Invoice Factoring for Staffing Agencies (Boost Stability)

Staffing agencies provide a vital service by connecting businesses with qualified workers to fill open positions. However, the staffing industry faces unique financial challenges that can impact stability and growth.

Specifically, staffing agencies often incur significant upfront costs to recruit, screen, hire, and pay workers before receiving payment from their business clients. This lag between outgoing payroll and incoming payments from invoices can strain cash flow, especially for smaller agencies with limited working capital.

Invoice factoring has emerged as an effective solution to boost staffing agencies’ financial stability amidst these cash flow gaps. However, it is just one of many financing options for small businesses. This article explores how factoring stabilizes finances for staffing firms to strengthen operations and fuel growth. It also covers some of the top invoice factoring companies for staffing companies, including Cashflow.io.

The Cash Flow Crunch in Staffing

Before receiving payments, staffing firms face the challenge of managing substantial upfront costs. These expenses encompass various crucial elements, including recruitment costs, which encompass expenditures involved in advertising job openings, conducting applicant screenings, in-depth interviews, skill assessments, and comprehensive background checks.

Onboarding expenses, another significant component, encompass the costs of integrating newly hired workers, covering paperwork, training programs, essential equipment, and other necessities for a smooth onboarding process.

Additionally, there are payroll outlays to consider, which encompass the wages, benefits, and payroll taxes for the workers placed by staffing agencies, all of which must be managed before client payments are received.

Management expenditure, covering costs related to staff time and effort in candidate sourcing, managing worker placements, and addressing issues throughout the staffing process, is also a critical factor in these upfront costs.

To make matters worse, these costs tend to accrue rapidly, often amounting to tens or hundreds of thousands per week for mid-size to large agencies. However, staffing firms generally don’t receive payments from their clients until 30, 60, or even 90 days after workers begin assignments.

This lag between outgoing payments and incoming customer invoices can severely squeeze cash reserves. Many agencies struggle to sustain smooth operations and growth amidst these cash flow gaps. Established staffing firms with strong client rosters face liquidity challenges due to tight cash flows.

How Does Invoice Factoring for Staffing Agencies Work?

With factoring, agencies can gain immediate access to a large percentage of invoice value instead of waiting 30 days or more for customer payments. Here’s how the invoice factoring process works:

- The staffing agency submits unpaid client invoices to a factoring company.

- The factoring company purchases the invoices by advancing a cash percentage, often 80-90% of the invoice’s value, to the agency within a few days.

- The factoring company collects payment from the staffing client on the invoice due date.

- Upon receiving the invoice payment, the factoring company may remit the remaining balance minus a factoring fee to the staffing agency.

What are the Benefits of Factoring for Staffing Agencies?

| Benefit | Key Points |

|---|---|

| Immediate Access to Capital | Invoice factoring provides quick access to funds tied in invoices, aiding in meeting essential expenses promptly. |

| Cash Flow Smoothing | Factoring mitigates cyclical cash flow disruptions, ensuring a consistent capital flow between client invoice cycles. |

| Support for Growth Financing | Empowers agencies with additional capital to expand, diversify services, and facilitate hiring, fostering business growth. |

| Risk Mitigation and Credit Protection | Rigorous credit assessments safeguard agencies from non-payments, shielding against financial losses from unreliable clients. |

| Enhanced Borrowing Terms | Improves agencies’ credit profiles, enabling better borrowing terms such as lower interest rates on loans or lines of credit. |

1. Immediate Access to Capital

Staffing agencies often encounter immediate financial needs to cover essential expenses such as payroll, staffing, and operating costs. Invoice factoring grants swift access to funds tied up in invoices, offering a lifeline that promptly meets these crucial obligations. This immediate injection of working capital alleviates the strain caused by the need to collect money from late-paying clients, enabling agencies to navigate cash flow challenges efficiently.

2. Cash Flow Smoothing

The nature of staffing operations involves cyclical cash flow patterns that can cause disruptions in the day-to-day financial management of the agency. Invoice factoring is pivotal in mitigating these fluctuations by providing a consistent flow of capital between client invoice cycles. This steadies financial operations, offering a cushion against the uncertainties associated with payment delays and ensuring smoother business continuity.

