The 7 Best Tipalti Alternatives in 2023

Tipalti, may not be the best option for small to midsize businesses due to its complex pricing structure and steep setup fees. Users have reported limitations with customization, integration, and reporting capabilities. Support channels have also received mixed reviews, with some customers citing slow and inconsistent responses. Tipalti’s limited payment options and lack of support for some global currencies can restrict its usefulness for companies making international payments.

As businesses scale, Tipalti’s out-of-the-box approach can become too rigid. Organizations are exploring competitive alternatives that offer robust payment automation, greater configuration, and more tailored support. Tipalti customers should evaluate if an alternative vendor may better meet their specific finance workflows and global payment needs.

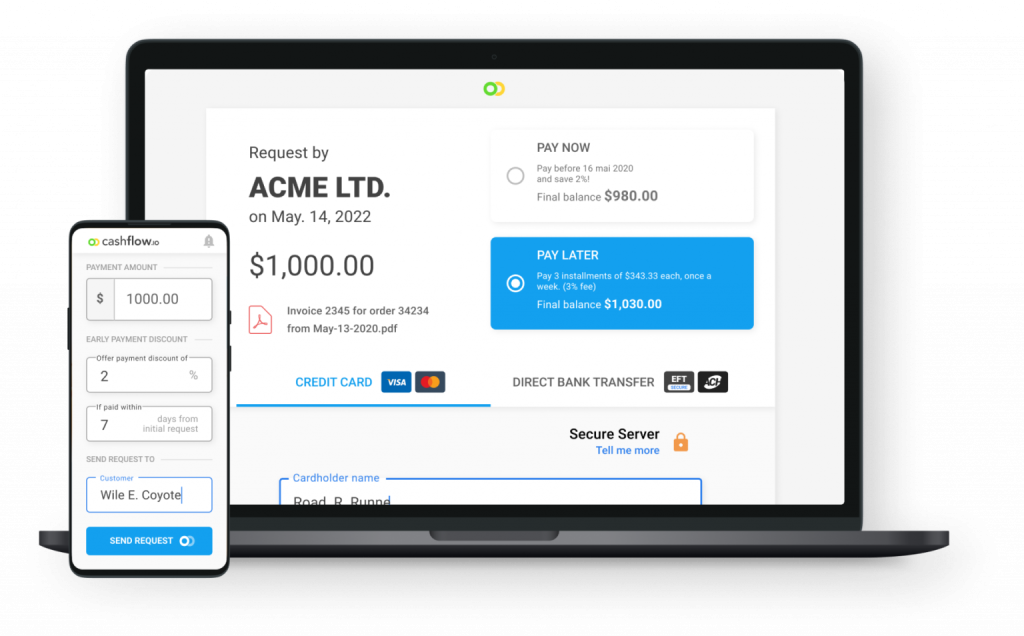

Alternative #1: Cashflow.io

For businesses seeking an all-in-one financial management platform, Cashflow.io is a top choice that shines in key areas. Cashflow.io centralizes payables, receivables, and financing into one convenient hub accessible from any device.

You can easily automate payables by forwarding invoices to a unique email address that automatically triggers bank transfers. This streamlines vendor payments into a simple process without toggling between multiple bank portals. Cashflow.io also enables the creation of customized recurring payment plans for clients to improve cash flow with on-time customer payments. Aside from automating payables and receivables, Cashflow.io offers transaction-based financing that helps you manage large orders.

Cashflow.io is designed to address common pain points through its strengths in streamlining financial workflows for those seeking robust payment automation, greater flexibility and responsive support.

Key Features

- Automate and simplify: Streamline your entire process, from quote to cash. Send, receive and finance customer orders more efficiently than ever.

- Bring your own payments: Quickly connect your own payment processor to start receiving digital payments with no disruption.

- No integration costs: Get started quickly – for free. Pay as you grow.

- Work from anywhere: Manage your business transactions on any device, using simple but powerful cloud-based tools.

- Built for teams: Set permissions for each user in your team to ensure that they can access only what you want.

Streamline Accounts Payable Operations

With Cashflow.io, you can centralize and simplify your accounts payable management through a single platform. By forwarding your invoices to a specialized email address, you initiate automatic bank transfers for settling vendor bills. This eradicates the cumbersome task of accessing various banking interfaces to handle each transaction manually. In essence, Cashflow.io refines your accounts payable workflow, saving you both time and manual effort.

