Paying for healthcare can be really hard for many people today. The costs are high and the bills are confusing.

Friday, April 19, 2024

by

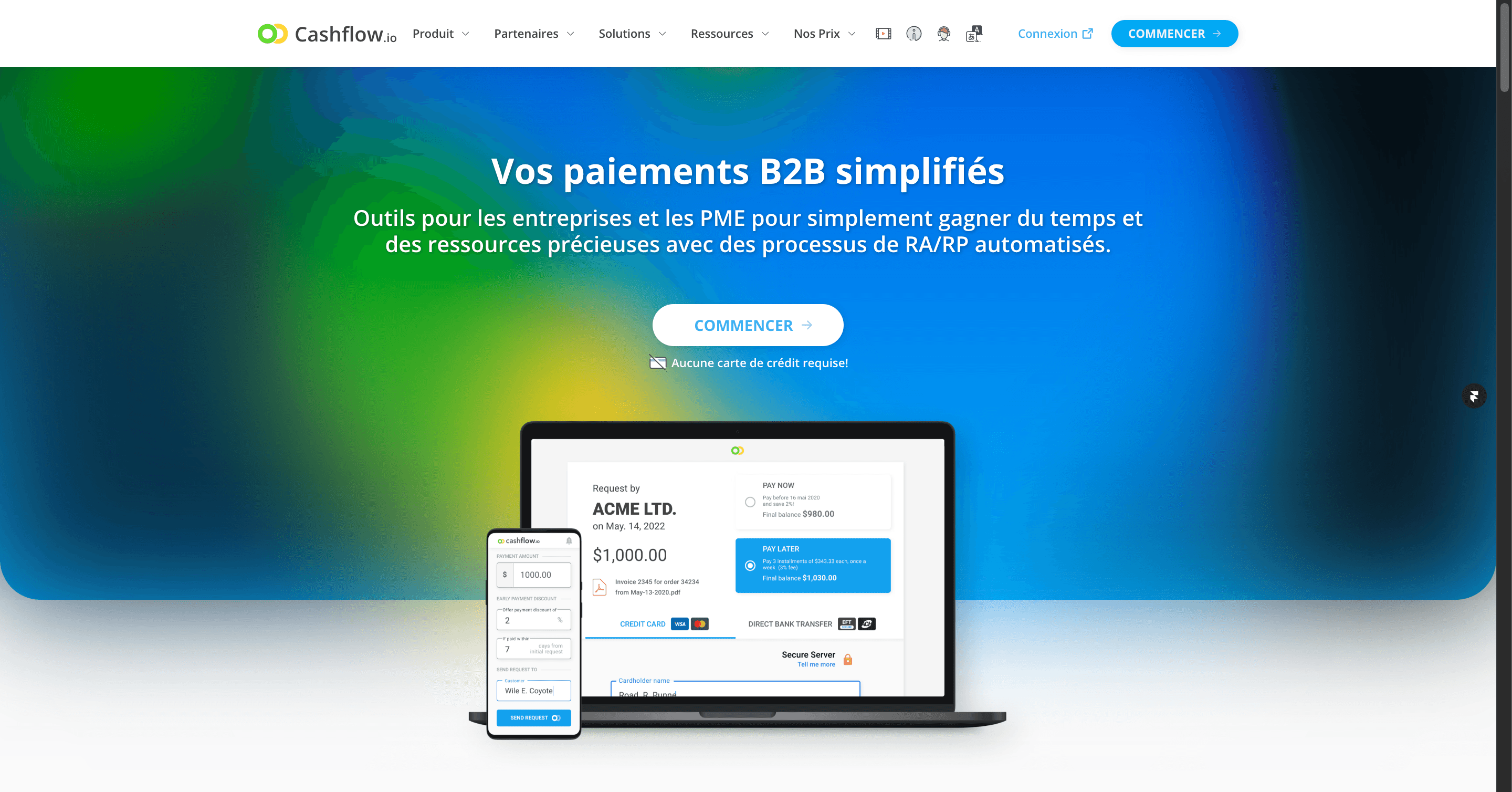

Cashflow.io

1. Cashflow.io – Automated Payment Plans

As an automated end-to-end billing and payment management platform, Cashflow.io makes it easy for healthcare providers to offer customized payment plans and access revenue faster. Critical features like automated billing, reminders, and analytics help optimize workflows and cash flow.

