The 6 Best Brex Alternatives in 2024

Businesses initially attracted to Brex’s benefits and customer-centric approach have discovered that its services may not adapt as their requirements change. The company’s somewhat opaque credit evaluation processes can pose challenges for rapidly expanding businesses. On top of some operational challenges, Brex’s strong emphasis on tech startups may leave businesses in other industries feeling underserved.

For these companies, it might be worth considering alternative options. Competitors in the financial sector have responded to Brex’s success by prioritizing flexibility, personalization, and better customer support. This article aims to introduce six noteworthy alternatives to Brex in 2023, offering solutions in finance, card issuance, accounts payable software, and business banking.

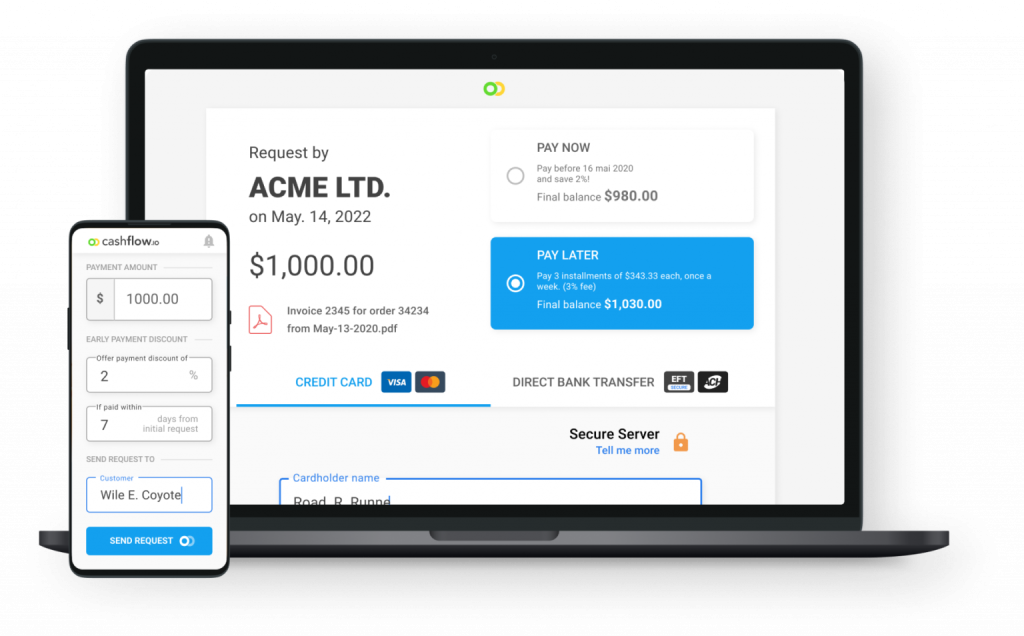

Alternative #1: Cashflow.io

When it comes to finding an excellent payment solution, Cashflow.io stands out as the top choice. This versatile platform offers comprehensive management of your payables, receivables, and financing needs all in one place. With Cashflow.io, the process of automating payables becomes effortless. You can simply forward your invoices to a unique email address, which triggers bank transfers seamlessly. The user-friendly interface consolidates all your payments within a single login, eliminating the need to switch between various bank portals.

On the receivables side, Cashflow.io empowers you to create tailor-made payment plans, automate reminder emails, and ensure timely payments with pre-authorized debits. This proactive approach significantly improves cash flow by eliminating the hassle of dealing with late payments. Cashflow.io also offers transaction-based financing, making it easy to secure quick approval and same-day funding for substantial customer orders. As your customers make payments, the platform takes care of repayments automatically, streamlining your financial operations.

Key Features

- Automate and simplify: Streamline your entire process, from quote to cash. Send, receive and finance customer orders more efficiently than ever.

- Bring your own payments: Quickly connect your own payment processor to start receiving digital payments with no disruption.

- No integration costs: Get started quickly – for free. Pay as you grow.

- Work from anywhere: Manage your business transactions on any device, using simple but powerful cloud-based tools.

- Built for teams: Set permissions for each user in your team to ensure that they can access only what you want.

Streamline Payables for Effortless Management

With Cashflow.io, simplifying and automating your payables has never been easier. You can effortlessly centralize and automate your payables all within one platform. Simply forward your invoices to a designated email address and watch as bank transfers for vendor payments are triggered automatically. This eliminates the need for the cumbersome process of logging into multiple bank portals for each payment, saving you valuable time and reducing manual effort.

