How to Offer Lawyer Payment Plans

The cost of legal services remains a significant barrier for many who need access to justice. According to the World Justice Project, over 80% of civil legal problems reported by low-income Americans receive inadequate or no legal help. This “justice gap” exists partly because clients lack the financial means to pay legal fees upfront.

Offering lawyer payment plans can help bridge this affordability gap by providing flexible financing options. When crafted thoughtfully, these arrangements make your services accessible to more clients while stabilizing your firm’s cash flow.

This article explains how lawyer payment plans work and their benefits. You’ll also learn actionable strategies for implementing payment plans at your firm with success.

What Are Lawyer Payment Plans?

A lawyer payment plan allows clients to pay legal fees in set instalments over an agreed-upon timeframe rather than one lump sum. These arrangements come in all shapes and sizes, with payment schedules typically structured around the client’s budget and needs.

For example, a client may pay 50% of the total upfront as a retainer fee and the remainder in equal monthly payments over six months. Others may prefer quarterly instalments. When customized appropriately, both the law firm and the client can benefit.

Unlike legal fee financing, customer payment plans don’t involve borrowed funds from a third-party lender. The client agrees to pay the full amount directly to your firm over time. Payment plans restructure how and when you receive payment for services to improve affordability.

Understanding Lawyer Payment Plans

Creating effective lawyer payment plans involves tailoring them to suit your law firm’s requirements and your clients’ needs. When devising and discussing payment options, several vital aspects merit consideration:

Establishing Billing and Payment Processes

The fundamental aspect of any payment plan involves setting up a robust system for billing clients and receiving payments. This process initiates with addressing essential queries:

- Will your firm manually generate and dispatch invoices and payment reminders?

- What method will be used for sending bills: traditional mail or email? Will credit card payments be accepted? Is there a retainer fee?

- How will multiple payment plans and client balances be tracked?

- Is a tool available to automate invoice generation, distribution, and tracking? (Refer to the tools section below)

Answering these inquiries aids in constructing a systematic approach and templates for the accepted payment plans at your firm.

Reaching Consensus with Clients

Before finalizing a payment plan, it’s crucial to ascertain that the client can comfortably manage the agreed-upon instalments. Engage in upfront discussions with potential clients during consultations to ensure mutual understanding. Having predefined payment plan templates streamlines this process.

Formalizing the Agreement

Once you and the client are aligned, it’s essential to document the terms in a payment agreement that the client signs, confirming their commitment to the determined payment plan.

Dealing with Delayed Payments

Establishing protocols for handling late payments is essential. Consider whether to charge interest or late fees and decide if there’s a grace period for delayed payments. It’s prudent to review the ethics rules related to this matter with the bar association in your state.

Why Offer Payment Plans? Benefits for Law Firms

Introducing payment plans at your firm can strengthen relationships and improve profitability. Consider these advantages:

Attract More Clients

- Expanded Clientele: Payment plans demonstrate adaptability in your billing approach, appealing to a broader audience that traditional payment structures might have deterred.

- Accessibility: Offering flexible payment options allows clients who may not qualify for external financing to access your legal services, widening your potential client base.

- Community Engagement: Embracing payment plans reflects a commitment to community service by ensuring legal support is available to a diverse range of individuals.

Improve Cash Flow

- Predictable Revenue: Steady instalments from payment plans provide a consistent cash flow, mitigating the uncertainty of waiting for lump-sum payments or dealing with irregular billing cycles.

- Financial Stability: Less reliance on sporadic or delayed client payments ensures smoother financial operations, allowing the firm to manage operational expenses and growth initiatives better.

Increase Profits

- Enhanced Financial Performance: Embracing payment plans can lead to a notable increase in overall profitability by as much as 10-20%, per the American Bar Association. Consistent, timely payments bolster the firm’s financial health.

- Elevated Efficiency: Improved financial stability allows the firm to focus on revenue-generating legal work, optimizing resources and maximizing profitability.

Enhance Client Loyalty

- Building Trust: Providing payment flexibility fosters trust and credibility among clients. This approach demonstrates an understanding of their financial constraints, potentially enhancing client loyalty.

- Positive Client Experience: Offering payment options that cater to individual financial situations can contribute to higher client satisfaction, resulting in a higher likelihood of repeat business and referrals.

Save Time

- Streamlined Operations: Automated payment reminders and tracking systems significantly reduce the administrative burden of managing payment plans.