Get Paid Faster with Custom Payment Plans

Cashflow.io enables you to receive payments by creating customized recurring payment plans tailored to each client. You can also utilize handy features like automated payment reminders and pre-authorized debits to ensure customers pay on time per the agreed upon schedule. Prompt customer payment significantly improves your cash flow so you can worry less about accounts receivable and reinvest in business growth.

Access Financing When You Need It

Cashflow.io provides transaction-based financing options through its platform for quick approval and same-day funding of large orders. This empowers you to accept new business opportunities that may have previously exceeded your capacity.

Quick and Easy Onboarding

Onboarding with Cashflow.io is quick and easy, with the ability to connect your business accounts and payment processors at no cost. The platform is highly customizable to fit your business needs as you scale.

Top-Tier Security

Cashflow.io employs top-tier security standards like AES-256-bit encryption and adheres to PCI and SOC compliance rules to protect your data. It does not directly store sensitive information, operating through certified PCI payment processors.

Intuitive Tools Save You Time

The user-friendly tools and dashboard provide an intuitive snapshot of your financial data accessible on the go from any device. This saves you time through convenient centralized access.

Responsive Customer Support

Cashflow.io also has knowledgeable customer support available by phone, chat, and email for prompt assistance.

Alternative #2: Melio

If you’re looking for a simpler and more budget-friendly payment automation solution, Melio is a decent alternative instead of Tipalti. Melio offers a streamlined interface tailored for small businesses and startups. Its simple bank transfer and check payment features make managing payables easy without steep learning curves. Melio also charges no monthly fees, just transaction fees on credit card payments.

However, Melio has more limited capabilities compared to Tipalti’s extensive suite of payment automation features. It may not scale as well for larger or global companies needing complex payables workflows. But for basic payment needs, Melio provides a cheaper and easier option worthy of consideration.

While Tipalti excels in customization and global payment support, Melio shines in its simplicity. When deciding between these two payment automation solutions, weigh your specific needs, pricing, and ease of use. For basic accounts payable automation, Melio can provide a cost-effective alternative.

Alternative #3: Stampli

With its simple invoice capture, approvals, and payment features, Stampli provides a streamlined option well-suited for small to midsize businesses. Its pricing model does not include steep setup fees or monthly platform charges like Tipalti. Transaction-based fees give more predictable costs as you scale.

However, Stampli has more basic capabilities than Tipalti’s extensive features. It lacks support for complex global supplier payments, advanced reconciliations, and robust analytics. But for basic AP needs, Stampli offers a smoother onboarding process and a cheaper solution to automate accounts payable workflows.

While Tipalti shines in customization and enterprise-level controls, Stampli wins on simplicity and affordable pricing. Assess your feature needs, complexity, and budget when deciding if Stampli could be a good alternative to achieve your AP automation goals. It provides a lighter-weight option for many small businesses to reduce manual AP tasks.

Alternative #4: AvidXChange

AvidXchange provides a streamlined solution for small to midsize businesses to automate basic accounts payable tasks like invoice capture, approvals, and payments. With its focus on ease of use, AvidXchange can save manual effort without overwhelming users with complex features.

However, AvidXchange lacks extensive global payment capabilities and advanced reconciliation tools offered by Tipalti. It may not scale as seamlessly for large or multinational organizations. But for domestic companies with simple AP needs, AvidXchange delivers capable automation at a more affordable price than Tipalti.

While Tipalti excels in customization and global payments, AvidXchange wins on simplicity and being lightweight. Evaluate your unique requirements, growth, and budget when deciding if AvidXchange could suit your purposes as a “good enough” alternative to reduce repetitive AP work. For many small businesses, it provides a cost-effective option.

