The 6 Best Melio Alternatives in 2024

Melio has emerged as a premier vendor payment service in business payment processing. However, users report waiting hours for replies, with customer support appearing inexperienced and disinterested. Users feel stranded and unsupported with no phone number available and eventual cessation of response.

Furthermore, Melo serves a single-purpose function. While they offer vendor payments, you may want a platform with more functionality (and fewer logins). The experiences users share make it understandable why you may want to find alternatives.

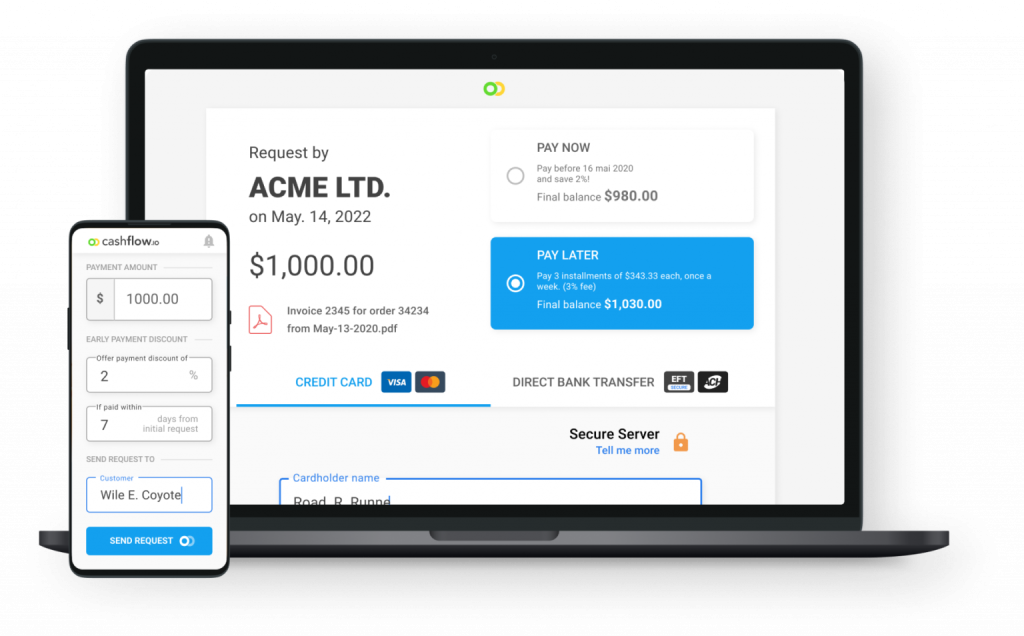

Alternative #1: Cashflow.io

If you’re looking for a great payment solution, Cashflow.io is the top choice. Cashflow.io is an all-in-one platform for managing your payables, receivables, and financing. With Cashflow.io, you can easily automate payables by forwarding invoices to a unique email address to trigger bank transfers. The interface centralizes your payments under one login, saving you from toggling between bank portals.

On the receivables side, you can create customized payment plans, automatically send reminders, and collect payments on time with pre-authorized debits. This improves cash flow by eliminating late payments. Cashflow.io enables transaction-based financing so that you can get quick approval and same-day funding for large customer orders. As your customer pays, repayments are handled automatically.

Key Features

- Automate and simplify: Streamline your entire process, from quote to cash. Send, receive and finance customer orders more efficiently than ever.

- Bring your own payments: Quickly connect your own payment processor to start receiving digital payments with no disruption.

- No integration costs: Get started quickly – for free. Pay as you grow.

- Work from anywhere: Manage your business transactions on any device, using simple but powerful cloud-based tools.

- Built for teams: Set permissions for each user in your team to ensure that they can access only what you want.

Automate Payables for Simplicity

Cashflow.io allows you to consolidate and automate your payables through one platform easily. Forward your invoices to a unique email address that automatically triggers bank transfers for vendor payments. This eliminates the headache of manually logging into multiple bank portals to process each payment. With Cashflow.io, you streamline payables into a straightforward process to save time and reduce effort.

Dedicated Customer Support

Cashflow.io has knowledgeable customer support representatives who quickly respond to questions without extended wait times. If any issue arises, you can expect fast and effective assistance rather than waiting hours for an email reply. Support is available by phone, chat, and email.

Get Paid Faster with Custom Payment Plans

Cashflow.io also has tools to receive payments. The platform enables you to create customized recurring payment plans tailored to each client. You can also utilize handy features like automated payment reminders and pre-authorized debits to ensure customers pay on time per the agreed-upon schedule. Prompt customer payment significantly improves your cash flow, so you can worry less about accounts receivable and reinvest in business growth.

