The 7 Best Airbase Alternatives in 2023

While Airbase offers a capable spend management platform, its focus on corporate cards leaves some accounts payable automation features lacking. For companies needing more robust AP capabilities, Airbase may fall short.

With its emphasis on virtual and physical card management, Airbase provides only basic support for core invoice and payment tasks. It lacks advanced global payment options and reconciliations needed for complex supplier workflows. Additionally, Airbase centers on controlling spend rather than providing full cash management. Its feature set may not meet the needs of businesses requiring deeper cash flow analysis and planning.

Airbase’s extensive features could prove overly complex and expensive for small businesses with straightforward financial needs. With these limitations in mind, companies requiring advanced AP automation and cash management are exploring alternative platforms.

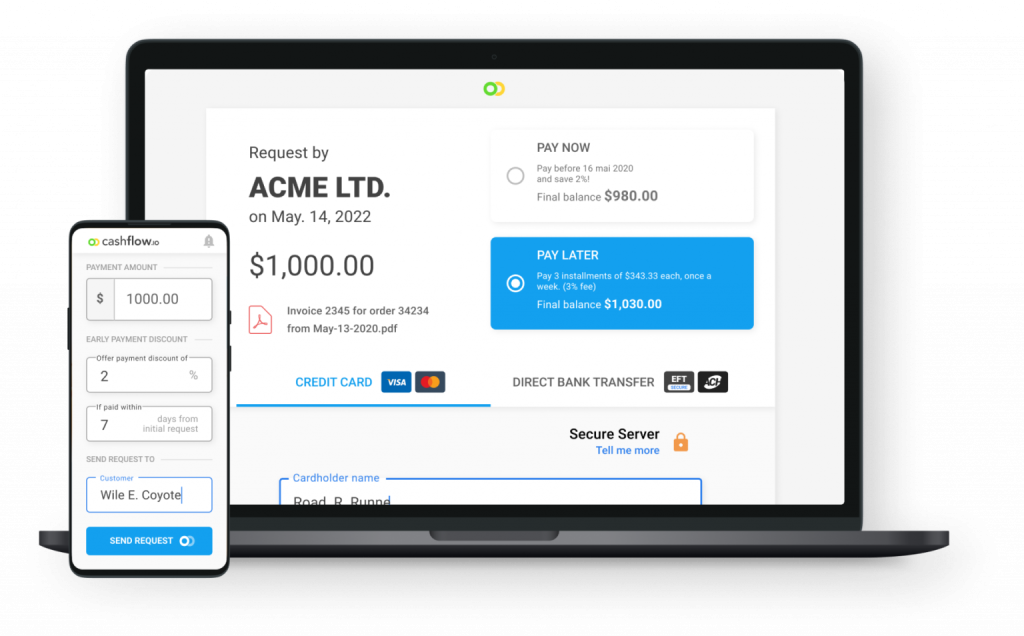

Alternative #1: Cashflow.io

If you’re looking for a financial tool that does more than just manage spending, Cashflow.io is worth considering. It combines bill payments, money collection, and even loan options into one easy-to-use platform you can access from any device.

With Cashflow.io, you can automate your bill payments by sending invoices to a special email address. This triggers automatic bank transfers, making it easier to pay vendors without logging into multiple bank accounts. The platform also lets you set up custom payment plans for your clients, helping you get paid on time and improve your cash flow. If you need quick funding for big orders, Cashflow.io has you covered with its financing options.

In summary, Cashflow.io offers a well-rounded financial management solution. It addresses many of the limitations in Airbase, especially if you’re looking for more automated payment options, flexibility, and responsive customer support.

Key Features

- Automate and simplify: Streamline your entire process, from quote to cash. Send, receive and finance customer orders more efficiently than ever.

- Bring your own payments: Quickly connect your own payment processor to start receiving digital payments with no disruption.

- No integration costs: Get started quickly – for free. Pay as you grow.

- Work from anywhere: Manage your business transactions on any device, using simple but powerful cloud-based tools.

- Built for teams: Set permissions for each user in your team to ensure that they can access only what you want.

Streamlined Payables Management

Cashflow.io introduces a unified platform for payables management that simplifies the entire workflow. The system triggers automated bank transactions by directing invoices to a designated email, eliminating the need for labor-intensive manual processes. This operational efficiency allows your enterprise to focus on critical strategic goals.

