Invoice Factoring for Freight Brokers (Accelerate Cash Flow)

Running a successful freight brokerage is no easy feat. You must balance managing carriers and shippers, tracking loads, and handling all the back-office work like invoicing and collections. And on top of it all, you must ensure your business has enough working capital to cover day-to-day operations and growth.

Many freight brokers turn to invoice factoring to accelerate their cash flow. Invoice factoring gives freight brokers immediate access to cash tied up in their outstanding invoices, so they can pay carriers quickly without waiting 30-90 days for customers to pay.

This article will explore how freight broker factoring works, its key benefits, and how services like Cashflow.io are helping brokers get paid faster.

The Challenges of Slow Invoice Payments for Freight Brokers

One of the biggest challenges facing freight brokers is getting paid on time. After completing a load, brokers typically send their invoice to the shipper with 30, 60 or 90-day payment terms. But shippers don’t always pay on time – in fact, it takes 54 days on average to collect on an invoice in the transportation industry.

This means brokers are often floating costs for 1-3 months. They have to pay carriers within 15-30 days to keep them happy but don’t get paid themselves for up to 90 days by shippers. This creates a cash flow gap that can restrain growth and profitability.

Brokers are stuck in the middle of slow B2B payments, ultimately having to fund the freight bill until their invoices are paid. Without sufficient working capital, brokers struggle to scale their business, provide quick payments to carriers, and acquire new customers.

How Does Invoice Factoring For Freight Brokers Work?

Invoice factoring provides a cash flow solution that keeps brokers liquid despite slow-paying invoices. With invoice factoring, brokers can get paid for their invoices within 24 hours rather than waiting 30 days or longer.

Here’s how it works:

- A freight broker completes a load for a shipper as usual. The broker pays the carrier from their own funds.

- The broker sends the invoice to a factoring company instead of the shipper.

- The factoring company purchases the invoice and advances 80-90% of the value to the broker within 24 hours.

- The factoring company collects payment directly from the shipper on the invoice’s due date.

- Once paid in full, the factoring company sends the remaining balance minus their fee to the broker.

This immediate influx of cash allows freight brokers to continue growing their business without cash flow gaps. The broker gets paid quickly, keeps carriers happy with fast payments, and avoids funding invoices themselves while waiting for shippers.

Is Invoice Factoring Right For Your Freight Brokerage?

Invoice factoring might be the perfect remedy if your brokerage is facing growth limitations due to shipping delays and sluggish B2B payments. Consider if factoring aligns with your specific needs:

- Delayed Client Payments: Does your current clientele typically take over 30 days to settle invoices? Invoice factoring expedites payments, often delivering funds within 24 hours.

- Restricted Capital Reserves: Are you struggling to expand your brokerage due to limited access to working capital, hindering QuickPay services? Factoring offers adaptable funding that grows in tandem with your brokerage’s growth.

- Expansion Goals: Are you aiming to increase your business’s market share by taking on more shippers and loads but lack immediate cash flow? Utilize factoring to access capital and seize new opportunities promptly.

- Administrative Overload: Does your brokerage spend excessive time on AR management and invoicing? Let a factoring company handle collections, freeing your focus for more high-value tasks.

- Carrier Payment Challenges: Sluggish carrier payments often result in high churn rates and dissatisfied shippers. Factoring facilitates same-day or next-day payments to carriers, enhancing service reliability.

If these challenges sound familiar, consider integrating a factoring program. Successful brokerages leverage factoring to secure dependable working capital, mitigate risk, and streamline operations for greater efficiency.