Responsive Customer Support at Your Service

Count on Cashflow.io for dedicated customer support. Our knowledgeable representatives quickly respond to your inquiries, ensuring you receive prompt and effective assistance without enduring long wait times. You can expect efficient support via phone, chat, or email if you have questions or face any issues.

Accelerate Receivables with Custom Payment Plans

Cashflow.io empowers you to design tailored recurring payment plans for each client. Additionally, leverage convenient features like automated payment reminders and pre-authorized debits to guarantee timely payments according to your agreed-upon schedule. Prompt customer payments significantly enhance your cash flow, allowing you to focus less on accounts receivable and more on driving business growth.

Access Financing with Ease

Need financing for substantial customer orders? Cashflow.io has you covered. Gain quick access to financing through the platform with near-instant approval and same-day funding. Say goodbye to lengthy bank applications and waiting periods. This integrated financing solution empowers you to confidently pursue new business opportunities.

Effortless Start, Customization, and Scalability

Getting started with Cashflow.io is a breeze. Connect your business bank accounts and payment processors at no cost. The platform is highly customizable, allowing you to tailor features as your business evolves. As your company grows, Cashflow.io scales with you, offering more convenient access to financing.

User-Friendly Tools for Time Savings

Cashflow.io condenses your financial data into user-friendly dashboards accessible on any device. This centralized hub for managing payables, receivables, and financing provides an intuitive snapshot, saving you precious time. The user-friendly interface ensures you can work seamlessly on-the-go, whether from your phone or tablet.

Top-Notch Security for Your Peace of Mind

Rest easy with Cashflow.io knowing that your data is protected with the highest security standards, including AES-256-bit encryption. We strictly adhere to PCI and SOC compliance guidelines. Your data security is our utmost priority. Furthermore, Cashflow.io does not directly store sensitive information, utilizing certified Level 1 PCI payment processors to ensure your peace of mind.

Alternative #2: Airbase

Airbase is a leading modern spend management platform designed for businesses with 100 to 5,000 employees, offering efficient control over spending, faster financial book closures, and risk management through its user-friendly software that combines accounts payable automation and expense management. The company also offers corporate cards and can integrate with popular mainstream accounting software and a few ERPs. Both Brex and Airbase offer virtual and physical cards, spend management features, and seamless integrations. However, when it comes to meeting the evolving needs of scaling firms, there are some key differences between Brex and Airbase that are worth nothing.

- Brex built its reputation on easy corporate card issuance, while Airbase started in accounts payable automation.

- Airbase provides more extensive approval workflows and reporting than Brex’s streamlined offering.

- Airbase accommodates mid-market companies scaling up globally, whereas Brex focuses on earlier-stage startups.

- Brex promotes its brand through outsized rewards programs, while Airbase wins on depth of features.

- Airbase beats Brex on breadth of accounting system integrations beyond Quickbooks.

At a high level, Airbase prevails for larger firms looking for advanced controls, while Brex suits early-stage customers wanting simple fintech foundations. The two competitors diverge as needs scale up.

Alternative #3: Melio

Melio is a user-friendly accounts payable platform tailored for small businesses, enabling convenient online bill payments through various methods, seamless integration with QuickBooks, and automated scheduling for efficient payment transactions. Both Brex and Melio share the ability to issue virtual cards and streamline payables. There are a few differences that you’ll want to note if you are comparing them against each other:

- Brex built a full finance platform including corporate cards and spend management, whereas Melio focuses specifically on accounts payable automation.

- Melio serves mainly small businesses, while Brex accommodates startups through growth-stage companies.

- Melio provides basic digital bill payment capabilities, while Brex offers additional accounting integrations, reporting, and controls.

- Brex provides a wide array of rewards and perks, while Melio touts its simplicity and ease of use.

- Melio handles B2B payments between companies, while Brex can manage all types of spending.

In summary, Melio is tailored for the simple AP needs of small businesses, while Brex can scale to meet the evolving complexity of startups – particularly in the tech space. The two solutions diverge based on customer size and needs.

Alternative #4: Stampli

Stampli is a user-friendly accounts payable platform that seamlessly integrates with over 70 ERPs, offering efficient automation, complete visibility, and control over AP-related communication and workflows, while also providing advanced features like fraud detection and vendor management to enhance overall efficiency and accuracy. On the surface, Brex and Stampli share some similarities – both offer virtual payment cards, seamless integrations, and modern interfaces. However, when evaluating the two platforms in depth, notable differences stand out.

