios, closely addressing edge cases and potential error situations. This extensive testing ensures the automation functions as intended and meets the desired efficiency standards.

6. Roll Out Gradually: Initiate the automation process by first automating a few critical workflows. This gradual approach allows you to validate the effectiveness of the automation and iron out any initial challenges that may arise. Once you’ve addressed these issues, gradually extend automation to other processes, minimizing disruption and optimizing the overall transition.

7. Regularly Optimize Workflows: Post-implementation, establish a system for continuous monitoring and assessment of the performance of automated workflows. Identify opportunities for further optimization, efficiency improvements, and error reduction. Regularly update and refine the automation to maintain and enhance long-term efficiency gains, ensuring a continuously streamlined accounting process.

In Conclusion

Intelligently automating aspects of the accounts receivable process is critical for 21st-century businesses seeking enhanced productivity, insights, and efficiency. While QuickBooks provides helpful automation features, specialized platforms like Cashflow.io excel in end-to-end AR automation. Evaluating options aligned with your unique needs and scaling automation in a phased manner ensures smooth adoption and maximum benefits realization. When approached strategically, AR automation has the potential to transform cash flow management and turbocharge accounting productivity to new heights, giving your business a creative way to get a leg up over the competition.