How to Automate B2B Payments

In today’s fast-paced business world, efficiency is key. Streamlining processes and automating tedious tasks can save valuable time and resources. B2B payments are no exception. Automating B2B payments can simplify the payment process, reduce errors, and improve cash flow. In this step-by-step guide, we will explore the basics of B2B payments, discuss the need for automation, and provide a comprehensive breakdown of the process.

The Need for Automation in B2B Payments

Manual B2B payment processes can be time-consuming, error-prone, and resource-intensive. As businesses grow and handle larger volumes of transactions, manual processes become increasingly challenging to manage. Automation can help overcome these challenges and bring numerous benefits to businesses of all sizes. Adobe estimates the cost of manually processing an invoice to be $15 to $40, depending on the complexity. Mitigating this cost through automation represents a substantial opportunity to save money in your business.

Manual processes, with their reliance on physical paperwork and manual data entry, can slow down payment cycles and introduce unnecessary delays. These delays can have a ripple effect, impacting cash flow and straining relationships with suppliers and vendors alike. However, existing platforms such as Cashflow.io provide options to automate payables.

A Step-by-Step Guide to Automating Accounts Payable

| Title | Summary | Approximate Timeline |

|---|---|---|

| Evaluate Your Business Needs | Assess your B2B payment requirements, considering transaction volume and scalability. | Month 1 |

| Purchase and Implementation | Once you have identified a tool that suites your business, purchase it and begin the implementation. | Month 2 |

| Streamline Approval Workflows | Set up approval workflows for payment efficiency and seamless integration with accounting systems. | Month 3 |

| Comprehensive Staff Training | Train your staff in using the automated system, ensuring a smooth transition and feedback collection. | Month 4 |

| Regular System Checks | Conduct routine system checks, monitor performance, and stay updated with software improvements. | Ongoing |

| Data Security | Prioritize data security with appropriate features and protocols to safeguard financial information. | Ongoing |

| Optimize Automation Processes | Continuously review and refine automation processes for improved efficiency and cash flow management. | Ongoing |

If you are considering automating your B2B payment processes, follow these steps to ensure a smooth transition:

- Evaluate Your Business Needs: Before automating B2B payments, assess your requirements, such as transaction volume and scalability. Choose an automation tool that aligns with your needs, offering seamless integration and robust security features.

- Purchase and Implementation: Once you have a good understanding of the specific processes that you would like to automate, and have identified a tool to utilize, purchase and implement it. This may involve temporarily hiring a developer to help if the solution is not turnkey.

- Streamline Approval Workflows: Set up approval workflows to simplify the payment approval process. You may also want to use tools that seamlessly work with your existing systems, such as Quickbooks integration.

- Comprehensive Staff Training: Train your staff to use the new system effectively. Provide comprehensive training sessions, helping employees understand their roles and responsibilities within the new automated workflow. Encourage feedback to ensure a smooth transition.

- Regular System Checks: After implementing the automation tool, perform regular system checks and updates. Monitor system performance, resolve issues, and stay up-to-date with software updates to maintain efficiency and effectiveness in your B2B payment automation.

- Data Security: Prioritize data security, safeguarding your payment processes. Utilize security features to protect sensitive financial information and prevent unauthorized access.

- Optimize Automation Processes: Continuously review and optimize your automation processes. Identify areas for improvement and refine your workflows to maximize efficiency, ultimately benefiting from reduced errors and improved cash flow management.

The Challenges of Manual B2B Payments

The challenges of not automating B2B payments are significant, as manual processes can introduce a number of inefficiencies and complications into your business that will cost you time and money. Here are some of the implications below:

- Manual Data Entry and Paperwork: Without automation, B2B payments often rely on manual data entry and paperwork. This cumbersome process is prone to errors, leading to payment discrepancies and reconciliation challenges.

- Inefficiencies and Delays: Manual B2B payment processes can become overwhelmed, especially when dealing with a high volume of transactions. This can result in delays in payment processing, which, in turn, affects your business’s liquidity and relationships with suppliers.