Key Features

Automated payment plan setup

Flexible instalment options

Digital billing and reminders

Benefits

The automation and integration capabilities of Cashflow.io provide multiple benefits for healthcare organizations. Automated billing and reminders reduce administrative workload so staff can devote more time to patient care. Meanwhile, the integrated financing features allow providers to generate additional revenue through payment plan surcharges while expanding access to care.

2. Denefits – Customizable Payment Plans

Denefits lets healthcare providers craft payment plans tailored to each patient’s financial situation. By removing traditional insurance barriers, Denefits simplifies billing and expands patient access. Reviews are mixed, with some praising the flexible payment options and others critiquing unclear contract terms and customer service. Though it consolidates billing management, Denefits could improve by offering more transparent terms and better support.

Key Features

Customized plans based on patient needs

Simplified billing management

Expanded patient access

Benefits

The high degree of payment plan customization matched to each patient’s finances improves satisfaction and the likelihood of payment completion. Consolidating billing onto one platform also streamlines back-office work for staff. Broadening access to care with flexible payment options helps attract more patient volume and drive revenue.

3. CareCredit – Specialized Healthcare Financing

CareCredit provides healthcare providers a dedicated credit card and financing plans to help patients manage uncovered expenses. CareCredit is widely accepted across providers and treatments, offering varied financing terms. But interest rates rise significantly after intro periods expire. Reviews highlight CareCredit’s healthcare focus, though criticize confusing interest charges. More transparency on changing rates could improve the patient experience.

Key Features

Healthcare-specific card and financing

Short and long-term payment plans

Wide coverage of medical services

Benefits

Multiple plan options allow patients to manage expenses based on the required treatment. Widespread acceptance of the CareCredit card by healthcare providers across services makes it convenient for covering various medical costs.

4. PatientPay – Streamlined Billing & Payments

PatientPay integrates billing, payments, and analytics to optimize revenue cycle management. By centralizing data and automating workflows, PatientPay streamlines payment plan administration. However, its tools are more operational than financial, lacking some customized financing options. Reviews praise its capabilities but note room for growth in tailored financing offers and features.

Key Features

Automated billing tools

Payment plan integration

Analytics for revenue tracking

Benefits

PatientPay provides integrated tools to optimize different aspects of the revenue cycle. Automated billing simplifies payment plan administration for staff while integrated analytics offer data-driven insights into financial performance. The ability to manage billing and payments on one platform also enhances efficiency.

Pricing

Pricing varies based on features needed and patient volume. Plans are available on a monthly subscription basis.

5. GreenSky – Mobile Financing Access

GreenSky facilitates fast financing approvals through its easy-to-use mobile app. This expands affordable payment choices for healthcare providers and quick access for patients. However, certain financing plans have high interest rates. Reviews applaud the mobile convenience but cite some cases of unclear contract terms. Enhanced transparency could provide a better patient experience.

Key Features

Mobile app for easy access

Instant financing decisions

Multiple loan options

Benefits

The mobile app brings financing offers directly to patients for quick and simple approvals. Providers can expand their affordable payment options through mobile-driven financing plans. Fast decisions also expedites patient access to funds.

6. QuickFee – Streamlined Payment Plans

QuickFee simplifies payment plan management through process automation. By automatically generating plans and centralizing information, QuickFee saves time for staff and patients. However, the tool does not provide healthcare-specific financing options. Reviews are positive overall, focusing on simplifying workflow but noting the lack of customized medical financing plans.

Key Features

Automated payment plan creation

Flexible plan options

Optimized cash flow

Benefits

Patients can benefit from the flexible repayment options automated by QuickFee. The biggest advantage of the platform is its ability to centralize information and save staff time, while accelerated cash flow improves financial performance.

7. SwipeSimple – Payment Processing & Plans

SwipeSimple specializes in payment processing yet integrates with separate financing plans, offering expanded options. However as its focus is payment acceptance, it lacks robust standalone financing features. Reviews are mixed – some like the flexibility it provides, while others critique the customer service experience. More support and transparent terms could improve satisfaction.

Key Features

Payment processing

Plan integration capabilities

Multiple payment modes

Benefits

The main benefits provided by SwipeSimple include enhanced payment flexibility and options. The platform allows secure acceptance of various payment types while integrating with separate financing plans. This expands the range of payment modes and financing solutions healthcare providers can offer.

8. MediPro Credit – Medical Financing Assistance

MediPro Credit assists providers in arranging customized financing for healthcare expenses while helping patients obtain funding. Though details are limited, MediPro differentiates itself through medical-focused tools and financing assistance. With few reviews available, more information could provide greater insight into its value proposition.