Custom Payment Cycles in Accounts Receivable

Cashflow.io transcends conventional payment methods by providing the flexibility to design custom payment cycles for each client. Automated notifications and pre-approved debits facilitate prompt revenue collection, bolstering financial resilience and facilitating strategic planning and capital allocation.

Efficient Financing for Business Growth

Capitalize on growth opportunities through Cashflow.io’s efficient financing avenues. The platform expedites the approval process and offers same-day capital disbursement for substantial orders, supplying the necessary funds to capitalize on larger market opportunities and fuel business growth.

Customer Assistance for Financial Operations

Find peace of mind with Cashflow.io’s committed customer assistance team, reachable via multiple communication channels such as phone, live chat, and email. Their prompt and effective issue resolution is a reliable pillar for your ongoing financial activities, ensuring smooth operations.

Adaptable Platform Integration

Cashflow.io stands out for its effortless integration capabilities, providing a seamless transition and free linkages to your existing banking and payment infrastructures. The platform’s scalability ensures it remains in sync with your business’s evolving requirements, aligning perfectly with your expansion plans.

Mobile-Friendly Financial Dashboards

Cashflow.io refines your financial oversight by consolidating data into user-friendly dashboards accessible on multiple devices. This approach to mobile compatibility streamlines administrative tasks, enabling data-driven decision-making and enhancing operational productivity.

Stringent Security Protocols

With Cashflow.io, the security of your financial data is assured. The platform employs rigorous measures such as AES-256-bit encryption and compliance with PCI and SOC guidelines to safeguard sensitive information. This steadfast dedication to security instills the confidence to manage your financial operations without apprehension, solidifying the platform’s role as a reliable partner in your fiscal ecosystem.

Alternative #2: Stampli

Stampli and Airbase are cloud-based accounts payable automation solutions to streamline invoice processing and payments. Some key differences:

- Stampli emphasizes flexibility and not requiring changes to existing ERPs or processes. It can deploy very quickly. Airbase offers more end-to-end spend management capabilities beyond just AP automation.

- Stampli claims stronger AI/Machine learning capabilities to automate capture, coding, and routing tasks. Airbase offers guided buying workflows and vendor management.

- Stampli is focused on mid-market and large enterprises. Airbase targets small to medium businesses.

- Stampli has received high customer satisfaction scores and is a Leader in recent G2 reports. Airbase also performs well in reviews and reports.

- Stampli offers phone, online, and email support. Airbase provides online, email, and knowledge base.

- Stampli integrates with over 70 accounting systems. Airbase connects to NetSuite, Sage, QuickBooks, and others.

Stampli may be the better option if you want seamless integration and minimal disruption to existing systems. Airbase provides more complete spend management but requires more change. Both are market leaders in AP automation with happy customers. The choice depends on your specific needs and preferences.

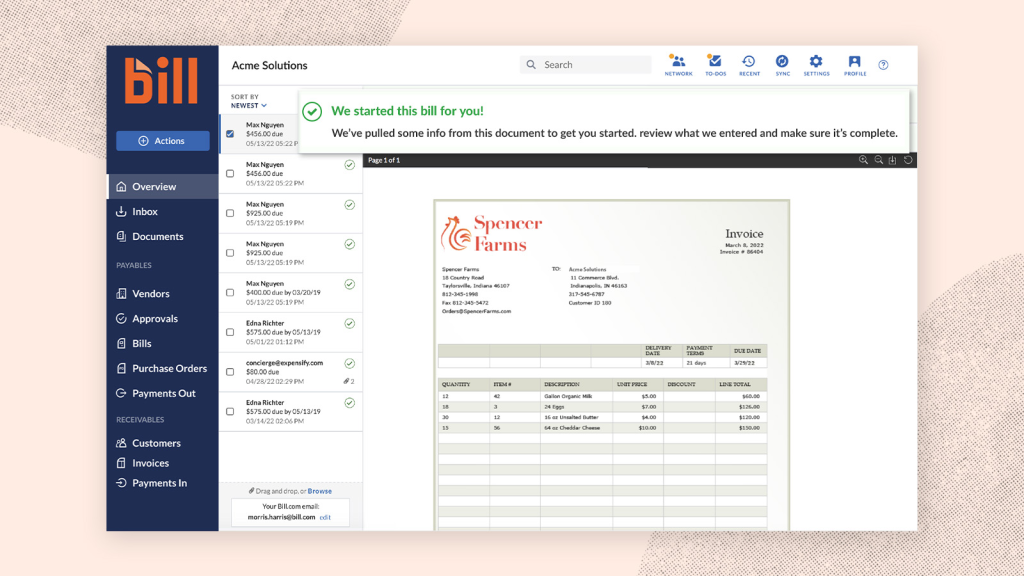

Alternative #3: BILL.com

Bill.com and Airbase both provide cloud-based accounts payable and spend management solutions. Bill.com has been around longer, since 2006, while Airbase was founded in 2017.

