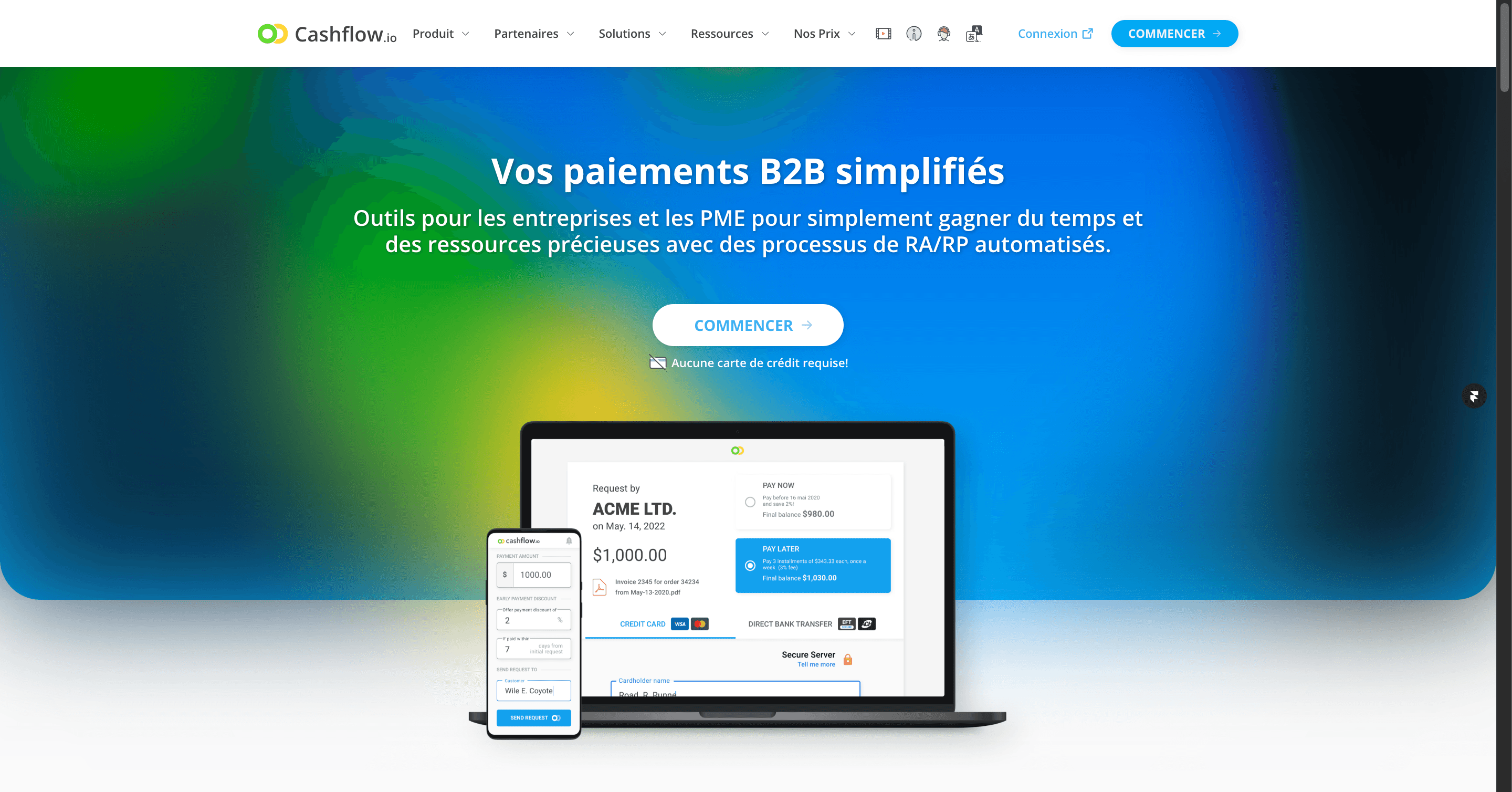

In today's digital economy, small-to-midsize businesses are the backbone of commerce worldwide. Still, they often grapple with dated financial processes that could significantly impact their operations. The transition from manual, paper-based accounting systems to automated, digital solutions is not just a choice but a necessity. Enter Cashflow.io—a revolutionary Software as a Service (SaaS) tool that is redefining trade finance for businesses everywhere.

Thursday, May 1, 2025

by

Cashflow.io

In today's digital economy, small-to-midsize businesses are the backbone of commerce worldwide. Still, they often grapple with dated financial processes that could significantly impact their operations. The transition from manual, paper-based accounting systems to automated, digital solutions is not just a choice but a necessity. Enter Cashflow.io—a revolutionary Software as a Service (SaaS) tool that is redefining trade finance for businesses everywhere.

The Problem: Traditional Trade Finance

For years, businesses have had to navigate the complexities of trade finance through antiquated systems. Manual processes have been prone to errors, time-consuming, and less efficient. The lack of suitable alternatives for mid-market businesses has often resulted in businesses being underserved by both digital wallet solutions and enterprise-level software.

Additionally, access to affordable and flexible financing options remains a challenge for many businesses. They are often subject to high-interest rates and rigid terms that stifle their growth potential. In an increasingly competitive global marketplace, this situation is untenable.

The Solution: Cashflow.io's Revolutionary SaaS Platform

Cashflow.io presents an innovative solution to these pressing problems. Our mission is to simplify and streamline back-office operations for brick-and-mortar businesses looking to transition from paper-based systems to integrated digital payments and financing.

