What is AR Automation: A Beginner Guide

Effective accounts receivable (AR) management is a cornerstone of successful business operations. However, the traditional manual AR processes involving spreadsheets, paper invoices, and ledger books are time-consuming and highly inefficient in today’s fast-paced business environment.

This beginner’s guide is designed to elucidate the concept of AR automation, its pivotal benefits, and how businesses can transform their AR workflows by harnessing the power of automation.

Understanding Accounts Receivable Automation

Accounts Receivable Automation (AR automation) is a technological solution to digitize, streamline, and automate the standard accounts receivable processes. These processes encompass critical activities such as:

- Generating and Dispatching Digital Invoices: Creating and sending digital invoices swiftly and efficiently.

- Automated Payment Reminders: Sending out reminders to clients regarding their pending payments, ensuring timely settlements.

- Online Client Payments: Facilitating clients to make payments online through secure and convenient platforms.

- Reconciliation of Payments: Automating the reconciliation of payments received with the corresponding invoices, minimizing discrepancies.

- Tracking AR Aging and Metrics: Utilizing automated systems to keep track of accounts receivable aging and other pertinent metrics, providing insights into financial health.

By automating these manual tasks, AR automation creates streamlined, efficient, and scalable AR processes that significantly benefit businesses.

Key Advantages of AR Automation

| Benefit | Key Points |

|---|---|

| Time-Saving | Automates repetitive manual tasks, allowing staff to focus on strategic responsibilities. |

| Error Reduction | Minimizes human errors, preventing problems like revenue leakage. |

| Speedy Invoicing | Generates and delivers digital invoices swiftly to customers, expediting the invoicing process. |

| Accelerated Payments | Automated reminders and online payment options speed up invoice settlements. |

| Enhanced Reporting | Real-time AR analytics and dashboards provide valuable insights, aiding informed decision-making. |

| Improved Customer Experience | Self-service portals, reminders, and mobile access contribute to a positive customer experience, fostering goodwill. |

| Scalability | Automated processes can handle increasing transaction volumes as businesses grow, ensuring scalability. |

One of the foremost advantages of automating your AR is the sheer amount of time your business will save. By automating repetitive manual tasks such as sending payments, employees can channel their time and efforts into more strategic responsibilities, ultimately enhancing productivity and efficiency within the organization.

Automated workflows minimize human errors often accompanying manual processes, mitigating potential problems like revenue leakage. This preserves financial accuracy and cultivates a sense of reliability and trust with clients and stakeholders. Another critical benefit lies in speedy invoicing. Digital invoices are generated and delivered swiftly to customers, expediting invoicing and facilitating prompt payment cycles.

An often underestimated advantage is the enhancement of customer experience. Self-service portals, reminders, and mobile access provide customers convenient and seamless interactions, contributing to a positive overall experience.

Lastly, AR automation ensures scalability. As businesses expand and transaction volumes increase, automated processes adapt effortlessly, allowing you to scale your operations without compromising efficiency. These collective advantages affirm the transformative impact of AR automation benefits on modern business operations.

Choosing the Right AR Automation Software

Picking the right AR automation platform is like finding the perfect tool for a job – it needs thoughtful consideration of different factors. When you are looking for the right software, evaluate them using the criteria below:

- Available Features: Assess the features, including invoicing capabilities, reminders, payment processing, and customer portals.

- Integration: Ensure seamless integration with your accounting system and payment processors for a cohesive data management process.

- Customizability: Look for the ability to tailor workflows and rules to your business needs.

- Scalability: Confirm that the software can effectively handle your transaction volumes and is designed to grow alongside your business.

- Security and Compliance: Prioritize platforms that uphold stringent data security measures and comply with relevant industry standards and regulations.

- Customer Support: Opt for a platform that provides robust customer support and ample resources to assist you throughout the implementation and ongoing usage.

What are Popular Accounts Receivable Automation Tools for Beginners?

| Tool | Suitable For |

|---|---|

| Cashflow.io | Midsize businesses |

| Melio | Small businesses |

| Stampli | Small to midsize businesses |

| AvidXChange | Small to midsize businesses |

| BILL.com | Small businesses |

| Brex | Businesses focusing on card management |

| Airbase | Larger businesses focusing on card spend management |

- Cashflow.io: Is an incredibly robust financial platform offering an all-in-one solution for managing payables, receivables, and financing within a single, accessible hub. Its exceptional strength lies in customization, allowing tailored payment reminders and offering transaction-based financing options. Users benefit from an intuitive interface, making financial operations streamlined and efficient. Their responsive customer support further enhances the overall experience, and they are very easy to work with.

- Melio: Offers a straightforward and budget-friendly payment automation solution tailor-made for small businesses. Its user-friendly interface simplifies managing payables, particularly through uncomplicated bank transfers and check payments. While Melio is cost-effective and easy to use, it may lack some advanced features necessary for larger enterprises or those with complex global payment needs.