Some key differences:

- Bill.com has a lower starting price of $45/month compared to Airbase’s customized enterprise pricing. So if cost is a main driver, Bill.com may be the better option.

- Airbase offers more unified spend management capabilities beyond just accounts payable. Bill.com is more focused specifically on streamlining AP workflows.

- Bill.com has integrations with major accounting systems. Airbase also connects but claims deeper integration abilities.

- Bill.com serves mainly SMBs and smaller teams. Airbase targets mid-market and larger enterprises.

- Both platforms receive positive reviews and ratings. However, Bill.com has more overall reviews given its longer history.

- Bill.com offers phone, email, and online chat support. Airbase provides online, email, and a knowledge base.

Overall, Bill.com is the more affordable pick for basic AP automation, especially for smaller businesses. Airbase provides more advanced all-in-one spend management for larger companies. But both are reputable options worth considering.

Alternative #4: Tipalti

Tipalti and Airbase both provide cloud-based accounts payable and payment automation solutions. Some key differences:

- Tipalti focuses more on supplier payments, global payouts, and tax compliance. Airbase offers broader spend management capabilities beyond just AP.

- Tipalti serves mainly medium to large enterprises. Airbase targets small and mid-market companies.

- Tipalti handles high payment volumes and complex workflows for scaling companies. Airbase emphasizes ease of use.

- Tipalti has deep ERP integrations. Airbase also connects but claims a faster setup.

- Tipalti provides phone and email support. Airbase offers online, email, and a knowledge base.

- Tipalti has more payment options – ACH, check, wire, etc. Airbase also supports ACH, check, and virtual cards.

- Both platforms are highly rated. Tipalti scores well for payouts, Airbase for usability.

Overall, Tipalti may be preferable for larger or global companies needing to scale payments and reconcile across systems. Airbase suits SMBs wanting unified spend management. But both are reputable solutions for AP automation.

Alternative #5: Brex

Brex and Airbase offer corporate card and spend management solutions tailored to businesses. Brex focuses more on cards and rewards, while Airbase provides broader AP automation features.

Some key differences:

- Brex offers generous rewards like cashback and travel points on card purchases. Airbase provides more limited cashback rewards.

- Brex serves mainly startups and tech companies. Airbase targets mid-market enterprises across industries.

- Brex emphasizes easy approvals based on company cash flow. Airbase also doesn’t require personal guarantees.

- Airbase has broader spend management capabilities for AP, expenses, and invoices beyond just cards. Brex focuses specifically on card optimization.

- Both platforms integrate with accounting systems like QuickBooks and NetSuite.

- Brex provides phone, chat, and email support. Airbase offers online, email, and a knowledge base.

- Airbase may provide more controls and workflows for managing spend. Brex simplifies card issuing.

Overall, Brex is likely better suited for startups wanting easy card access and rewards. Airbase is preferable for unified spend management across AP and cards. But both are reputable solutions.

Alternative #6: AvidXchange

AvidXchange and Airbase offer cloud-based AP automation solutions to help streamline invoice processing and payments. Some key differences:

- AvidXchange has been around longer, founded in 2000, compared to Airbase, which launched in 2017. So it has a more established customer base.

- AvidXchange focuses solely on accounts payable automation, while Airbase provides broader spend management features.

- AvidXchange serves mid-market and large enterprises. Airbase targets small to mid-size businesses.

- Airbase claims faster, easier setup. AvidXchange has deeper ERP integrations with major systems.

- Both platforms provide various payment methods – check, ACH, and virtual card. Airbase also offers corporate cards.

- AvidXchange offers phone, email, and chat support options. Airbase provides online, email, and a knowledge base.

- AvidXchange has a lower starting price at $120/month vs. Airbase’s customized pricing.