Access Financing When You Need It

Cashflow.io lets you quickly access financing for large customer orders directly through the platform. You get near-instant approval, and funding deposited the same day, enabling you to take on bigger jobs that may have previously exceeded your capacity. The integrated financing eliminates the need to go through banks and lengthy applications. This empowers you to accept new business opportunities confidently.

Easy to Start, Customize, and Scale

Cashflow.io is designed for an easy onboarding process. You can connect your business bank accounts and payment processors at no cost. The platform is also highly customizable, with settings to tailor features over time to fit your evolving business needs. Cashflow.io scales with you as your company grows by providing more convenient access to financing.

User-Friendly Tools Save You Time

Cashflow.io condenses your financial data into easy-to-use dashboards accessible on any device. This centralized hub for your payables, receivables, and financing gives you an intuitive snapshot to save time. The user-friendly interface also enables working on-the-go from your phone or tablet.

Top-Tier Security for Peace of Mind

Cashflow.io employs the highest security standards, such as AES-256-bit encryption, adhering to PCI and SOC compliance guidelines. Your data protection is the top priority. Cashflow.io does not directly store sensitive information, operating via certified Level 1 PCI payment processors for your peace of mind.

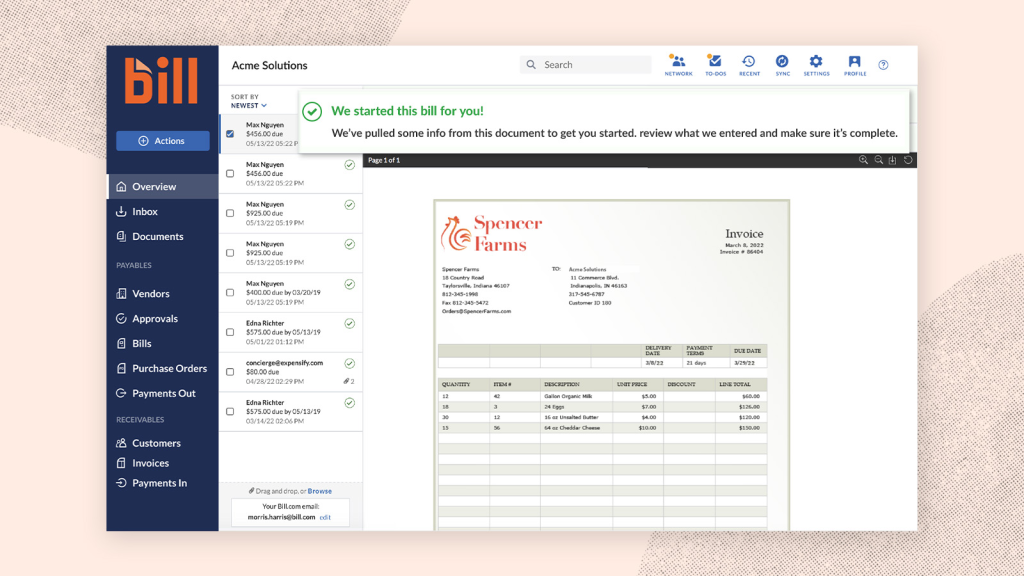

Alternative #2: BILL.com

To optimize accounts payable specifically, Melio provides a streamlined solution focused on vendor payments. However, BILL.com is better suited as a full financial automation platform with tools for payables, receivables, cash flow management, etc. It has broader accounting capabilities compared to Melio’s specialized vendor payment focus. However, BILL.com requires a paid subscription starting at $79 per month.

Some other key differences:

- BILL.com has wider integrations with accounting software like QuickBooks, while Melio has more limited accounting integrations.

- Melio offers faster payment options tailored for paying bills that BILL.com lacks.

- BILL.com provides more extensive reporting and cash flow forecasting features compared to Melio.

Melio is a simple, affordable option focused specifically on optimizing accounts payable. But BILL.com offers a more complete financial management solution, albeit at a cost.

Alternative #3: Tipalti

Tipalti provides a comprehensive finance automation platform covering payables, global payments, expenses, and more. It has a robust feature set and advanced capabilities like tax compliance and supplier onboarding. However, Tipalti is a paid solution starting at $149/month.

Some key differences:

- Tipalti has broader features, including global payments, while Melio solely focuses on accounts payable.

- Tipalti requires a paid subscription, whereas Melio has a free plan available.

- Tipalti has wider accounting software integrations than Melio.

- Melio offers faster payment options tailored for paying suppliers.