3. Support for Growth Financing

The influx of capital from invoice factoring empowers staffing agencies to explore new business opportunities and expand their service offerings. It provides the financial muscle needed to take on additional clients, diversify services, and facilitate hiring more staff. This capacity for expansion is instrumental in supporting the agency’s growth trajectory and maintaining a competitive edge in the market.

4. Risk Mitigation and Credit Protection

Professional factoring companies undertake thorough credit assessments of the agencies’ customers before purchasing their invoices. This rigorous vetting process safeguards agencies from potential non-payments and minimizes the risk associated with unreliable or non-creditworthy clients. It acts as a protective shield against financial losses due to customer insolvencies or payment defaults.

5. Enhanced Borrowing Terms

Utilizing invoice factoring not only provides immediate cash flow solutions but also positively impacts the credit profile of staffing agencies. Strengthening their creditworthiness enables these agencies to qualify for improved borrowing terms, such as securing lower interest rates on business loans or lines of credit. This strengthened financial position opens further opportunities and improved financial management.

How to Pick an Invoice Factoring Company?

| Criteria | Key Points |

|---|---|

| Industry Expertise | Partner with firms experienced in staffing to offer tailored solutions for industry-specific challenges. |

| Reputation for Customer Service | Opt for companies known for transparent practices, flexibility, and exceptional customer support. Avoid those with hidden fees or rigid terms. |

| Financial Stability | Opt for firms with strong financial health and robust credit ratings for reliable and consistent services. |

| Integration with Technology | Select factors that seamlessly sync with staffing software platforms to streamline and automate the factoring process. |

| Flexibility in Offerings | Choose firms providing customizable advances, term flexibility, and no restrictive contracts to maintain control over factoring. |

| Cost Transparency and Competitive Rates | Partner with companies offering transparent fees and competitive rates, avoiding hidden charges or unclear fee structures. |

With thousands of factoring firms and fintech lenders now offering invoice factoring services, staffing agencies must choose the right partner. When assessing factoring companies, staffing firms should evaluate partners based on these key criteria:

1. Industry Expertise and Experience

Partnering with a seasoned factoring firm with specialized staffing experience is crucial. Such firms understand the intricate dynamics of the industry, enabling them to offer tailored solutions that address the unique challenges and requirements of staffing agencies.

2. Reputation for Customer Service

Choosing a factoring company renowned for its exceptional customer service is essential. Opt for a company with a reputation for transparent practices, flexibility in service offerings, and excellent support. Steer clear of firms associated with complaints regarding hidden fees or inflexible terms.

3. Financial Stability

Opting for a well-capitalized factoring firm with a strong financial standing ensures reliable services. If possible, check the firm’s credit ratings and financial health to guarantee a robust partnership that can withstand industry fluctuations and provide consistent support.

4. Integration with Technology

Evaluating factoring partners that offer seamless integration and synchronization with leading staffing software platforms is critical. This technological alignment streamlines the factoring process, enhancing efficiency and ensuring a more synchronized and automated approach to invoice management.

5. Flexibility in Offerings

Choose a factoring firm that provides a tailored solution, offering customized advances and flexibility without binding lock-in contracts. This flexibility enables staffing agencies to maintain control over their factoring arrangements, adjusting to their evolving needs.

6. Cost Transparency and Competitive Rates

Partnering with a company that offers competitive rates and complete transparency around fees is vital. Avoid firms with concealed charges or unclear fee structures. Clear and open communication about costs is key to establishing a mutually beneficial partnership.

By considering these factors, staffing agencies can make an informed and well-rounded decision when selecting an invoice factoring partner. This strategic partnership ensures a seamless, efficient, and supportive relationship, allowing the agency to navigate its financial landscape confidently and reliably.

What are the Top 3 Invoice Factoring Software Solutions?