- Increased Productivity: Minimizing time spent on manual accounting tasks allows legal professionals to focus on core legal work, optimizing overall productivity and efficiency within the firm.

What are the Most Common Ways to Accept Payment?

Exploring various avenues is crucial when considering payment options for attorney fees if immediate payment isn’t feasible. As a lawyer seeking to offer payment plans to your clients, it’s beneficial to understand the traditional and emerging financing options available:

Personal Loan

Offering guidance on acquiring personal loans is a standard approach. This option involves clients taking out loans to help finance their legal needs with manageable repayment schedules.

Credit Cards

Encouraging clients to use credit cards for payment is a common practice. However, emphasizing the need for timely payments can prevent high interest rates from accruing.

Legal Payment Plans

Presenting tailored payment plans has been a standard solution. These plans enable clients to spread legal fees across an agreed-upon timeframe, making legal assistance more accessible.

Family and Relatives

Suggesting clients seek assistance from their network is a traditional method. This involves receiving financial support from friends and family to cover legal expenses.

Crowdfunding

A relatively new yet popular option is crowdfunding through platforms like GoFundMe or Kickstarter. It allows clients to seek financial aid for their legal cases, but many are apprehensive to share the full extent of their legal troubles in such a public way.

How Do Lawyer Payment Plans Work? Critical Steps for Success

| Step | Key Points |

|---|---|

| 1. Evaluate Your Firm’s Finances | Assess financial stability and estimate instalment-based revenue needs for covering overhead costs. |

| 2. Draft a Payment Plan Agreement | Create a clear agreement outlining payment details, late payment policies, and compliance with legal ethics rules. |

| 3. Discuss Payment Options During Consultations | Communicate available payment plans, aligning them with client budgets and preferences. |

| 4. Obtain Client Consent | Secure written client consent via a signed payment plan agreement. |

| 5. Send Invoices and Reminders | Regularly issue invoices with due dates and automate reminders to prevent missed payments. |

| 6. Track Payments in Legal Billing Software | Maintain individual client ledgers using legal software, tracking payments and addressing missed installments. |

| 7. Run Financial Reports | Analyze reports to monitor payments received versus outstanding receivables, facilitating early issue identification and plan assessment. |

When properly structured, lawyer payment plans create a win-win for your firm and clients. Consider these best practices when implementing payment plans:

1. Evaluate Your Firm’s Finances

Assess your current finances and cash flow needs before offering payment plans. Can your firm sustain its operations if relying on instalment-based revenue? Conservatively estimate the payment frequency and amounts you require to cover overhead.

2. Draft a Payment Plan Agreement

Create a simple agreement template that outlines:

- Payment amount, frequency, and method

- Handling of late/missed payments

- Interest, penalties, or grace periods

- How invoices are delivered

Review your state bar’s ethics rules on payment plans to ensure compliance. A standard agreement draft streamlines the process of finalizing plans with clients.

3. Discuss Payment Options During Consultations

Explain available payment plan options and standard agreement terms during initial consultations. Assess if a payment plan aligns with the client’s budget and preferences for maximizing adherence. An open conversation sets clear expectations.

4. Obtain Client Consent

Once you’ve agreed on the payment plan terms, obtain written client consent by having them sign your standard payment plan agreement. Both parties should retain copies of the signed document.

5. Send Invoices and Reminders

Communicate payment due dates by sending recurring invoices with the upcoming amount and due date. Automate reminders when payments are coming up or late to prevent missed instalments.

6. Track Payments in Legal Billing Software

Using legal software, create an individual ledger for each client with an active payment plan to track instalments. Note any missed payments and follow your agreement’s procedure for addressing late payments.

7. Run Financial Reports

Regularly analyze reports on received payments versus outstanding receivables. This helps you identify problems early and assess whether your payment plan model works.

What is the Best Tool for Financing in Professional Services Financing?