- Tipalti provides more extensive reporting and analytics features.

Overall, if you want comprehensive finance automation, Tipalti is a robust pick despite the cost. But if you just need to optimize payables, Melio provides that for free in a simple solution.

Alternative #4: Stampli

Stampli is an accounts payable automation software that helps streamline invoice processing without changing existing ERP systems or processes. It comes with AI capabilities like automated data extraction and matching invoices to purchase orders.

Some key differences:

- Stampli has advanced automation features, while Melio has a more basic and straightforward bill payment function.

- Melio has a free plan available, whereas Stampli requires a paid subscription.

- Stampli integrates with ERPs like NetSuite, while Melio has more limited accounting software connections.

- Melio provides faster payment options tailored for suppliers.

- Stampli offers robust reporting compared to Melio’s basic insights.

Overall, if you want to keep current processes and maximize automation, Stampli is a more advanced pick despite the cost. But if you just need a simple, free bill payment tool, Melio excels at that specific function.

Alternative #5: AvidXchange

AvidXchange is a full-featured accounts payable automation platform with capabilities like invoice capture, approvals, payments, reporting, and integrations. However, it requires a paid subscription.

Some key differences:

- AvidXchange has broader AP automation features, while Melio solely focuses on payment.

- Melio has a free plan available, but AvidXchange requires a paid subscription.

- AvidXchange offers robust reporting/analytics compared to Melio’s basic insights.

- Melio provides faster payment options tailored for suppliers that AvidXchange lacks.

- AvidXchange has wider accounting software integrations compared to Melio.

Overall, AvidXchange is a strong choice despite the cost if you want full AP automation capabilities. But if you just need an affordable, simple bill payment solution, Melio excels at that targeted function with its free plan.

Alternative #6: Quickbooks

QuickBooks Online is a full-featured accounting software that helps manage a small business’s finances. It provides tools for invoicing, expense tracking, reporting, payroll, and more.

Some key differences:

- QuickBooks Online has broader accounting capabilities like invoicing, whereas Melio is specialized in accounts payable.

- QuickBooks Online requires a monthly subscription starting at $20/month, while Melio has a free plan available.

- QuickBooks Online integrates with various third-party apps, while Melio has more limited integrations.

- Melio offers faster, more convenient payment options tailored for paying vendors.

- QuickBooks Online has more robust reporting and analytics features.

Overall, QuickBooks Online is better suited as a full accounting platform, while Melio excels at optimizing vendor payments. If you want to optimize bill payment specifically, Melio provides a streamlined solution, often at no cost. But QuickBooks Online is a better pick for handling all aspects of financial management in one place.

What is the best Melio alternative?

In summary, Cashflow.io scores the highest when evaluating key criteria like automation, customization, reporting, support, and affordability. It offers full process automation, high customizability, centralized reporting dashboards with quick and responsive support. The combination of power, flexibility, and value makes Cashflow.io the best overall choice compared to alternatives for managing payments and financing.

| Solution | Cashflow.io | BILL.com | Tipalti | Stampli | AvidXchange | QuickBooks |

|---|---|---|---|---|---|---|

| Automation | Full automation for payables, receivables, financing | Full financial automation including payables, receivables, cashflow | Comprehensive automation for payables, global payments, expenses | Advanced automation focused on AP and invoicing | Full automation across the AP process | Full accounting automation including invoicing, reporting |

| Customization | Highly customizable payment plans, settings | Moderate customization | Limited customization | Moderate customization | Moderate customization | Highly customizable |

| Reporting | Centralized dashboards | Robust reporting and forecasting | Extensive reporting and analytics | Strong reporting insights | Strong reporting and analytics | Robust analytics and insights |

| Support | Quick responsive support via phone, chat, email | Good support | Good support | Decent support | Decent support | Good support |

| Affordability | Affordable plans | Starts at $79/month | Starts at $149/month | Paid subscription required | Paid subscription required | Starts at $20/month |

| Score | 9/10 | 7/10 | 7/10 | 7/10 | 7/10 | 8/10 |

Conclusion

In conclusion, you’re not alone if you’re looking for a Melio alternative. While Melio serves as a simple solution for vendor payments, it falls short in its lack of functionality and poor customer support. After evaluating various alternatives, we recommend Cashflow.io as the best alternative on the market. With full automation, customization, reporting capabilities, and quick and responsive customer support, Cashflow.io stands out as the superior option.

If you’re ready to optimize your payables, receivables, and financing all in one platform, Cashflow.io is the way to go. Head to their homepage to learn more and get started.