Overall, AvidXchange suits larger companies wanting a robust AP solution deeply integrated with ERPs. Airbase is more user-friendly for SMBs needing unified spend management. But both are reputable options.

Alternative #7: Melio

Melio and Airbase both offer cloud-based accounts payable and payment solutions, but with some key differences:

- Melio has a lower starting price of $0 compared to Airbase’s customized pricing. So it may be the more budget-friendly option.

- Melio focuses specifically on streamlining AP workflows. Airbase provides broader spend management capabilities beyond AP.

- Melio serves mainly small businesses and freelancers. Airbase targets mid-market and larger enterprises.

- Airbase claims to be easier to set up and use. Melio emphasizes integrations with accounting software.

- Melio offers ACH, check, and card payments. Airbase also includes corporate card management.

- Both platforms receive positive reviews, but Airbase scores higher for usability.

- Melio provides email, and chat support. Airbase offers online, email, and a knowledge base.

So in summary, Melio is simpler and more affordable for basic AP needs, especially for smaller teams. But Airbase brings more features and scales better for larger companies.

What is the best Airbase alternative?

In summary, Cashflow.io stands out for its comprehensive approach to financial management, offering robust payment automation, transaction-based financing, and customizable accounts receivable solutions. While other platforms may excel in specific areas, Cashflow.io provides a balanced, all-in-one solution that scales with your business needs. Its “pay as you grow” pricing model offers flexibility, and its high integration capabilities mean you can easily connect it to your existing systems. Moreover, its strong security protocols and highly rated customer support make it a reliable choice for businesses of all sizes.

Stampli and Tipalti, for instance, are more focused on specific market segments and offer fewer features for comprehensive financial management. BILL.com and Melio may be more budget-friendly but lack the advanced features and scalability that Cashflow.io provides. While robust, Brex is more card-focused, and AvidXchange leans more towards accounts payable automation rather than a comprehensive financial management solution.

| Comparison Factors | Cashflow.io | Stampli | BILL.com | Tipalti | Brex | AvidXchange | Melio |

|---|---|---|---|---|---|---|---|

| Pricing Model | Pay as you grow | Customized | $45/month | Customized | Customized | $120/month | Freemium |

| Target Market | Mid-sized businesses | Mid-market to large enterprises | SMBs | Medium to large enterprises | Startups & tech companies | Mid-market to large enterprises | Small businesses & freelancers |

| AP Automation | Strong | Strong | Moderate | Strong | Limited | Strong | Moderate |

| Spend Management | Comprehensive | Limited | Limited | Limited | Card-focused | Limited | Limited |

| Customer Support | Phone, chat, email | Phone, online, email | Phone, email, chat | Phone, email | Phone, chat, email | Phone, email, chat | Email, chat |

| Integration Capabilities | High | Over 70 accounting systems | Major accounting systems | Deep ERP integrations | QuickBooks, NetSuite | Deep ERP integrations | Accounting software |

| Security Standards | AES-256-bit, PCI, SOC | High | High | High | High | High | Moderate |

| User Reviews | Highly rated | Strong G2 reports | Positive, long history | Highly rated | Positive | Established, positive | Positive but simpler |

| Unique Features | Transaction-based financing, customizable AR solutions | AI/ML capabilities | Lower starting price | Global payouts, tax compliance | Generous card rewards | Deep ERP integration | Budget-friendly |

Conclusion

Searching for a comprehensive financial management platform can be daunting, especially when the existing solutions like Airbase may not fully align with your business’s specific needs in accounts payable automation and cash management. Airbase, while strong in corporate card management, lacks in areas such as advanced global payment options, deep cash flow analysis, and may not be the most cost-effective for small businesses with simpler needs.

In this article, we’ve explored seven alternatives to Airbase, each with its strengths and weaknesses. However, Cashflow.io is a compelling choice for businesses seeking a balanced, feature-rich solution. It offers robust payment automation, transaction-based financing, and customizable accounts receivable solutions. Its flexible pricing model and high integration capabilities make it adaptable to various business sizes and needs. Moreover, its strong security protocols and highly rated customer support make it a reliable choice for managing your finances.

If you’re looking for a platform that not only fills the gaps left by Airbase but also offers additional features to empower your financial management, Cashflow.io is worth considering. For a deeper dive into how Cashflow.io can revolutionize your financial workflows, click here to visit their website and schedule a personalized demo today.