Benefits of Factoring for Freight Brokers

| Benefit | Key Point |

|---|---|

| Rapid Access to Cash | Obtain working capital within 24 hours, ensuring prompt payments to carriers and covering crucial operational expenses. |

| Speedy Carrier Payments | Utilize QuickPay via factoring for same-day carrier payments, fostering loyalty and reliability within the brokerage. |

| Enhanced Operational Efficiency | Relieve staff from AR management, allowing focus on pivotal sales and operational functions, optimizing overall efficiency. |

| Accelerated Growth Trajectory | Access working capital to expand the client base, take on more loads, and scale up brokerage operations for market expansion. |

| Debt-Free Financing | Factoring unlocks cash from existing invoices without incurring debt, eliminating the need for high-interest loans or equity loss. |

| Tailored Funding Solutions | Selectively factor specific invoices, providing customized access to funds without fixed monthly costs or required volumes. |

| Risk Mitigation and Collections | Delegating credit risk and collections to factoring companies alleviates stress and guards against non-payment risks. |

Invoice factoring offers an array of critical advantages for freight brokerages, spanning cash flow enhancement, operational streamlining, and accelerated growth:

1. Rapid Access to Cash

Gain immediate access to working capital within 24 hours rather than enduring prolonged payment cycles. This swift access empowers timely payment to carriers and other essential expenses, ensuring seamless operations.

2. Speedy Carrier Payments

Utilize quick payment options backed by factoring solutions to extend same-day payments to carriers. This prompt payment system fosters carrier loyalty, securing your brokerage’s reliability and standing in the market.

3. Enhanced Operational Efficiency

Factoring relieves the burden of accounts receivable management and collection duties, allowing brokerage personnel to focus on pivotal sales and operational functions, thus optimizing business efficiency.

4. Accelerated Growth Trajectory

The influx of working capital from factoring enables brokerages to take on additional loads and expand their client base. This financial empowerment paves the way for scaling up operations and expanding market presence.

5. Debt-Free Financing

Factoring provides financial backing without the constraints of high-interest loans or compromising equity. Leveraging existing invoices unlocks cash flow without incurring debt, ensuring financial fluidity.

6. Tailored Funding Solutions

Selectively factor specific invoices, granting control over when to access funds as needed. This flexibility eliminates fixed monthly costs or obligatory volumes, offering a customized financial approach.

7. Risk Mitigation and Outsourced Collections

Entrust the factoring company with credit risk and collections management. This delegation alleviates stress, safeguarding against non-payment risks and reducing the brokerage’s operational burden.

How to Choose an Invoice Factoring Solution for Freight Brokerages?

| Criteria | Key Points |

|---|---|

| Industry Expertise | Collaborate with firms experienced in freight brokerage to provide tailored solutions for industry-specific challenges. |

| Reputation for Customer Service | Opt for companies known for transparent practices, flexibility, and exceptional customer support. Avoid those with hidden fees or rigid terms. |

| Financial Stability | Choose firms with strong financial health and robust credit ratings for reliable and consistent services. |

| Integration with Technology | Select factors that seamlessly sync with freight brokerage software platforms to streamline and automate the factoring process. |

| Flexibility in Offerings | Choose firms providing customizable advances, term flexibility, and no restrictive contracts to maintain control over factoring. |

| Cost Transparency and Competitive Rates | Partner with companies offering transparent fees and competitive rates, avoiding hidden charges or unclear fee structures. |

With numerous factoring firms and fintech lenders now providing invoice factoring services, freight brokerages must find the right partner. When assessing factoring companies, freight brokerages should consider the following key criteria:

1. Industry Expertise and Experience

Allying with a seasoned factoring firm specializing in freight brokerage is essential. These firms comprehend the intricate dynamics of the industry, enabling them to offer customized solutions addressing the unique challenges and requirements of freight brokerages.

2. Reputation for Customer Service

Selecting a factoring company renowned for exceptional customer service is crucial. Opt for a company with a reputation for transparent practices, flexibility in service offerings, and excellent support. Avoid firms linked to complaints about hidden fees or inflexible terms.

3. Financial Stability

Choosing a well-capitalized factoring firm with a strong financial standing ensures reliable services. Examining credit ratings and financial health guarantees a robust partnership capable of withstanding industry fluctuations and providing consistent support.

4. Integration with Technology

Evaluating factoring partners that seamlessly integrate with leading freight brokerage software platforms is vital. This alignment streamlines the factoring process, enhancing efficiency and ensuring a more synchronized and automated approach to invoice management.

5. Flexibility in Offerings

Opt for a factoring firm that tailors its solution, offering customized advances and flexibility in terms without binding lock-in contracts. This flexibility empowers freight brokerages to maintain control over their factoring arrangements, adapting to their evolving needs.