- Brex built an end-to-end finance platform encompassing cards, spend controls, and banking. Stampli focused specifically on optimizing accounts payable workflows.

- Stampli serves mid-market firms scaling globally, while Brex targets earlier-stage startups.

- Stampli provides advanced approval routing and reporting lacking in Brex’s pared-down offering.

- Brex touts card rewards and perks, whereas Stampli wins on smart invoice automation.

- Stampli handles the full invoice-to-payment cycle, while Brex focuses on spend management.

In general, Stampli suits larger businesses needing AP workflow efficiency, while Brex appeals to startups wanting basic fintech foundations. The two diverge based on customer maturity and needs.

Alternative #5: Bill.com

BILL.com is a leading financial operations platform for small and midsize businesses (SMBs), that offers an integrated platform to streamline payables, receivables, and spend management tools. It can help facilitate faster payments through its extensive member network, serving as a trusted partner to prominent U.S. financial institutions, accounting firms, and accounting software providers. Brex and Bill.com share the ability to optimize cash flow and streamline financial workflows. However, there are notable differences between the two competitors:

- Brex built an all-in-one finance platform encompassing cards, banking, and spend controls, while Bill.com focuses specifically on accounts payable and receivable automation.

- Bill.com serves small businesses ready to digitize invoicing and payables, whereas Brex accommodates startups through growth-stage companies.

- Bill.com offers advanced custom workflows, reporting, and integrations lacking in Brex’s more basic offering.

- Brex touts generous card rewards and perks, while Bill.com emphasizes efficient processes and cost savings.

- Bill.com handles end-to-end invoice management, while Brex revolves around real-time spend visibility and controls.

To summarize, Bill.com suits businesses with complex AP/AR needs, while Brex appeals to tech startups wanting a simple spend management foundation. The two diverge based on customer maturity and financial needs.

Alternative #6: Tipalti

Tipalti is a cloud-based platform that specializes in automating and managing mass payments, especially for mid-sized companies dealing with international transactions. The platform offers a robust feature set, including advanced capabilities like tax compliance and supplier onboarding.

- Brex emphasizes real-time spend visibility and controls, as well as offering generous card rewards and perks.

- Brex focuses on spend management, whereas Tipalti provides a broader finance automation platform covering payables, global payments, expenses, and more.

- Brex’s pricing can be complex, while Tipalti starts at $149/month.

- Tipalti offers wider accounting software integrations compared to Brex.

Brex is suitable for startups and growing companies seeking simplicity in spend management and card rewards, while Tipalti targets mid-sized companies with more comprehensive finance automation needs.

What is the best Brex alternative?

In summary, Cashflow.io scores the highest when evaluating key criteria like automation, customization, reporting, support, and affordability. It offers full process automation, high customizability, and centralized reporting dashboards with quick and responsive support. The combination of power, flexibility, and value makes Cashflow.io the best overall choice compared to alternatives for managing payments and financing.

| Solution | Cashflow.io | Airbase | Melio | BILL | Stampli | Tipalti |

|---|---|---|---|---|---|---|

| Automation | Full automation for payables, receivables, financing | Full automation across the AP process, approvals, invoicing and more | Full accounting automation including invoicing, reporting, and AR/AP | Full financial automation including payables, receivables, cashflow | Advanced automation focused on AP and invoicing | Comprehensive automation for payables, global payments, expenses |

| Customization | Highly customizable payment plans, settings | Moderate customization | Moderate customization | Moderate customization | Moderate customization | Limited customization |

| Reporting | Centralized dashboards | Strong reporting and analytics | Robust analytics and insights | Robust reporting and forecasting | Strong reporting insights | Extensive reporting and analytics |

| Support | Quick responsive support via phone, chat, email | Decent support | Good support | Good support | Decent support | Good support |

| Affordability | Affordable plans | Custom pricing based on business size | Starts at $20/month | Starts at $79/month | Paid subscription required | Starts at $149/month |

| Score | 9/10 | 7/10 | 8/10 | 7/10 | 7/10 | 7/10 |

In Conclusion

In summary, as businesses seek alternatives to Brex in 2023, Cashflow.io emerges as the top choice. This all-in-one platform excels in simplifying payables, receivables, and financing. With automation, customizable payment plans, and seamless scalability, Cashflow.io offers versatility for startups and growing companies.

Its user-friendly interface and cost-effective growth make it the superior alternative to Brex. For those looking to optimize financial processes, Cashflow.io stands out as the best option. Explore its features and kickstart your financial efficiency today by visiting their website.