Retailer’s Guide to Offering Customer Financing

As a retailer, you want to close every sale. But for some customers, affording that big-ticket purchase in one payment is a dealbreaker. Offering financing gives more customers the ability to pay over time. This guide will cover everything you need to know to offer customer financing confidently.

What is Customer Financing?

Customer financing allows customers to split payments for a purchase into multiple installments over time. Rather than paying the full amount upfront, the customer makes regular payments towards the total cost.

Offering financing opens up sales opportunities for customers who can’t afford steep lump sums. It also encourages higher order values since budget-conscious shoppers can splurge on premium products.

With customer financing, you receive full payment upfront. The customer makes payments to the financing provider. There are two main financing options:

- In-House Financing – You handle financing directly, processing applications and collecting payments.

- Third-Party Financing – You partner with a financing company such as Cashflow.io that handles applications and payments.

Third-party financing is usually the better option for retailers since the provider handles all the financing administration. As a retailer, you simply complete the sale and receive full payment. You won’t need to worry about collecting money from late paying clients.

Why should I Offer Customer Financing?

Offering consumer financing expands the accessibility of your services to a broader customer base. It enables customers to access your services without immediate concerns about a hefty upfront payment when receiving the invoice. You can leverage consumer financing to:

- Enhance your professional image and differentiate yourself in a competitive market.

- Eliminate obstacles that might hinder clients from accepting service quotes.

- Increase job acquisition

- Secure larger deals

- Facilitate upselling opportunities.

Informing customers upfront about instalment payment plans often leads to a notable sales boost.

How Much Does Customer Financing Cost?

Customer financing typically incurs a fee of 3% to 6% per transaction, a measure designed to minimize upfront expenses during a sale. In addition to transaction-based charges, certain financing partners might levy a monthly fee, potentially up to $50, contingent upon the transaction volume. It’s advisable to seek comprehensive payment terms from your partner before entering an agreement.

Customers engaging in financing may face an interest fee on the financed amount. Some financing providers offer clients the option of 0% financing spread across three months. Performing a cost-benefit analysis can help ascertain if the generated additional revenue outweighs the incurred financing costs, enabling a better evaluation of its financial viability.

What are the Benefits and Drawbacks of Customer Financing?

| Benefits | Drawbacks |

|---|---|

| Increased Average | Complexity |

| Improved Cash | Bad Debt Risk |

| Higher Close | Fees and Expenses |

| Customer Loyalty | Operational Costs |

| Access to Customers | Regulatory Compliance |

What are the Benefits of Offering Customer Financing?

- Increased Average Order Value: By providing financing options, customers tend to spend more as they can spread the cost of purchases over time. This leads to larger transactions and higher average order values as customers opt for higher-priced items they might not afford upfront.

- Improved Cash Flow: Utilizing third-party financing allows businesses to receive full payment upfront for goods or services. Unlike waiting for customers to pay in instalments, immediate full payments enhance cash flow, providing access to funds for immediate business needs or investments.

- Higher Close Rates: Offering financing options removes barriers for customers who can’t afford a lump sum payment. By providing payment plans or credit options, businesses can close more sales as customers who were hesitant due to cost constraints can now afford their desired purchases.

- Customer Loyalty: Financing options enhance customer satisfaction and a smoother buying experience. Customers appreciate flexible payment choices and are likelier to remain loyal to retailers offering these convenient financing solutions.

- Access to Customers: Financing expands a retailer’s customer base by accommodating individuals with limited budgets. This inclusion allows retailers to tap into new demographics or customer segments who might not have otherwise been able to afford their products or services.

- Competitive Edge: Retailers are committed to customer convenience and experience by offering financing options. This progressive approach sets them apart from competitors and positions them as customer-centric businesses, potentially attracting more customers.

What are the Drawbacks of Customer Financing?

- Complexity: Introducing financing increases complexities in managing payments, credit checks, and bookkeeping, often demanding more resources and staff.

- Bad Debt Risk: Providing financing raises the risk of customer defaults, especially without proper credit checks or during economic instability, potentially leading to financial losses.

