How to Offer Financing as a Contractor

Construction is a costly and cash-intensive industry. Paying for materials, equipment, and labor often requires large upfront outlays long before contractors receive client payments. This cash flow gap can restrain business growth and put companies at financial risk.

Offering financing helps contractors improve cash flow by advancing capital against future customer payments. Financing also makes projects more accessible for clients by allowing them to spread costs over time. This guide will explore the financing options, how to integrate financing into your sales process, and tips for overcoming client objections.

Why Contractors Should Offer Financing

Here are some of the biggest reasons offering financing can benefit your construction business:

- Closes More Deals – Customers are more likely to accept proposals when you can offer customer payment plans. Financing also helps upsell clients to more profitable projects.

- Higher Revenue – Financing increases your project sizes. Clients approve more add-ons and upgrades when they can spread costs over time.

- Competitive Advantage – Very few contractors offer integrated financing options. You gain an edge over competitors by providing flexible payment choices.

- Fills Cash Flow Gaps – Financing lets you stage payments over construction draw cycles rather than paying colossal material/equipment costs upfront.

- Qualify for Bigger Jobs – Funding from financing enables taking on more ambitious projects with more considerable total costs.

- Professionally Manage Growth – Financing provides capital to scale smoothly versus relying on reserves or credit cards.

Types of Contractor Financing

Many contractors worry offering financing will be complex and time-consuming. But today’s financing platforms make the process extremely simple and hands-off. Let’s explore some options for you to offer financing tailored specifically to construction projects and billing cycles. Several types of financing are suitable for the needs of contractors. Each has unique benefits catered to different types of capital requirements. We’ll overview some of the most common types of financing used by contractors below.

Accounts Receivable Financing

Also called invoice factoring, this option advances capital against unpaid customer invoices. It delivers funding faster by not waiting 30-60+ days for clients to pay invoices. This generally also lets you automate accounts receivable, freeing up time for you to focus on projects.

Equipment Financing

Equipment financing covers the upfront costs of heavy machinery, vehicles, tools, or other equipment. The lender purchases the equipment and then leases it to the contractor for fixed monthly payments (usually 36-60 months).

At the end of the lease, you can purchase the equipment, return it, or re-lease it at a lower rate. Equipment financing preserves capital for other business needs rather than tying it up in equipment.

Purchase Order Financing

Also called materials financing, this option provides funding to cover upfront equipment and materials costs for new projects before sending client invoices.

With Cashflow.io’s purchase order financing, we finance the total invoice amount of your purchase order and pay your supplier directly. You get materials delivered without large outlays of cash. As you bill clients over the project, you repay the advance through our automated system. Repayment aligns with your invoicing and client payment schedules.

Home Improvement Financing

Home improvement financing enables contractors to offer financing applications and arrangements for their residential clients. Applications are powered through a financing provider.

If approved, the client repays the loan directly to the financing company over a fixed term, while you, as the contractor, receive payment upfront after the work is completed.

This helps secure deals with homeowners with limited home remodelling or repair financing. Just remember financing carries interest and fees, so don’t pressure clients. Offer it as an option if budget concerns arise.

Lines of Credit

A line of credit provides flexible access to capital up to a predefined limit. You only tap what’s needed and pay interest on the amount used. It’s like a credit card tailored for your business. Credit lines help manage uneven cash flows and cover unplanned costs. Having readily available capital means you never miss an opportunity due to cash constraints.

How to Offer Financing In Your Business

Now that we’ve covered some types of financing options let’s explore ways to offer financing capabilities within your contracting business:

Partner With a Financing Company

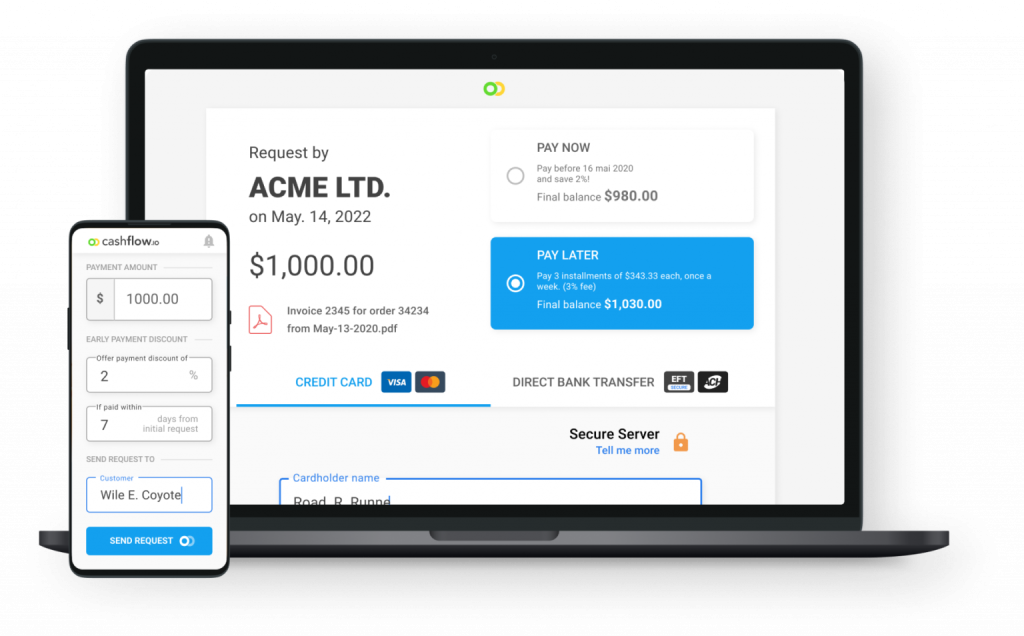

The easiest way to offer financing is to partner with a provider like Cashflow.io. We handle the financing application, underwriting, and capital providing.

You refer clients to apply through our smartphone app or online portal. We can issue credit decisions quickly, and fund approved financing in as little as 2-3 days. We also deliver flexible repayment terms tailored to construction billing cycles – not rigid due dates. This makes it easier to align financing paybacks with customer payments. Ask us how we can help create a seamless financing experience for your business.

Present as a Payment Option

Position financing as one of multiple payment options rather than the only way to pay. Frame it as an added choice that may fit client budgets better.

You might say, “We offer checks, credit cards, and 6-month interest-free financing plans to handle total costs. Let me know which option works best for your budget.”

Providing choices allows you to secure the ideal payment arrangement on deals. Just be sure to consult clients to ensure the solution fits their needs.

Train Your Team on Discussing Financing

For many contractors, financing conversations require a learning curve. Your sales reps likely aren’t experts at discussing interest rates, fees, and comparing financing products.

That’s ok. Start by training your team on the basics, like translating total cost into monthly rates: “You can own this HVAC upgrade for just $250 per month.” Over time, they’ll get more comfortable fielding financing questions.

You can also set up quick access to financing specialists from providers like Cashflow.io. Let your sales reps escalate complex financing details to the true experts.

Get valuable tips and advice on “Offering Lawyer Payment Plans” by visiting our Blog.

How to Integrate Financing Into Your Sales Process

Smartly incorporating financing conversations into your sales process takes finesse. Here are some proven tips for naturally promoting financing:

Discuss Financing Early

Don’t wait until the contract is signed to spring financing. By doing this, you can avoid the total price shock by introducing monthly payment options early when reviewing project scopes and estimates. Don’t force the issue if the client is concerned about the total cost.

Offer Pre-Approval

Invite clients to apply for instant financing approval via mobile app before finalizing a contract. When customers see they qualify for attractive rates, they increase budgets and approve more add-ons.

Emphasize Flexible Payment

Explain that financing means customized payment schedules based on specific needs and cash flow cycles – not rigid due dates. You repay amounts as you receive customer payments. This flexibility is highly compelling for clients.

Redirect Budget Objections

If a client expresses concern about total costs exceeding their budget, gently pivot the conversation to affordable monthly payments within reach. This recalibrates the perception of affordability.

Send Financing Details in Writing

After discussing financing options verbally, follow up with a written summary of the recommended financing plan and next steps so the client has time to review and understand. But let the client bring financing back up to avoid appearing overly pushy.

How to Overcome Client Objections

When clients raise issues, financing can help turn their concerns into an opportunity to secure the deal. Here are some tips for responding to common objections with financing solutions:

“It’s Over My Budget”

Refocus on monthly amounts: “I understand the total exceeds your budget. But we offer attractive financing with monthly payments of around $1,500. Does that fit your budget better?”