- Stampli: Provides access to streamlined invoice management and payments with a predictable, transaction-based pricing model, making it an economical choice. Geared towards small to midsize businesses, it provides essential features for accounts payable automation. However, it may not offer the extensive capabilities required for intricate global supplier payments, making it more suitable for businesses with simpler payment workflows.

- AvidXChange: Designed with simplicity and ease of use in mind, making it ideal for small to midsize businesses to automate fundamental accounts payable tasks like invoice capture and approvals. While its emphasis on user-friendliness and affordability is beneficial, it may lack the robust global payment capabilities essential for larger or multinational organizations with complex payment workflows.

- BILL.com: Offers a simplified interface, catering to the needs of small businesses and emphasizing seamless integration with QuickBooks. It’s a cost-effective option for automating basic accounts payable tasks. However, its capabilities may be more limited compared to other alternatives, especially for larger organizations or those with intricate payment requirements.

- Brex: Specializes in corporate card management, Brex provides a streamlined solution to monitor and control employee spending through virtual and physical card options. It stands out for its simplicity and affordability, particularly in the realm of card spending. However, it may not offer as advanced capabilities for core accounts payable automation when compared to other alternatives, making it suitable for businesses primarily focused on efficient card management.

- Airbase: Focuses on managing virtual and physical card transactions, aiming to help businesses control employee spending effectively. With a cost-effective structure, it doesn’t burden users with platform fees. While it excels in card management simplicity and affordability, its features for core accounts payable automation may not be as extensive compared to other alternatives. This positions Airbase as a fitting choice for businesses placing a strong emphasis on efficient card spend management.

What is the Best Accounts Receivable Automation Tool for Beginners?

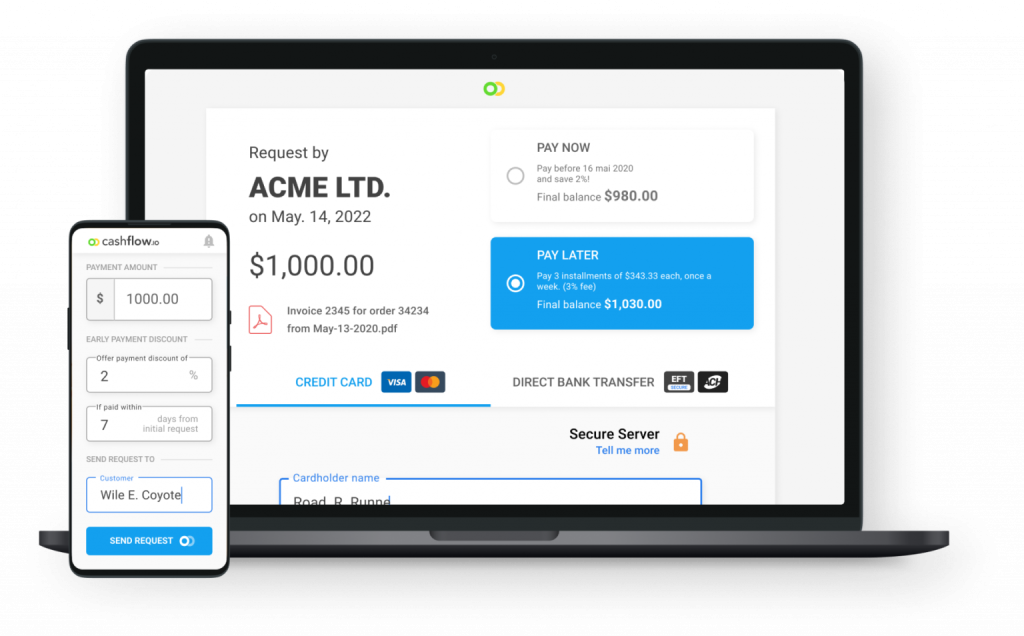

In your pursuit of a versatile financial tool that goes beyond basic spending management, Cashflow.io is a standout option. This platform seamlessly integrates bill payments, revenue collection, and flexible loan options into one accessible solution usable across various devices.

Simplified Bill Payments and Collections

Cashflow.io streamlines the bill payment process by allowing you to automate payments through forwarding invoices to a designated email address. This triggers automatic bank transfers, eliminating the need to manage multiple bank accounts. Additionally, the platform enables you to create custom payment plans tailored to your clients, ensuring timely payments and improving cash flow.

Flexible Financing Options

A notable feature of Cashflow.io is its ability to swiftly provide financing solutions for significant orders. If your business requires quick funding to seize growth opportunities, Cashflow.io offers efficient financing options with expedited approval processes. This facilitates same-day capital disbursement, empowering you to capitalize on substantial market prospects and drive business expansion.

Responsive Customer Support for Smooth Operations

Cashflow.io places a strong emphasis on customer satisfaction, offering dedicated customer support accessible through multiple channels such as phone, live chat, and email. Their responsive issue-resolution process becomes a reliable pillar for your ongoing financial operations, ensuring a smooth and uninterrupted experience.

Seamless Platform Integration and Scalability

Cashflow.io ensures a seamless integration experience, effortlessly integrating with your existing banking and payment infrastructures. The platform’s scalability ensures it evolves alongside your business, aligning perfectly with your changing needs and growth trajectory.