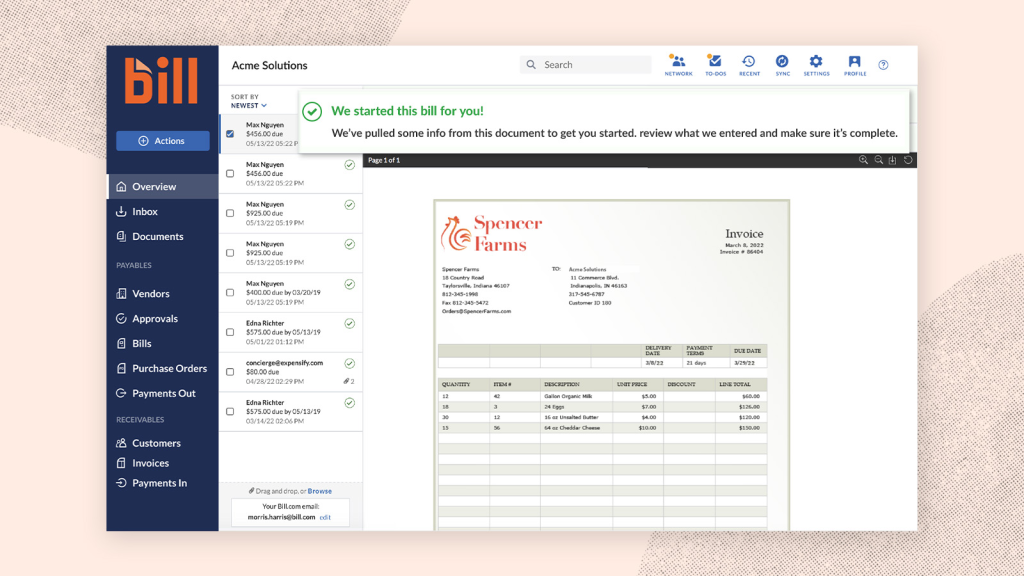

Alternative #5: Bill.com

Bill.com provides a simplified interface tailored for small businesses to automate basic accounts payable tasks. With its focus on ease of use and seamless QuickBooks integration, Bill.com delivers capable automation without overwhelming complexity.

However, Bill.com offers more limited capabilities than Tipalti’s extensive global payment and compliance features. It may not scale as efficiently for larger or multinational organizations. But for domestic companies with straightforward AP needs, Bill.com represents a smooth and low-cost option.

Alternative #6: Brex

If you’re primarily focused on corporate card management, Brex is a potential alternative instead of Tipalti. With its emphasis on virtual and physical card spending control, Brex provides a streamlined solution for companies to monitor employee purchasing. It charges no platform fees, earning revenue from card transaction fees.

However, Brex has more basic capabilities for core accounts payable automation tasks like invoice and payment management than Tipalti’s extensive AP features. It may not scale as efficiently for complex global supplier payment workflows. But Brex offers capable automation at a lower cost for domestic card spend management than Tipalti.

While Tipalti excels at customization and compliance for payables, Brex wins on card management simplicity and affordability. Evaluate your unique requirements, growth, and budget when deciding if Brex fits your purposes as a “lighter-weight” alternative for card-related financial processes. For many businesses, it provides a cost-efficient option to control card spending.

Alternative #7: Airbase

With its emphasis on virtual and physical card management, Airbase provides a streamlined solution for companies wanting to control employee spending. It charges no platform fees, earning revenue from card transaction fees.

However, Airbase offers more basic capabilities for core accounts payable tasks like invoice and payment management than Tipalti’s extensive features. As with brex, Airbase may not scale as efficiently for complex global payment workflows. However, it still delivers capable automation at a lower cost structure. While Tipalti excels at customization and compliance, Airbase wins on simplicity and affordability for companies focused solely on card spend.

What is the best Tipalti alternative?

In summary, Cashflow.io is an affordable all-in-one financial platform with payables automation, strong compliance, and great support. The other alternatives fill specialized niches – Melio and Bill.com for small businesses, Stampli/AvidXchange/Airbase for medium businesses, and Brex for card management. But Tipalti remains ideal for large global enterprises.

| Cashflow.io | Melio | Stampli | AvidXchange | Bill.com | Brex | Airbase | |

|---|---|---|---|---|---|---|---|

| Features | All-in-one financial platform | Core AP automation | Basic AP automation | Basic AP automation | Basic AP automation | Card management | Card management |

| Customization | Highly customizable | Limited customization | Moderate customization | Moderate customization | Limited customization | Minimal customization | Minimal customization |

| Pricing | Affordable, no setup fees | Affordable | Affordable, no setup fees | Competitive pricing | Low transparent pricing | No platform fees | No platform fees |

| Support | Excellent support | Basic support | Good support | Good support | Good support | Good support | Good support |

| Ideal For | All business sizes | Small businesses | Small/medium businesses | Small/medium businesses | Small businesses | Card spend management | Card spend management |

Conclusion

Finding the right payment automation solution can be difficult, especially when considering alternatives to an established provider like Tipalti. As we’ve seen, businesses have varied needs and constraints when managing payables and payments.

However, for a full-featured financial platform, Cashflow.io stands out as the best all-in-one alternative to simplify your quote-to-cash process. With extensive automation, top-notch security, transaction financing, and responsive support, Cashflow.io empowers you to efficiently manage payables, receivables, and cash flow in one unified hub accessible across devices.

If you’re ready to explore how Cashflow.io can transform your financial operations with robust payment automation and more, visit their website at cashflow.io to learn more and request a demo.