- Resource Drain: Manual payment processes demand a substantial investment of time and manpower. Your employees spend valuable hours on routine administrative tasks, diverting them from more strategic responsibilities.

- Lack of Transparency: Manual processes lack the transparency and visibility that automation provides. Without a clear audit trail, it becomes difficult to track and reconcile payments accurately. This lack of transparency can lead to confusion, disputes, and strained relationships with business partners.

- Risk of Errors: Consider the time and effort required to manually verify each payment. Human error is an inherent risk, and even a small mistake can have significant financial consequences. Automation can implement robust verification systems that significantly reduce this risk.

- Opportunity Cost: Time and resources spent on manual processes could be better utilized elsewhere. Automation frees up these resources, enabling your employees to focus on more value-added tasks that contribute to your business’s growth and success.

The Five Benefits of Automating B2B Payments

| Benefit | Key Insight |

|---|---|

| Improved Efficiency and Time Savings | Automation streamlines processes, reducing manual work and enabling quicker, more efficient payments. |

| Reduced Errors | B2B payment automation minimizes human errors, ensuring payment accuracy and preserving business relationships. |

| Enhanced Cash Flow Management | Automation provides predictability, helping businesses manage cash flow effectively and optimize working capital. |

| Improved Vendor Relationships | Timely payments through automation build trust, leading to better supplier partnerships and negotiation opportunities. |

| Enhanced Security and Fraud Prevention | Electronic payment methods in automation come with built-in security, safeguarding business finances from potential threats. |

1. Improved Efficiency and Time Savings

One of the most immediate benefits of automating your B2B payments is the remarkable boost in efficiency that your business will experience. Manual payment processes often involve time-consuming data entry and paperwork, leading to delays and administrative overhead. By automating these tasks, you can streamline the entire payment process, making it quicker and more efficient.

For instance, consider the task of processing invoices, a common bottleneck in many businesses. Cashflow.io allows you to forward invoices to a designated email address, which can automatically trigger payments. This not only saves time but also minimizes errors associated with manual data entry. The result? You can make payments swiftly and efficiently, allowing your team to focus on strategic tasks rather than routine administrative work.

2. Reduced Errors

Manual payment processes are inherently prone to human errors, such as data entry mistakes or payment discrepancies. These errors can lead to payment disputes, costly reconciliation efforts, and even damage your business relationships. A recent study indicated that human errors in accounting cost the US economy $18.2B per year. Here’s where a payment automation tool truly shines: it minimizes these errors by limiting human input.

By automating data capture and validation, Cashflow.io ensures payment accuracy, preserving your highly valuable business relationships. Imagine the relief of knowing that your payments are consistently accurate, free from costly mistakes, and in perfect alignment with your agreements.

3. Enhanced Cash Flow Management

Automation allows businesses to schedule and execute payments predictably. This predictability is essential for effective cash flow management. By ensuring that payments are made on time and in accordance with agreed-upon terms, businesses can optimize their working capital and financial stability.

4. Improved Vendor Relationships

Your relationships with suppliers and vendors are invaluable. How do you improve them? Timely and accurate payments are fundamental to fostering trust with your partners and vendors. A payment automation tool ensures that payments are made promptly, which goes a long way in building and maintaining strong partnerships. As a result, you’ll find that suppliers are more willing to work with you on better terms, offer preferential pricing, and even explore collaborative opportunities.

5. Enhanced Security and Fraud Prevention

Automation often involves electronic payment methods that are more secure than traditional paper-based processes. Electronic funds transfer (EFT) and virtual card payments, for example, come with built-in security measures. This reduces the risk of check fraud, lost checks, or unauthorized payments, ultimately safeguarding a business’s financial assets. Automation adds an extra layer of security to the payment process, protecting a business from potential financial threats.

Selecting the Right Software for Automating B2B Payments

Choosing the appropriate software to automate B2B payment processes is a pivotal decision for businesses seeking efficiency and growth. Consider the following factors when selecting the right software to streamline your B2B payments:

- Functionality: Ensure that the chosen software aligns with your specific B2B payment requirements. Look for features that support integration with existing systems and facilitate regulatory compliance. The software should cater to your unique needs, whether you’re handling high transaction volumes or specialized payment methods.