“Now’s Not The Right Time”

Propose a promotional financing offer to create urgency: “Let’s get you taken care of now. We have a six-month promotion, no payment, no interest financing when you start today. You get the benefits of a new system without initial payment concerns.”

“Your Competitor Is Cheaper”

Highlight payment flexibility as your unique advantage: “Their proposal may be less overall. However, we offer flexible financing that breaks costs into 12 monthly payments. This payment flexibility is something competitors can’t match.”

The Future of Contractor Financing

- Innovations in Financial Technology: Ongoing advancements in financial technology have introduced specialized financing solutions customized for the construction sector.

- Tailored Financing for Contractor Needs: Emerging financial tools address the distinct requirements of contractors, offering unique and targeted financing options.

- Fostering Growth in Construction: Accessible and specialized financing avenues drive growth and efficiency within the construction industry, enabling contractors to pursue larger projects and expand their businesses.

- Addressing Specific Challenges: Contractor-focused financing innovations tackle challenges such as cash flow management, equipment procurement, and project scalability.

- Increasing Affordability and Accessibility: These new financing models aim to make construction financing more affordable and accessible, supporting contractors in navigating fluctuating markets and economic conditions.

Cashflow.io: The Best Tool for Powering Construction Invoice Factoring and Payment Plan Financing

Cashflow.io emerges as the leading solution for construction invoice factoring, revolutionizing accounts receivable management tailored for the construction industry.

Streamlined Construction Invoice Factoring

Cashflow.io simplifies the intricate process of construction invoice factoring through seamless automation. Its technology enables effortless submission of construction-related invoices, triggering swift advancements. This automation streamlines operations, ensuring a steady cash flow—a vital aspect in the construction sector.

Tailored Financing for Construction Payment Plans

The standout feature of Cashflow.io is its agility in addressing diverse financial needs within construction projects. It expedites funds against outstanding construction-related invoices, providing immediate working capital essential for managing payment plans and addressing operational expenses promptly.

Dedicated Support Catered to the Construction Industry

Cashflow.io prioritizes the unique needs of construction businesses, offering specialized and responsive customer support. Its seamless integration capability with existing construction systems ensures a smooth transition, while scalability aligns with the evolving needs of construction enterprises.

User-Friendly Interface and Enhanced Security for Construction Projects

The software boasts a user-friendly interface, facilitating effortless management of construction-related invoices across devices. Mobile-friendly dashboards enhance accessibility, enabling better decision-making and operational efficiency. Moreover, stringent security measures ensure the confidentiality of sensitive financial information, which is critical for construction payment plan financing.

Cashflow.io is the epitome of efficiency and reliability in construction invoice factoring and payment plan financing for the construction industry. With streamlined automation, tailored financing, dedicated support, user-friendly interface, and stringent security, Cashflow.io redefines efficiency and stability in managing construction-related accounts receivable. Embrace Cashflow.io to optimize financial efficiency and success within construction projects.

The Bottom Line

Managing cash flow is a constant challenge in the construction industry. However new contractor financing options provide the working capital needed to drive growth and profitability.

Accounts receivable financing through Cashflow.io offers an innovative approach to turning invoices into immediate cash for construction contractors. The approval process emphasizes your clients and projects – not just your company’s balance sheet.

FAQs

What are the primary financing options available for construction contractors?

Discuss various financing options like trade credit, lines of credit, accounts receivable financing, project cost financing, equipment financing, and business credit cards tailored for construction businesses.

Why do construction contractors require financing, and what challenges do they face?

Address contractors’ financial challenges due to delayed payments, high project costs, and the cash flow gap between expenses and payments received.

How can accounts receivable financing benefit construction contractors?

Highlight the immediate access to cash tied up in invoices, improved cash conversion cycle, and flexibility without taking on debt as key contractor benefits.

What factors should contractors consider when choosing financing options?

Discuss the critical aspects such as interest rates, qualification requirements, repayment terms matching client invoices, flexibility, and risk factors while choosing suitable financing solutions.

How do accounts receivable financing work specifically for construction contractors?

Explain the step-by-step process of accounts receivable financing tailored for construction businesses, emphasizing how it accelerates cash flow and avoids unnecessary debt.