The 7 Best AR Automation Tools of 2024

For any business, efficiently collecting payments from customers is critical to success. Manual, paper-based accounts receivable processes can be extremely time-consuming, inefficient, and prone to errors resulting in a complex collections process for many modern businesses. AR automation software is becoming essential to optimize the entire credit-to-cash cycle by eliminating repetitive manual tasks. However, with the wide variety of solutions on the market, it can be challenging to determine which platform best meets the needs of modern enterprises.

This comprehensive article will compare the key features, capabilities, and benefits of the top AR automation tools, including Cashflow.io, Melio, Tipalti, AvidXchange, Stampli, Airbase, and BILL.com. We’ll provide detailed insights to help identify the ideal software for streamlining AR workflows, accelerating cash flow, enhancing forecasting, and driving productivity across financial operations in your organization.

Evaluating Your Requirements

With the wide variety of solutions on the market, evaluate your key requirements before selecting automation software. Consider factors like:

- Current AR workflows – Where are your existing processes’ bottlenecks and pain points? Look for a solution to target and alleviate these trouble spots with automation directly.

- Business size – Larger enterprises often benefit from more robust platforms, while streamlined solutions may better suit small businesses.

- Industry needs – Are there unique AR requirements in your specific industry that you must address? Identify industry-specific features.

- Customer base – Do you need multilingual and multi-currency support for international customers? How tech-savvy are your customers?

- Accounting software – Will the solution integrate seamlessly with your general ledger platform?

- IT environment – SaaS solutions are the easiest to deploy. If you have strict IT requirements, be sure to evaluate on-premise options.

- Budget – Solutions range from free to enterprise prices. Align potential ROI to the cost.

By carefully evaluating your organizational needs and priorities, you can zero in on the AR automation solution that will deliver the biggest impact.

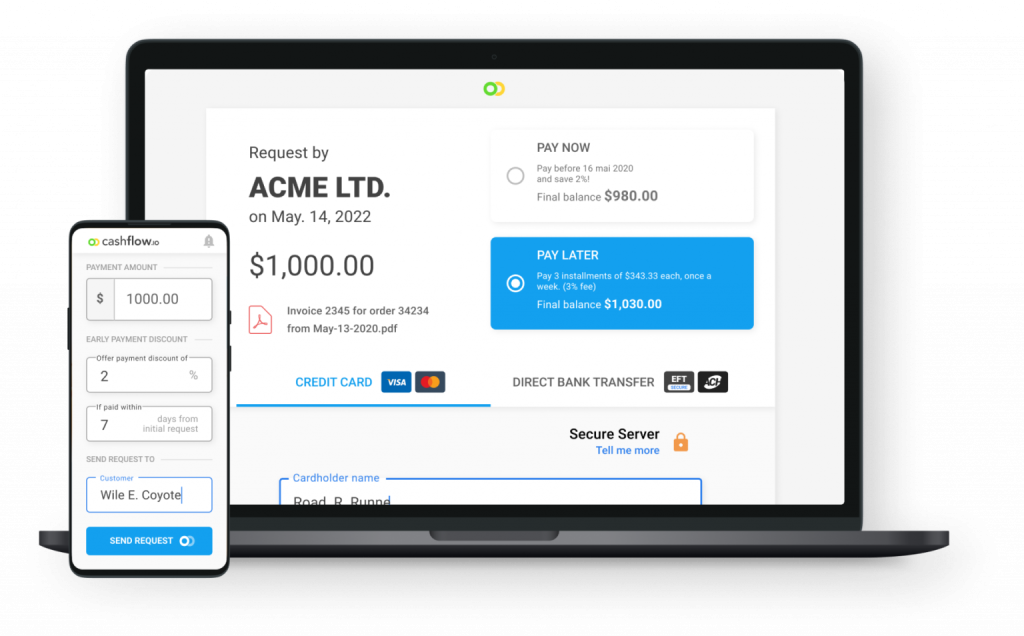

The Best Overall: Cashflow.io

Cashflow.io is an end-to-end AR automation solution that simplifies and streamlines receivables management. It provides powerful tools to create tailored recurring customer invoices and payment plans, deliver digital invoices, automate reminders and follow-ups, facilitate fast customer payments, and generate detailed analytics.

Key Features

- Customizable recurring invoices – Automatically generate repeating invoices on fixed schedules personalized to each customer’s billing needs.