Key Features

Custom medical financing

Tools for payment plans

Patient financing assistance

Benefits

With MediPro, providers can easily facilitate financing and payment plans catered to healthcare needs. Patients also receive support in securing necessary medical financing.

Stay informed about best practices in “Offering Lawyer Payment Plans” by reading our Blog.

What is the Best Payment Plan Software to Make Medical Services Affordable in 2023?

Addressing the financial intricacies of medical practices requires innovative tools, and Cashflow.io stands out as a premier payment plan software offering tailored solutions for the healthcare sector. Its groundbreaking eQuote with financing feature redefines medical invoice factoring, empowering practitioners to unlock flexible payment options while seamlessly accessing advanced funds.

Enhanced Patient Accessibility through Customized Payment Plans

In the realm of healthcare services, affordability remains pivotal. With Cashflow.io’s Payment Plans, medical professionals gain a game-changing tool to provide bespoke payment plans. These plans not only improve patient accessibility to treatments but also grant practices the financial flexibility needed to serve a broader demographic.

Streamlined Backend Operations with Automated Billing

Beyond patient-centric features, Cashflow.io reimagines backend processes. The introduction of automated billing revolutionizes and expedites billing tasks. This automation liberates medical professionals from manual billing responsibilities, allowing them to prioritize patient care while ensuring efficient financial management.

Efficient Supplier and Vendor Payment Management

Managing the administrative aspects of a medical practice can be time-intensive. Cashflow.io emerges as an all-inclusive solution, enabling effortless payments to suppliers and vendors. This streamlined process saves valuable time, boosting overall back-office efficiency for medical practices.

With these advanced features, Cashflow.io is an indispensable tool in the medical invoice factoring landscape. Its ability to offer tailored payment plans, streamline billing processes, and facilitate seamless vendor payments equips healthcare professionals with the financial acumen to navigate a dynamic and patient-centric industry.

The 8 Best Payment Plan Services at a Glance

Cashflow.io

Key Features: Automated setup, Installments, Digital billing

Best For: Automating workflows

Rating: 4/5

Denefits

Key Features: Custom plans, Simplified billing, Accessibility

Best For: Customization and flexibility

Rating: 4/5

CareCredit

Key Features: Specialized financing, Payment plans, Wide coverage

Best For: Large healthcare systems

Rating: 5/5

PatientPay

Key Features: Automated billing, Payment integration, Analytics

Best For: Revenue optimization

Rating: 4/5

GreenSky

Key Features: Mobile app, Instant decisions, Loan options

Best For: Mobile-centric providers

Rating: 4/5

QuickFee

Key Features: Automated creation, Flexible plans, Cash flow

Best For: Cash flow improvement

Rating: 4/5

SwipeSimple

Key Features: Processing, Plan integration, Payment modes

Best For: Payment flexibility

Rating: 3/5

MediPro Credit

Key Features: Custom financing, Payment plan tools, Financing assistance

Best For: Financing and affordability

Rating: Not available

Wrapping Up

The importance of payment plan software in transforming the healthcare financial experience cannot be overstated. As evident from the solutions explored, these tools not only ease financial strain on patients but also unlock revenue opportunities and streamline workflows for providers.

Healthcare startups may opt for lower-cost solutions like PatientPay, while large chains like CareCloud suit more prominent institutions. Ultimately, embracing innovations like automated payment plans paves the path toward a more compassionate system of care where cost never impedes one’s access to health and well-being.

FAQs

What are the main benefits of payment plan software for healthcare providers?

Payment plan software provides many benefits for healthcare providers, including improved patient satisfaction, increased affordability and access to care, optimized revenue and cash flow, reduced administrative burden, and seamless integrations.

How does payment plan software help patients manage healthcare costs?

It allows patients to break down large bills into smaller instalment payments over time. This avoids upfront out-of-pocket costs patients may be unable to afford and provides financial flexibility.

What key features should I look for in choosing payment plan software?

Essential features include automated billing and reminders, flexible installment plans, financing integrations, analytics/reporting, mobile accessibility, seamless EHR/PM system integration, and customizable plans.

Does payment plan software improve revenue for healthcare organizations?

Yes, payment plans expand the potential patient pool by making services more affordable and increasing volume. Integrated financing also allows the monetization of account receivables.

What types of healthcare providers can benefit from payment plan software?

Payment plan software can benefit all provider types, including hospitals, dental and vision clinics, mental health practices, rehabilitation centers and private physician offices.

Partner With Cashflow.io

We’re always on the lookout for opportunities to partner with innovators and disruptors.

LEARN MORE