Our platform offers a unique, user-friendly interface with zero setup or integration costs. Cashflow.io combines the ease of digital wallet platforms with the robust capabilities of enterprise-level solutions. The result? A comprehensive SaaS platform that caters specifically to mid-market businesses.

Three-Pronged Approach: Send, Receive, Finance

Send & Receive Payments: Cashflow.io offers a unified solution for all payment needs. Whether you're sending or receiving digital payments, our platform provides a seamless experience, reducing transaction time and eliminating the need for multiple payment providers.

Automated Trade Financing: At the heart of Cashflow.io's unique value proposition is our innovative approach to trade financing. We offer SmartPO, Pay Later, and Invoice Financing options that are not loans but cash advances against future receivables. This means that our users get a same-day cash advance for all gross receivables while still being liable for repayment. Our trade financing service is underpinned by administration fees rather than traditional interest rates, making the service more accessible and user-friendly.

Invoice Financing: Our state-of-the-art OCR technology can extract data from invoices that are scanned, uploaded, or forwarded to us. We can then automate payment approvals based on the due dates, eliminating the pain of managing multiple invoices with different due dates.

Cashflow.io: The Power of SaaS for Your Business

The benefits of adopting SaaS for trade finance are multifaceted. As a cloud-based solution, Cashflow.io provides a high level of flexibility and accessibility. You can manage your payments and financing from anywhere, at any time, with just a few clicks.

By automating back-office operations, businesses can redirect their focus and resources toward growth and development. The time and effort saved can then be utilized for business expansion, customer service improvement, or new product development.

Moreover, the sophisticated algorithms and machine learning capabilities of our platform enable smarter, data-driven decision making. This intelligence helps businesses optimize their financial operations and improve their bottom line.

Cashflow.io: Designed for Your Business

Cashflow.io is designed specifically with mid-market businesses in mind. Our platform addresses the unique needs of businesses that have traditionally been underserved by existing solutions. Whether you're a law firm, an accounting firm, a custom industrial manufacturer, a medical clinic, or a franchisor, Cashflow.io is the ideal solution to digitize your B2B operations.

Title: The Evolution of Automated Invoice Financing: Transforming Businesses with Cashflow.io

In an era where technology is fundamentally changing the way businesses operate, one area often overlooked is the management of accounts receivable. Late payments and inefficient invoice processing can strain a business’s cash flow, inhibiting growth and potentially jeopardizing its operations. But what if you could automate the process, ensuring prompt payment and reducing the amount of time and resources dedicated to chasing invoices? Welcome to the age of Automated Invoice Financing powered by Cashflow.io.

The Problem: Traditional Invoice Management

For years, businesses, regardless of size, have grappled with the problems of invoice management. Manual tracking of various invoices, each with different due dates and payment terms, can be a logistical nightmare. This, coupled with the often-delayed payments, strains the cash flow and can be a barrier to smooth business operations and growth.

While there have been several solutions addressing this issue, none have entirely managed to serve the mid-market businesses stuck between digital wallets catering to micro-businesses and enterprise-level solutions requiring costly integrations.

Cashflow.io: Revolutionizing Invoice Management

Cashflow.io is pioneering the transition of businesses from a reactive to a proactive approach in managing their receivables. Our cloud-based Software as a Service (SaaS) platform offers an innovative, user-friendly solution to automate back-office operations, with a special focus on invoice financing.

Designed to serve the mid-market businesses, Cashflow.io fills the gap between rudimentary digital wallets and complex enterprise-level solutions. With zero setup or integration costs, it's the perfect bridge for businesses looking to transition from paper-based invoice management to a comprehensive, automated digital system.

Automated Invoice Financing: A Game Changer

At the heart of Cashflow.io's offering is the Automated Invoice Financing service. Here's how it works:

Invoice Ingestion: Businesses can scan, upload, or even forward invoices to Cashflow.io. Using advanced Optical Character Recognition (OCR) technology, we extract relevant data from the invoices, primarily focusing on the due date.

Invoice Financing: With Cashflow.io, businesses can avail themselves of financing based on their receivables. This isn’t a loan but a cash advance against future receivables. Businesses can receive same-day cash advances for all gross receivables while remaining liable for repayment. Our financing service is backed by administration fees rather than traditional interest rates, making it more accessible and business-friendly.

Automated Payments and Approvals: Managing multiple invoices with different due dates is a market pain that Cashflow.io aims to alleviate. With our platform, businesses can automate payment approvals based on due dates— a feature we like to call "Permission Based Billing". The automation simplifies invoice management, freeing up resources to focus on growth and customer service.

Embracing the Future of Invoice Management with Cashflow.io

The benefits of Automated Invoice Financing go beyond streamlined operations. Cashflow.io’s cloud-based platform offers unparalleled flexibility and accessibility. It allows businesses to manage their finances anytime, anywhere, ensuring prompt payments and a healthier cash flow.

Furthermore, the platform's sophisticated algorithms and machine learning capabilities enable smarter, data-driven decision-making, providing businesses with predictive analytics and insights to optimize their financial operations and improve their bottom line.

Concluding Remarks

Cashflow.io is not just a solution; it's a strategic ally for businesses navigating the complex waters of accounts receivable management. We believe that robust, user-friendly technology should be accessible to businesses of all sizes.

Automated Invoice Financing, courtesy of Cashflow.io, is not just the future of receivables management—it’s a revolution in the making. By combining state-of-the-art technology with a deep understanding of the challenges faced by mid-market businesses, we aim to facilitate a seismic shift in the way businesses manage their invoices and cash flow. In a marketplace that never sleeps, Cashflow.io i

Partner With Cashflow.io

We’re always on the lookout for opportunities to partner with innovators and disruptors.

LEARN MORE