Intuitive Mobile-Friendly Dashboards for Enhanced Oversight

Cashflow.io enhances financial oversight through its intuitive, mobile-friendly dashboards that consolidate data in a user-friendly format across multiple devices. This mobile compatibility streamlines administrative tasks, facilitating data-driven decision-making and enhancing operational productivity.

Robust Security Protocols for Peace of Mind

Cashflow.io prioritizes the security of your financial data. The platform implements stringent measures, including advanced encryption and compliance with industry guidelines, to safeguard sensitive information. This dedication to security ensures you can manage your financial operations securely, establishing Cashflow.io as a trusted partner in your fiscal ecosystem.

Incorporating Cashflow.io into your financial toolkit promises to enhance efficiencies, streamline processes, and advance your accounts receivable management towards a new level of financial efficiency and effectiveness. Explore the potential of Cashflow.io and take a step towards optimizing your financial operations.

Implementing AR Automation: Step-by-Step

If you’ve decided to move forward with automating your accounts receivable process, there are a few key steps that you’ll want to follow. While this is not a comprehensive summary, here is how to get started:

- Detailed Workflow Documentation: Thoroughly document your existing AR workflows, identifying pain points and gathering input from staff.

- Research and Selection: Research AR automation software options that align with your feature requirements and budget. Prioritize ease of use and scalability.

- Pilot Automation: Initiate a small-scale automation pilot, such as automated invoicing, to assess capabilities and streamline processes before a full-scale implementation.

- Integration: Integrate the chosen automation software with your existing accounting system and payment processors to ensure unified data management.

- Transition Planning: Develop a comprehensive transition plan and timeline for migrating from manual to automated AR workflows, accounting for training and adjustments.

- Staff Training: Conduct thorough training sessions to equip staff with the necessary skills to effectively utilize the software, encouraging adoption and feedback.

- Performance Monitoring: Regularly monitor key performance indicators (KPIs) after the launch to track system performance, identify issues early, and optimize processes for continuous improvement.

A Beginner’s Guide to Monitoring Key Performance Indicators (KPIs) in Accounts Receivable

Now that your software is implemented, how do you track its impact over time? Understanding the pulse of your Accounts Receivable (AR) operations is vital, and one effective way to achieve this is by prominently displaying essential Key Performance Indicators (KPIs) on your dashboards. These KPIs, including Days Sales Outstanding, Bad Debt Ratio, Current AR Ratio, and others, provide valuable insights into the efficiency of your AR processes.

Regularly analyzing these KPIs allows for quickly detecting negative trends or process bottlenecks. You can optimize your AR strategies by delving into identified issues, pinpointing root causes, addressing problematic accounts, and leveraging the data to identify process gaps. Let’s explore these critical KPIs for effective monitoring:

- Days Sales Outstanding (DSO): Measures the speed at which customers make payments.

- Average Days Delinquent (ADD): Tracks customers’ days to pay after invoice due dates.

- Accounts Receivable Turnover Ratio (ART): Demonstrates the speed of payment collection and cash conversion.

- Collections Effectiveness Index (CEI): Reflects payment collection efficiency linked to bad debts.

- Bad Debt to Sales Ratio: Indicates the percentage of uncollected credit sales.

- Write-Off Ratio: Represents the percentage of accounts receivable written off as bad debt.

- Right Party Contacted (RPC) Rate: The percentage of contact attempts made to the correct payment contact.

- Operational Cost Per Collection: Measures the cost incurred to collect each payment.

- Deduction Days Outstanding (DDO): Indicates the speed of customer payment collection.

- Number of Revised Invoices: Measures the frequency of invoice revisions, providing insights into process effectiveness.

In Conclusion

In today’s rapidly evolving business landscape, automating accounts receivable is no longer a luxury; it is necessary to foster growth and efficiency. By following the guidance outlined in this beginner’s guide, your company can seamlessly implement AR automation and unlock its full spectrum of benefits across your financial operations.

The automation journey begins with a single step, and embracing AR automation significantly enhances operational efficiency and elevates your business to new heights. Explore AR automation’s potential and witness its transformative impact on your financial processes and overall business success.

FAQs

How to Automate Accounts Receivable?

Automating accounts receivable involves using specialized software to streamline processes such as digital invoicing, automated payment reminders, online payments, and tracking accounts receivable status. This automation saves time, reduces errors, and accelerates payment cycles.

What Is Accounts Receivable Automation?

Accounts Receivable Automation, or AR automation, uses software to digitize and streamline processes related to accounts receivable. This includes digital invoicing, automated reminders, online payments, and tracking receivables. Its goal is to reduce manual effort, minimize errors, and enhance financial management efficiency.

How to Manage Accounts Receivable with Invoice Automation?

To manage accounts receivable using invoice automation, use software to automate invoice generation, reminders, and payment reconciliations. This streamlines invoicing ensures timely payments, and enhances overall efficiency in handling financial transactions.