- Fees and Expenses: Engaging third-party financing incurs fees like per-transaction charges or percentages, impacting overall revenue; some providers set minimum transaction requirements.

- Operational Costs: Managing customer financing demands expenses for credit checks, software, staffing, and additional services.

- Regulatory Compliance: Offering financing requires adhering to regional regulations and non-compliance, which can lead to legal consequences.

How Can I Offer Financing to Customers?

| Step | Key Points |

|---|---|

| Review Options | Assess industry fit and customer needs for in-house or third-party financing. Consider control, cost, and ease of implementation. |

| Pick an Option | Develop comprehensive policies for in-house financing or select a suitable third-party service provider. Define credit terms and application processes. |

| Implement it | Set up systems for managing accounts receivable (in-house). Integrate chosen service into checkout processes (third-party). Ensure seamless integration for customers. |

| Let Customers Know | Market financing options via email, website, social media, and product pages. Highlight benefits clearly. Display options prominently during the checkout process. |

1. Review Options: Assess your business’s financial capabilities and customer needs to determine the type of financing that suits you best. Consider whether in-house financing, where your business acts as the creditor, or third-party financing, utilizing external services, aligns better with your goals and resources. Evaluate factors like control, cost, ease of implementation, and industry suitability.

2. Pick an Option: After deciding between in-house or third-party financing, delve into the specifics. If opting for in-house financing, create comprehensive policies and procedures. Develop terms and conditions, a credit application processes, and decide on the credit terms you’ll offer. Select a suitable service provider for third-party financing based on their offerings, ease of integration with your systems, fee structures, and customer experience.

3. Implement it: Once you’ve chosen the financing option, implement it into your business operations. For in-house financing, set up your systems for managing accounts receivable. This involves preparing your accounting system for entries related to accounts receivable, establishing a credit system to assess customer creditworthiness, and setting up flexible payment terms.

For third-party financing, integrate the chosen service into your checkout process. This requires adding the financing option to your product pages, checkout pages, and point-of-sale systems. Ensure seamless integration to avoid complicating the checkout process for customers.

4. Let Customers Know: Marketing your financing options is crucial to inform customers of these offerings. Utilize various channels such as email marketing, your website, social media platforms, and product pages to communicate these financing options effectively. Highlight the benefits of the financing program and how it can help customers afford their purchases more easily.

Choosing a Third-Party Financing Partner

Third-party financing involves relying on an external provider to act as a lender during the point of sale. Customers commit to payment plans in these arrangements, settling the full purchase amount over time, usually through monthly instalments. These financing programs typically offer broader credit approval compared to stricter financing methods. Some programs may feature interest-free options, while others may apply interest charges at fixed rates.

How to Select a Financing Partner?

When assessing potential partners, keep a few key attributes in mind. Look for seamless integration capabilities that effortlessly blend into your checkout processes, ensuring a smooth online and in-store customer experience.

Quick credit decisions are also vital to prevent abandoned carts, enhancing customer satisfaction. Flexible pay-over-time options accommodate diverse budgets, catering to a broader clientele base. Prioritize partners committed to responsible lending practices, setting customers up for successful financial management.

Strong customer support and access to financial education resources are invaluable for comprehensive assistance. Additionally, consider partners that do not mandate monthly minimum sales volumes, allowing for greater flexibility. Lastly, opt for partners with transparent fee structures without hidden costs, promoting trust and transparency.

What are Responsible Customer Financing Practices?

While financing improves access to purchases, retailers must implement responsible lending practices. Be sure your financing partner:

- Conducts thorough affordability assessments before approving applicants.

- Explain all costs and obligations clearly at sign-up.

- Allows customers to pay ahead of schedule with no penalties.

- Provides hardship options and workable payment plans if customers fall behind.

- Offers financial education resources to improve money management skills.

You protect customers and your brand reputation by partnering with an ethical provider. Avoid partners who trap financially vulnerable applicants in predatory cycles of debt.