- Digital invoice delivery – Instantly send professional, customizable digital invoices and get notifications when customers view them.

- Auto payment reminders – Configure rules to automatically send payment reminder emails and follow up at the right times based on due dates.

- Fast online payments – Get paid quickly via seamless integrations supporting bank transfers, credit cards, Apple Pay, and ACH payments.

- Late fee automation – Automatically apply configured late fees to overdue invoices to incentivize timely payment.

- Robust AR analytics – Gain real-time insights into AR KPIs like aging summaries, payment cycles, disputes, deductions and other metrics to inform credit decisions.

- Accounting software integrations – Connect seamlessly with popular platforms like QuickBooks Online, QuickBooks Desktop, Xero, NetSuite, and others.

- Customer self-service portal – Give customers 24/7 access to a personalized portal to view invoices, statements, balances, and track payments.

In the realm of accounts receivable automation, Cashflow.io stands as a trailblazing solution, simplifying crucial financial processes. The platform revolutionizes the way businesses manage payables and receivables, seamlessly integrating financing workflows into a consolidated, user-friendly interface.

Enhancing Receivables Automation

Cashflow.io empowers businesses to design customized payment schedules and effortlessly send automated reminders. By enabling pre-authorized debits from customers, it minimizes late payments, optimizes cash flow and enhances financial stability. This automation grants businesses the ability to confidently strategize and invest in their growth.

Seamless Payment Handling

One of Cashflow.io’s standout features is its automated payables system. By forwarding invoices to a designated email, the platform triggers bank transfers, eliminating the need for manual processing. This streamlined approach saves valuable time, enabling businesses to focus on strategic initiatives.

Same-Day Funding Access

Cashflow.io streamlines access to financing for significant customer orders. The platform facilitates near-instant approval and same-day funding directly, providing immediate capital access. This enables businesses to pursue larger opportunities with confidence, fostering growth and expansion.

Effortless Setup and Scalability

Businesses benefit from Cashflow.io’s straightforward onboarding process and seamless integration with bank accounts and payment processors, all at no additional costs. The platform is highly adaptable, accommodating changing business needs and scaling effortlessly with business expansion. This flexibility makes it an ideal fit for businesses of varying sizes and growth stages.

Intuitive Dashboards for Enhanced Insights

Cashflow.io presents financial information through intuitive, easily accessible dashboards viewable on any device. This user-friendly experience facilitates efficient mobile business management, saving time and boosting productivity. Instant access to financial data enhances decision-making and overall efficiency.

Robust Security for Data Protection

Cashflow.io prioritizes the safety and confidentiality of financial data. Implementing robust security measures like AES-256-bit encryption and compliance with PCI and SOC guidelines, the platform ensures maximum data protection. Certified Level 1 PCI payment processors handle sensitive information with the highest standards of care, instilling confidence and peace of mind in business operations.

Why Cashflow.io?

Cashflow.io simplifies every aspect of AR by fully automating time-consuming manual processes. Custom recurring invoices combined with rules-based reminders significantly accelerate the order-to-cash cycle. Robust AR analytics provides real-time visibility into metrics needed to adjust credit policies, prioritize collections, and enhance forecasting accuracy. And seamless ERP integrations ensure efficient data syncing to maintain up-to-date financials.

With an easy-to-use interface and stellar customer support, Cashflow.io is the ideal scalable solution to transform AR productivity for businesses of all sizes.

Best for Analytics: Stampli

Stampli delivers powerful AR workflow automation coupled with robust analytics and reporting. It automatically captures invoice data, enables customizable rules-based workflows, and seamlessly integrates with over 70 major ERPs and accounting platforms.

Key Features

- AI-powered data extraction – Reduce manual invoice data entry by over 80% using AI to automatically capture key details.

- Customizable workflows – Configure rules to route invoices to approvers to match your processes for efficiency.

- Real-time AR analytics – Get critical insights into AR metrics like aging buckets, disputes, deductions, and more to guide decisions.

- Broad ERP integrations – Connects out-of-the-box with platforms like NetSuite, Dynamics, SAP, Acumatica, Sage, and many others.

- Predictive analytics – Statistical algorithms forecast future cash flow, equipping teams to optimize working capital.

Stampli excels at both streamlining manual AR workflows while also providing actionable financial insights. Its versatile platform drives long-term productivity improvement.