6. Cost Transparency and Competitive Rates

Partnering with a company offering competitive rates and complete fee transparency is vital. Avoid firms with concealed charges or unclear fee structures. Open communication about costs is fundamental to establishing a mutually beneficial partnership.

By considering these factors, freight brokerages can make an informed and comprehensive decision when choosing an invoice factoring partner. This strategic alliance ensures a seamless, efficient, and supportive relationship, allowing the brokerage to navigate its financial landscape confidently and reliably.

What are the Top 7 Freight Broker Factoring Services?

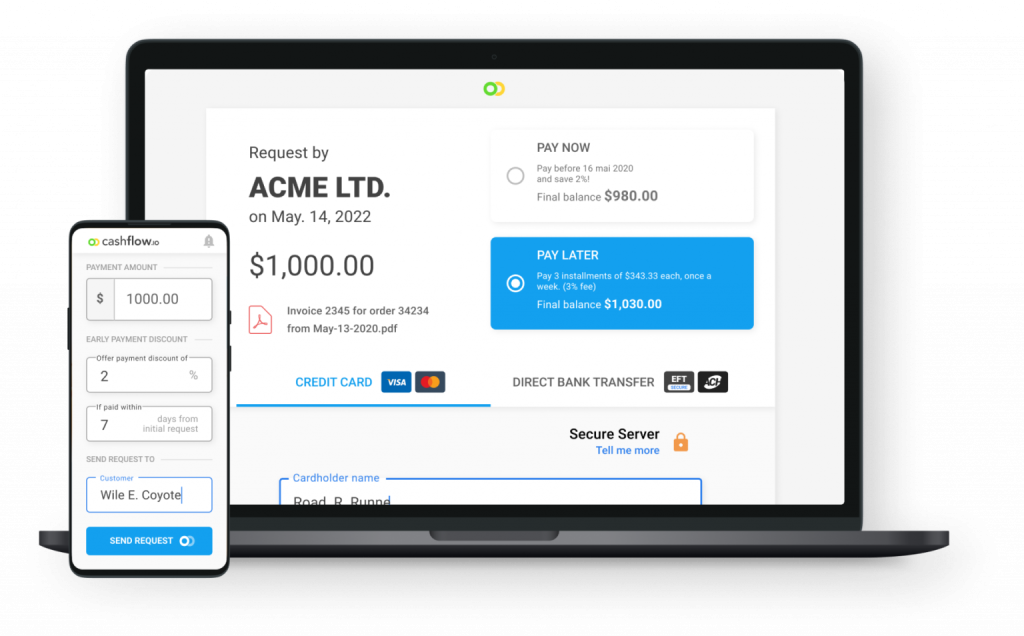

- Cashflow.io – A top-value provider for freight factoring, Cashflow.io has fast funding and a focus on superior customer service.

- OTR Solutions – Offers instant funding, true non-recourse factoring, competitive rates, excellent customer service, and no hidden fees or restrictive contracts; their partnership with DAT also allows for seamless integration and broker checks.

- Apex Capital Corp – Provides fast 24-hour funding, quality customer support through dedicated account executives, no monthly minimums or termination fees, and over 25 years of experience in the truck factoring industry.

- RTS – Known for fast 24-hour funding turnaround, low rates, and additional services like equipment leasing, but lacks transparent and easy-to-understand customer pricing.

- Phoenix Capital Group – Caters factoring services to carriers of all sizes with customized solutions, competitive flat rates, and a robust fuel card program accepted at over 1,900 fuel stations.

- Porter Freight Funding – Ideal freight factoring company for small carriers and owner-operators, provides same-day invoice funding, dedicated account managers, and discounts on insurance, compliance, and other services.

- Riviera Finance – Focuses on providing factoring services for small and medium fleets with flat rate factoring options, customizable collections process, and client portal for easy access to account information.

- TBS Factoring – An experienced company with over 50 years in business, it offers flat rates, recourse and non-recourse factoring options, fuel card programs, and a useful mobile application

What is The Best Invoice Factoring Solution for Freight Businesses?