Notable Trends in Customer Financing

1. Surge in Instalment Payment Options

In today’s retail landscape, the proliferation of instalment payment options, including Buy Now, Pay Later (BNPL) models, marks a significant trend. Offering customers the flexibility to pay in interest-free instalments over time rather than making a lump sum payment upfront has become a popular strategy. When incorporated into a seamless checkout experience, these payment plans attract more consumers, boost conversion rates, and encourage higher spending, contributing to increased revenue for businesses.

2. Flexibility and Customer-Centric Approach

The trend toward flexibility in payment methods reflects an increasingly customer-centric approach in retail financing. Consumers now expect a variety of payment choices, emphasizing businesses’ need to cater to diverse preferences. Multiple payment options, especially those tailored to suit different budgets and preferences, foster customer goodwill. Businesses embracing this trend demonstrate an understanding of their customers’ needs, nurturing loyalty and positive brand reputation while encouraging word-of-mouth recommendations.

3. Streamlined Payment Processes and Operational Efficiency

Another significant trend in retail financing revolves around streamlined payment processes and reduced administrative burdens. Solutions like instalment payment options often integrate platforms that simplify online and in-store transactions. With a focus on reducing overheads and administrative costs, businesses partner with reliable payment solution providers that handle transaction management, payment tracking, and risk mitigation. This shift minimizes the need for extensive administrative tasks, enabling businesses to concentrate on core activities, drive sales, and elevate revenue growth.

What are the Most Common Customer Financing Tools?

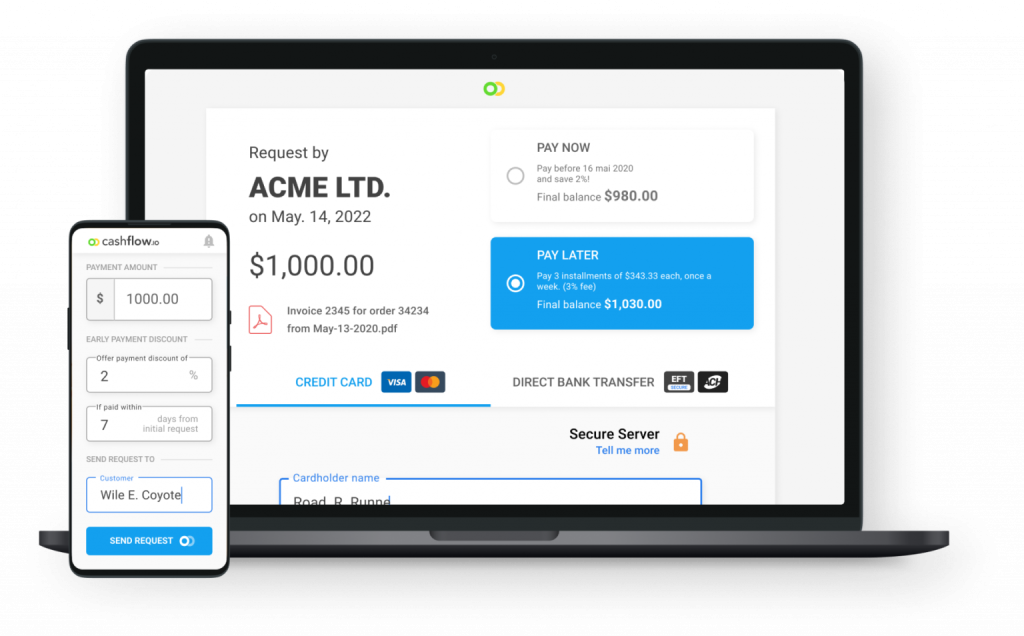

- Cashflow.io – Optimized Retail Financing. Cashflow.io streamlines the financing process, offering tailored financing solutions for retail businesses. It simplifies invoice factoring, provides cash advances, and integrates seamlessly with existing systems, ensuring retailers’ steady cash flow and growth.

- Affirm – Cleanest User Interface. Affirm simplifies consumer financing with its Adaptive Checkout feature, presenting clear financing options that are easy to understand. It benefits retailers aiming to offer straightforward financing to consumers unfamiliar with the process.