To maximize process efficiency and seamlessly incorporate factoring into your financial operations, staffing agencies should leverage factoring companies that integrate with leading staffing software platforms, such as:

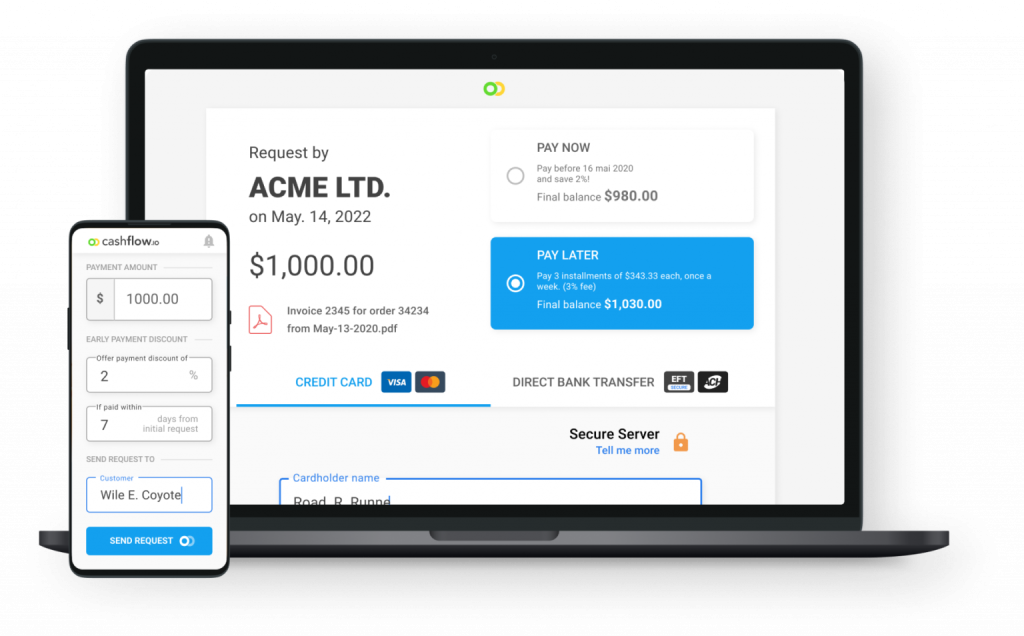

- Cashflow.io – Automates the invoice factoring, ensuring a consistent cash flow and timely payments. The platform offers swift financing options for substantial orders, enabling immediate capital disbursement and supporting business growth. Its scalability and integration with banking systems cater to the evolving needs of agencies, ensuring seamless financial operations.

- Bullhorn – A widely used staffing software, Bullhorn provides a centralized platform spanning front- and back-office functions. Bullhorn offers CRM, recruitment marketing, compliance, invoicing, and robust reporting analytics. Factoring integration allows staffing firms to finance Bullhorn invoices easily.

- Avionté – Providing end-to-end staffing management capabilities, Avionté enables holistic oversight of sales, sourcing, applicant tracking, onboarding, invoicing, compliance, and more. Avionté synergizes with factoring platforms to streamline financing and cash availability.

Who Can Use Invoice Factoring?

Invoice factoring offers substantial cash flow benefits, yet staffing agencies typically need to meet specific requirements to qualify for such programs:

- Operational Nature: Staffing firms seeking invoice factoring must primarily operate as business-to-business (B2B) entities, exclusively invoicing other businesses rather than individual consumers. Factoring companies typically do not finance business-to-consumer (B2C) receivables.

- Client Base: To qualify, agencies must possess a diversified portfolio of business clients with acceptable credit profiles that factoring companies can evaluate and underwrite. A varied customer mix without significant concentration among a limited number of accounts is preferable.

- Regular Invoicing: Essential to the process, staffing agencies must have a consistent pattern of invoicing their business clients for rendered staffing services.

- Pricing Structure: The rates charged by staffing agencies should align reasonably with market rates. Excessive markups on services may present challenges in the qualification process.

- Clear Receivable Status: Agencies looking to leverage invoice factoring should ensure no existing liens against their accounts receivable that could impact the factor’s interests.

Newer agencies might need to develop their customer portfolio and invoicing history before meeting the eligibility criteria. Many factoring companies provide onboarding support and will assist emerging agencies in meeting the requirements over time.

What is the Best Tool for Invoice Factoring for Staffing Agencies?

For staffing agencies seeking an exceptional invoice factoring solution, Cashflow.io stands out as the ideal tool, revolutionizing accounts receivable management within the staffing industry.