For freight companies seeking an efficient invoice factoring solution, Cashflow.io stands out as the premier tool, revolutionizing accounts receivable management within the freight industry.

Streamlined Invoice Factoring Process

Cashflow.io simplifies the invoice factoring process by automating invoice handling for freight companies. This tool allows for seamless submission of invoices, triggering swift and automatic advancements. Streamlining this process eliminates traditional hassles, ensuring a steady cash flow for freight companies.

Tailored Financial Solutions

A significant feature of Cashflow.io is its ability to offer tailored financing solutions for freight companies. It swiftly advances funds on outstanding invoices, quickly injecting working capital. This helps cover operational expenses promptly, ensuring consistent business operations and growth for freight companies.

Dedicated Support for Freight Companies

Cashflow.io prioritizes the needs of freight companies by offering specialized and responsive customer support. Assistance is available through various channels, ensuring dedicated support, addressing specific concerns, and promoting seamless operations for freight businesses.

Seamless Integration and Scalability

Cashflow.io seamlessly integrates with existing systems, ensuring a smooth transition for freight companies. Its scalable nature accommodates the agency’s changing financial needs and evolving business requirements, ensuring adaptability.

User-Friendly Interface for Enhanced Oversight

Cashflow.io presents a user-friendly interface, simplifying the management of invoices. With mobile-friendly dashboards, freight companies can easily track and manage their invoices across various devices, enabling better decision-making and enhanced operational efficiency.

Stringent Data Security Measures

Cashflow.io emphasizes data security through advanced encryption and compliance with industry standards, ensuring the protection of sensitive financial information. This offers peace of mind to freight companies relying on its services. Incorporating Cashflow.io into the financial toolkit of freight companies promises to streamline invoice factoring processes, ensure consistent cash flow, and optimize accounts receivable management, empowering these businesses to focus on core operations and growth.

Getting Set Up With Freight Broker Factoring

The process of setting up freight factoring is quick and easy with Cashflow.io. Here are the simple steps:

- Complete the online application – Apply for factoring services by filling out an online form with your basic business details.

- Connect your accounting software – Integrate tools like QuickBooks with the Cashflow.io software through their API. This enables easy invoice data syncing.

- Review your custom setup – Cashflow.io’s onboarding team will create your personalized factoring program, rates, and account management process.

- Fund your first load – Process a shipment as normal, and Cashflow.io will immediately purchase the invoice, putting cash in your account within 1 business day.

And you’re all set! Activating your factoring account and accelerating your brokerage cash flow takes just a few days.

Grow Your Brokerage Faster with Invoice Factoring

Slow invoice payments and cash crunches don’t have to limit your freight brokerage’s potential. By leveraging invoice factoring, brokers can take their business to new heights.

Cashflow.io makes it easy to get set up with affordable freight broker factoring that flexibly meets your business needs. With faster access to working capital, your brokerage can readily scale, provide an exceptional carrier experience through quick payments, and operate with leaner administrative costs.

Stop waiting around for invoices to get paid. Cashflow.io has the tools to get you paid within 24 hours so you can grow faster. Learn more about their factoring services for freight brokers here.

FAQs

Is invoice factoring similar to a traditional bank loan?

Invoice factoring and traditional bank loans differ significantly. Factoring involves selling invoices to a third party (factor) for immediate cash, while bank loans involve borrowing funds with an obligation to repay the loan amount plus interest.

How fast can a freight broker access funds through invoice factoring?

Typically, funds can be accessed within 24 to 48 hours after submitting the invoices to the factoring company, offering immediate relief for cash flow needs.

What if a client doesn’t pay the invoice that has been factored?

Depending on the agreement, the freight broker might be responsible for repurchasing the invoice or covering the outstanding amount to the factor.

Does invoice factoring negatively impact a broker’s credit?

Factoring doesn’t directly affect a broker’s credit as it doesn’t involve borrowing. The focus is on the creditworthiness of the broker’s clients rather than the broker’s credit score.

Are there any hidden fees associated with invoice factoring?

Generally, reputable factoring companies are transparent about their fees. Common charges might include a discount or factoring fee, and it’s crucial to review the agreement to understand all charges before entering into a factoring arrangement.