Best for SMBs: Melio

Melio offers user-friendly AR automation tailored for SMBs across industries. It provides the core tools needed to simplify invoice generation, payment reminders, customer self-service, and cash flow management.

Key Capabilities

- Recurring invoices – Schedule repeating invoices customized to each client’s billing needs.

- Custom payment terms – Tailor payment due dates and installment plans to fit each customer’s requirements.

- Digital delivery – Send professional invoices electronically via email or customer portal.

- Payment reminders – Configure automated emails to remind clients about approaching or missed due dates.

- Fast settlement – Bank-to-bank transfers facilitate quick access to funds after payment.

- Accounting integrations – Syncs transaction data with QuickBooks Online, QuickBooks Desktop, Xero, and more.

Melio meets the essential AR automation needs of SMBs with an easy-to-use platform. It optimizes cash flow while maintaining necessary financial controls.

Most Configurable: AvidXchange

AvidXchange provides end-to-end AR automation tailored to your workflows. It offers unparalleled configuration options to adapt to your organization’s specific invoicing, payment, and cash application processes.

Key Features

- Custom rule-based workflows – Configure approval rules aligned to your internal controls for efficient invoice processing.

- Digital invoice archiving – Maintain a centralized, searchable repository of historical invoices.

- Deep accounting integrations – Syncs transaction data with major platforms like Sage, Oracle NetSuite, SAP, Dynamics, and more.

- Powerful reporting – Get insights into AR metrics to guide credit decisions and cash forecasting.

- Online payments – Support digital payment methods like virtual cards, ACH, and check via AvidPay.

AvidXchange adapts to your organization’s unique workflows for optimal AR automation. Its robust tools align to your existing processes for seamless optimization.

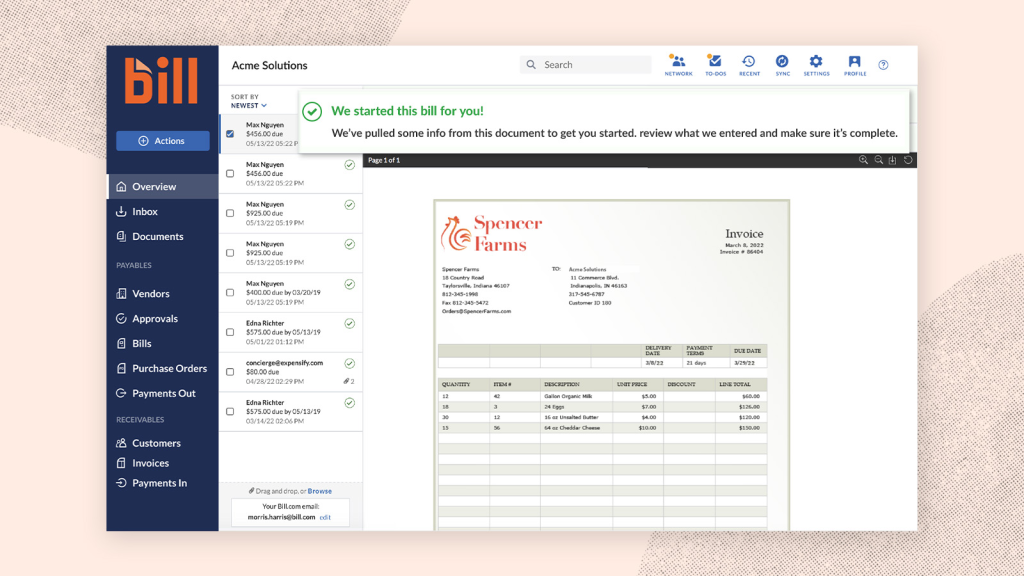

Full Financial Platform: BILL.com

BILL.com brings comprehensive financial process automation together into one unified cloud platform. It consolidates AR along with AP and integrated payments.

Key Benefits

- Unified workflows – Manage AR, AP, and payments workflows in one centralized system.

- End-to-end automation – Digitizes invoice delivery, reminders, cash application, and reconciliation.

- Configurable approvals – Customize rules-based routing for invoice approvals.

- Real-time insights – Make data-driven decisions with real-time visibility into AR metrics.

- Robust integrations – Sync transaction data with major small business accounting platforms.