Streamlined Invoice Factoring Process

Cashflow.io simplifies the invoice factoring process by automating invoice handling. This tool allows for seamless submission of staffing invoices, triggering swift and automatic advancements on these invoices. By automating this process, it eliminates the hassles associated with traditional invoice handling, ensuring a steady and predictable cash flow for staffing agencies.

Tailored Financing Solutions

A key highlight of Cashflow.io is its ability to provide tailored financing solutions for staffing agencies. This tool swiftly advances funds on outstanding invoices, offering a quick injection of working capital. This enables staffing agencies to meet payroll and operational expenses without delay, facilitating consistent business operations and growth.

Dedicated Support Catered to Staffing Agencies

Cashflow.io prioritizes the needs of staffing agencies by offering specialized and responsive customer support. Assistance is available via various channels, including phone, live chat, and email, ensuring that staffing agencies receive dedicated support for their specific concerns and inquiries, promoting seamless operations.

Seamless Integration and Scalability

Cashflow.io seamlessly integrates with existing systems, making the transition process smooth for staffing agencies. Its scalable nature ensures it can adapt as the agency grows, catering to changing financial needs and accommodating evolving business requirements.

User-Friendly Interface for Enhanced Oversight

Cashflow.io presents a user-friendly interface that simplifies overseeing and managing invoices. With mobile-friendly dashboards, staffing agencies can easily track and manage invoices across various devices, enabling better decision-making and operational efficiency.

Stringent Security Measures for Data Protection

Cashflow.io places a strong emphasis on data security. Through advanced encryption and compliance with industry standards, the tool ensures the confidentiality and protection of sensitive financial information, offering peace of mind to staffing agencies relying on its services. Incorporating Cashflow.io into the financial toolkit of staffing agencies promises to streamline invoice factoring processes, ensure consistent cash flow, and optimize accounts receivable management, empowering these agencies to focus on core operations and growth. Discover the potential of Cashflow.io and elevate your staffing agency’s financial efficiency.

Summing Up: Factoring Fuels Staffing Success

Invoice factoring addresses staffing agencies’ systemic cash flow challenges by converting deferred client payments into immediate working capital. This cash infusion stabilizes strained finances, allowing staffing firms to bridge cash gaps, cover pressing obligations, and seize growth opportunities.

When pursuing factoring, staffing agencies should evaluate potential partners based on criteria like industry expertise, technology integration, customer service, costs, and contract flexibility. Choosing the right factoring fit accelerates benefits while minimizing disruptions.

With early invoices paid via factoring, staffing agencies gain financial runway to expand services, placements, and sales to accelerate their trajectory and foster stability. If cash flow constraints are hindering your staffing firm’s progress, a strategic factoring program can provide the financing fuel for growth.

Frequently Asked Questions

Do Factoring Companies Send Out 1099s?

Factoring companies do not typically issue 1099 forms. In the case of invoice factoring, the factoring company purchases your accounts receivable and advances funds against them. As the original business owner, you are responsible for reporting the income earned from the factored invoices on your tax return.

What is Payroll Funding?

Payroll funding is a financial service designed to help businesses cover their employee payroll and related expenses. It involves securing financing based on accounts receivable, enabling businesses to meet their payroll obligations even if there is a gap between invoicing clients and receiving payments.

How Does Invoice Factoring Impact Credit Scores?

Invoice factoring doesn’t typically impact the credit score of a business. Since it’s based on the value of the invoices rather than the business’s creditworthiness, it doesn’t create debt that affects credit ratings. This FAQ explores the relationship between invoice factoring and credit scores, offering valuable insights to businesses seeking financial solutions without credit implications.

Can Invoice Factoring Be Used for International Clients?

Invoice factoring can often be used for international clients, but it typically depends on the factoring company’s policies and the specifics of the client’s location. Some factors may have restrictions or additional requirements for international invoices due to varying laws, currencies, and credit assessment processes.

What Happens if a Client Doesn’t Pay an Invoiced Amount Factored?

If a client fails to pay an invoiced amount that has been factored in, the responsibility for the outstanding payment usually falls back to the original business owner who sold the invoice. Depending on the agreement with the factoring company, the business owner may be required to repurchase the invoice or cover the outstanding amount to the factor. Businesses must understand the terms and conditions before entering into a factoring arrangement to mitigate such instances effectively.