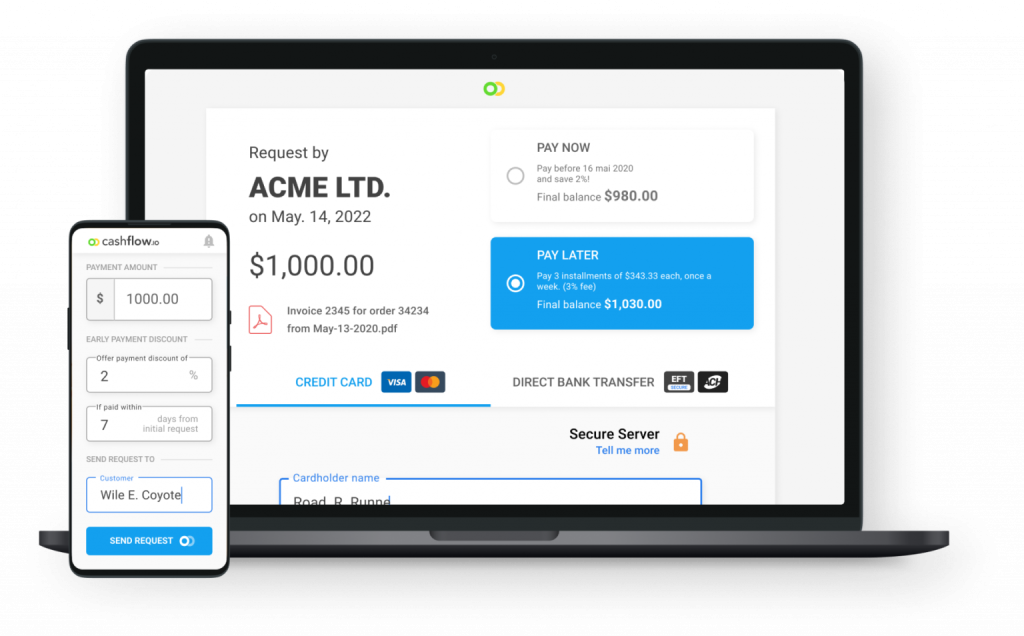

Cashflow.io emerges as a leading solution for legal professionals seeking to offer client payment plans, revolutionizing financial management customized for law practices.

Effortless Payment Plan Integration

Cashflow.io simplifies the intricate process of implementing client payment plans through seamless automation. Its technology facilitates easy setup and submission of payment plans, enabling swift advancements. This automation streamlines operations, ensuring consistent cash flow—an essential aspect in legal practices.

Customized Financing for Legal Payment Arrangements

A prominent feature of Cashflow.io is its flexibility in catering to diverse financial needs within legal services. It expedites funds, enabling lawyers to offer structured payment plans to clients while accessing immediate working capital. This financial agility is crucial for managing client payments and addressing operational expenses efficiently.

Tailored Support for Legal Practices

Cashflow.io prioritizes the specific requirements of legal professionals, providing specialized and responsive customer support. Its seamless integration with existing legal systems ensures a seamless transition, while scalability aligns with the evolving financial demands of law firms.

User-Friendly Interface and Enhanced Security for Legal Services

The software offers a user-friendly interface, simplifying the management of payment plans across various devices. Mobile-friendly dashboards enhance accessibility, facilitating better decision-making and operational efficiency. Moreover, stringent security measures guarantee the confidentiality of sensitive financial information, essential for legal payment plan arrangements.

Improve Access to Justice with Payment Plans

As a lawyer, you have a professional duty to promote access to justice. Offering payment plans improves the affordability and approachability of your services. When thoughtfully implemented, they can benefit both your clients and the firm.

Bridging the justice gap for financially distressed clients empowers more people to obtain legal assistance when needed. Payment plans allow you to turn no one away and uphold your commitment to serve.

FAQs

Can a lawyer accept payment plans?

Yes, lawyers have the option to accept payment plans from their clients. Depending on the lawyer’s policies and the nature of the legal services provided, they may offer flexible payment arrangements to accommodate clients’ financial situations.

How do lawyer payment plans work?

Lawyer payment plans involve mutually agreed-upon arrangements between the lawyer and the client to pay legal fees in instalments rather than in one lump sum. The specifics of the payment plan, including the amount, frequency of payments, and duration, are typically outlined in a formal agreement signed by both parties.

Can you set up a payment plan for a lawyer?

Yes, you can generally set up a payment plan with a lawyer. It’s advisable to discuss this possibility during your initial consultation. Many lawyers are open to negotiating payment plans that suit the client’s financial circumstances while ensuring fair compensation for their legal services.

Do lawyers accept payment plans?

Many lawyers accept payment plans to make legal services more accessible to clients who might face financial constraints. However, acceptance of payment plans may vary based on individual lawyers or law firms, their practice areas, and the specific terms they offer.

How to set up a payment plan with a lawyer?

To set up a payment plan with a lawyer, discuss your financial situation and the feasibility of a payment plan during your initial consultation. Be transparent about your ability to make payments, and negotiate terms that both you and the lawyer find acceptable. Ensure that all agreed-upon terms are documented in a formal agreement.