BILL.com delivers automation, visibility, and control across the financial spectrum. It enables centralized management of receivables, payables, and payments in one platform.

Most User-Friendly: Airbase

Airbase combines intuitive, consumer-grade design with robust AR features. Its sleek user experience enables frictionless adoption across organizations.

Key Advantages

- Intuitive interface – Enables quick ramp up and user adoption with easy navigation.

- Real-time AR analytics – Provides up-to-the-minute visibility into AR metrics to inform decisions.

- Configurable workflows – Supports rules-driven invoice routing tailored to existing approval processes.

- Accounting integrations – Connects seamlessly with popular mainstream bookkeeping platforms.

- Access controls – Manages team user permissions to enforce separation of duties.

Airbase simplifies and modernizes AR management through an elegant platform purpose-built for usability and automation.

Automated Global Payments: Tipalti

Tipalti specializes in automating global AR workflows across multiple countries, entities, currencies, and languages. It shines for mid-market companies managing distributed AR across borders.

Key Benefits

- Multi-currency invoice generation – Easily create invoices localized for your global customer base.

- Compliant local payment acceptance – Collect payments from 190+ countries following in-country regulations.

- Built-in tax compliance – Avoid penalties by meeting complex multi-region tax mandates.

- Multi-language self-service portal – Provide a localized experience for your international customers.

- Auto bank reconciliation – Eliminates tedious manual reconciliation of global AR payments.

Tipalti enables seamless, compliant automation of global AR workflows, removing complexity from cross-border collections.

Our Choices at a Glance

| Solution | Automation | Customization | Analytics | Support | Score |

|---|---|---|---|---|---|

| Cashflow.io | Comprehensive automation across all AR workflows | Highly configurable rules and settings | Robust real-time AR analytics and reporting | Quick, multi-channel live support | 9/10 |

| Stampli | Advanced workflow automation for AR processes | Flexible rules-based configuration | Powerful AR analytics and visualization | Email and online knowledge base resources | 8/10 |

| Melio | Core automation for invoicing, reminders, payments | Some process customization | Basic AR insights and reporting | Email and chat support channels | 7/10 |

| AvidXchange | End-to-end automation for the full AR cycle | Highly tailored configuration | Strong analytics and reporting | Phone, email, chat support options | 8/10 |

| BILL.com | Full automation across AR, AP, payments | Decent flexibility to customize processes | Real-time visibility into AR metrics | Email, chat, and phone support available | 8/10 |

| Airbase | Robust workflow automation for AR management | Moderate flexibility to tailor configurations | Real-time AR analytics and insights | Email and online knowledge base resources | 7/10 |

| Tipalti | Advanced global automation for cross-border AR | Limited ability to customize workflows | In-depth global AR analytics and reporting | Email and online documentation | 7/10 |

The Winning Solution

In conclusion, Cashflow.io stands out as the clear leader among top-rated AR automation systems for 2024. It enables comprehensive automation that can be tailored to each organization’s workflows. Customizable recurring invoices, reminders, customer self-service, and rules-based workflows accelerate the order-to-cash cycle.

Robust real-time AR analytics empower data-driven decisions to optimize cash flow, while responsive multi-channel support ensures you get timely answers. For a feature-rich AR automation platform purpose-built to drive efficiency, Cashflow.io is the winning solution.

FAQs

What is AR automation, and why is it important for businesses?

AR automation uses software to streamline and optimize the credit-to-cash cycle, reducing manual tasks in invoice processing, payments, and reconciliation. It’s crucial for enhancing efficiency, reducing errors, accelerating cash flow, and improving customer satisfaction.

How does AR automation benefit businesses?

AR automation brings several benefits, including faster invoice processing, improved cash flow management, reduced Days Sales Outstanding (DSO), enhanced visibility into AR metrics, increased productivity, cost savings through process efficiency, and a better customer experience.

How do I choose the right AR automation software for my business?

When selecting AR automation software, consider your current AR workflows, business size, industry needs, customer base, accounting software compatibility, IT environment, and budget. Assess the features, customization options, analytics capabilities, and integrations each software offers to align with your specific requirements.

What are some key features to look for in AR automation software?

Important features include customizable recurring invoices, digital invoice delivery, automated payment reminders, integration with accounting software, robust analytics providing real-time insights, and a user-friendly customer self-service portal. The software should streamline workflows, support online payments, and offer seamless ERP integration.