- User-friendliness: Opt for a user-friendly interface that minimizes the learning curve and requires minimal training for your team. A software solution that your employees can easily adopt ensures a smoother transition to automated B2B payments.

- Vendor Support: Prioritize software providers with a helpful support team. A reliable vendor can make a significant difference in the success of your B2B payment automation journey.

- Scalability: Consider the growth trajectory of your business. Ensure the selected software can scale effectively with increased transaction volumes and organizational expansion. Scalability is crucial to accommodate your evolving B2B payment needs.

The Best Choice for B2B Payment Automation

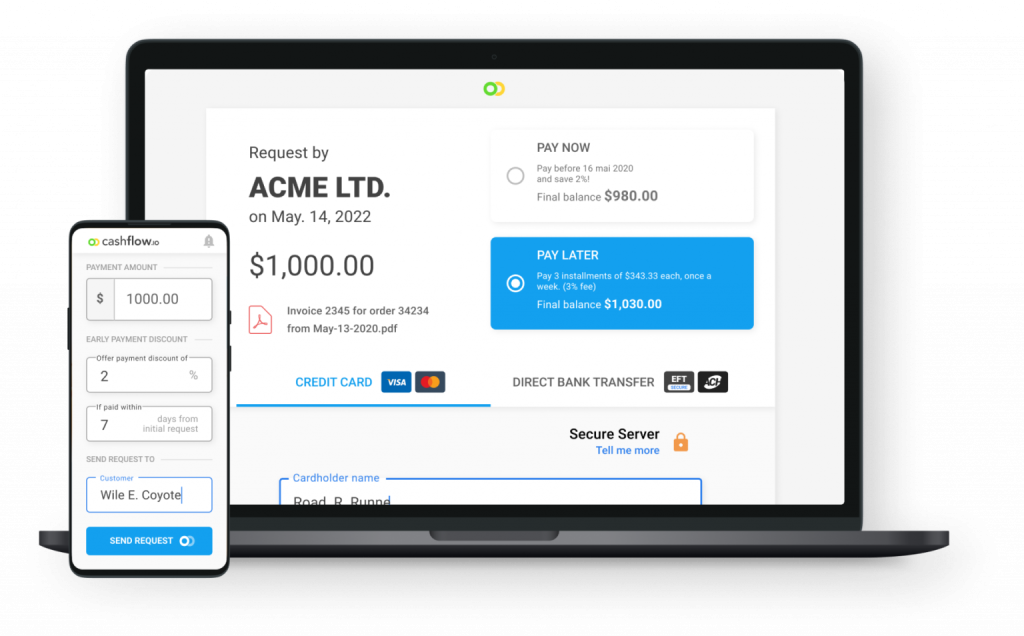

If you’re searching for a top-notch payment solution for automating your B2B payments, look no further than Cashflow.io. This comprehensive platform offers a one-stop solution for efficiently managing your payables, receivables, and financing needs.

With Cashflow.io, you can streamline your payment processes by automating payables. Simply forward invoices to a unique email address and watch as bank transfers are triggered seamlessly. This user-friendly interface consolidates all your payments within a single login, eliminating the need to juggle between different bank portals.

On the receivables front, Cashflow empowers you to create customized payment plans and effortlessly send payment reminders, ensuring you collect payments promptly through pre-authorized debits. This proactive approach not only enhances cash flow but also minimizes the occurrence of late payments.

In Conclusion

Automating B2B payment processes represents a strategic leap forward for businesses seeking to enhance their financial efficiency and streamline operations. Cashflow.io is a comprehensive B2B payment automation platform designed to simplify and optimize payment operations, enabling businesses to send and receive payments seamlessly, access financing options, and improve customer payment tracking. Its intuitive interface ensures a smooth onboarding process and robust security features provide peace of mind.

In your quest for improved financial management and operational efficiency, make the strategic choice today by exploring the benefits of B2B payment automation through platforms like Cashflow.io. It’s more than just software; it’s your pathway to a more streamlined, secure, and successful financial future.