- PayPal – Largest Native Userbase. As a widely recognized BNPL provider, PayPal taps into its massive userbase, offering credibility and access to millions of existing users. It suits retailers valuing reputation and those seeking growth through their fintech partner.

- Sezzle – Best for Only Offering Pay-in-4. Sezzle specializes in 0-interest, 4-payment plans over six weeks, providing simplicity and ease for consumers. Ideal for retailers dealing in smaller-ticket items, leveraging simplicity to drive volume sales.

- Skeps – Widest Variety of Financing Options. Skeps collaborates with multiple lenders, offering various funding products and credit requirements. It caters to retailers of various sizes and industries, accommodating small-ticket volume-based businesses to high-value services or products.

What is the Best Customer Financing Platform in 2023?

Cashflow.io simplifies customer financing by seamlessly integrating flexible payment options into retail quoting. Through eQuote, the tool enables the creation of personalized quotes with adaptable payment plans, enhancing customer satisfaction and significantly boosting conversions.

Tailored Financing Solutions for Enhanced Customer Experience

A standout feature of Cashflow.io is its ability to offer tailored financing solutions to retailers. Payment Plans empower businesses to present customers with flexible payment options, fostering increased satisfaction and loyalty among clientele.

Effortless Management of Customer Accounts

Cashflow.io streamlines account management through Automated Collections, enabling retailers to follow up on outstanding payments effortlessly. This feature saves time, optimizes cash flow, and ensures smooth financial operations.

Financial Flexibility for Business Growth

Cash Advances through Cashflow.io provide retailers with the financial flexibility to undertake larger projects and expand their business horizons. These advances facilitate business growth and allow for greater financial control and maneuverability.

Responsive Support Catered to Retailers

Cashflow.io prioritizes the needs of retail businesses by offering dedicated support channels via phone, live chat, and email. This specialized assistance ensures retailers receive responsive support for their specific financing needs, promoting seamless retail operations.

Secure and User-Friendly Interface

Cashflow.io ensures data security by employing stringent measures, including advanced encryption and compliance with industry standards. The tool’s user-friendly interface simplifies the oversight of customer financing, providing retailers with enhanced visibility and control over their financial operations.

The Bottom Line: Offer Customer Financing with Confidence

Engaging more customers becomes achievable by eliminating budget barriers through financing options. By embracing financing, businesses witness an increase in average order values and close rates while attracting diverse customer demographics.

Upfront payments enhance cash flow, fostering customer loyalty and encouraging repeat purchases. A well-structured financing program empowers retailers to provide flexible purchasing choices confidently. Cashflow.io simplifies financing, allowing retailers to concentrate on their core retail operations. Discover how Cashflow.io’s financing can benefit your retail store by contacting our business development team today to embark on this journey.

FAQs

How can I offer financing to my customers?

There are various ways to offer financing to customers. Consider partnering with third-party financing providers, establishing in-house financing programs, or exploring different credit options suitable for your business.

How can I offer financing to customers in the construction industry?

Offering financing in the construction industry may involve tailored solutions. Consider collaborating with financial institutions specializing in construction loans or creating financing plans for construction projects.

How do I start offering financing to my customers?

To initiate offering financing, assess the financial needs of your customer base. Research and establish partnerships with financial institutions or consider setting up in-house financing. Develop clear policies and communication strategies to present financing options effectively.

How do I offer customer financing effectively?

Effectively offering customer financing involves understanding your customers’ needs and financial capabilities. Tailor financing options, educate customers about available plans, streamline the application process, and ensure transparent communication about terms and conditions.

How do I offer finance to my customers and enhance sales?

To enhance sales through customer finance, provide clear and accessible financing options that align with customers’ purchasing behaviors. Streamline the financing process to encourage more customers to opt for financial plans.

How do I offer financing options that benefit both customers and my business?

Tailor financing options to suit diverse customer needs while ensuring the plans align with your business goals. Consider flexible payment schedules, competitive interest rates, and transparent terms to create win-win situations for both customers and your business.