Offering Affordable Healthcare with Medical Factoring

The healthcare industry is undergoing massive changes. With rising costs and increased regulation, providers are under more pressure than ever to deliver quality care while remaining financially viable. This challenge is especially acute for small and midsize practices, which lack the scale and resources of large hospital networks.

For these providers, optimizing cash flow is vital. Yet antiquated reimbursement systems mean practices often wait 90 days or more for insurance payments. Without access to working capital, missed payrolls, delayed investments, and other cash crunches can quickly threaten the survival of a practice.

Fortunately, medical factoring provides a powerful solution to liberate cash trapped in unpaid claims. This guide explains how healthcare providers of all types and sizes can use medical factoring to unlock affordable capital and remain financially healthy.

The Cash Flow Crisis in Healthcare

Like any business, healthcare providers have bills to pay. Doctors must make payroll every two weeks for nurses, medical assistants, and administrative staff. They must keep the lights on, buy medical supplies, and pay large equipment loans.

Despite having these regular expenses, provider cash flow is beholden to the billing and reimbursement system. After providing a service, practices usually have to wait 30-90 days for insurance companies to pay claims. Government programs like Medicare and Medicaid can take even longer.

This delay between providing services and getting paid places enormous stress on provider finances. Consider a medium-sized 5-doctor practice seeing 1,000 patients monthly, with average monthly billings of $200,000. Assuming a 60-day delay in payments, this practice would have $400,000 in unpaid claims at any given time – enough to cripple them if they lack access to working capital.

In short, the very structure of healthcare reimbursement makes consistent cash flow nearly impossible. Many providers struggle to make payroll, take on debt, or even go out of business entirely.

How Medical Factoring Helps Providers

Medical factoring provides rapid access to working capital locked away in unpaid claims. It lets providers sell approved claims to a funding company at a slight discount. The funder pays out most of the claim value upfront and collects the total amount once insurers pay the claims. This instant injection of capital has many benefits for providers:

- Swift Cash Flow Boost: Picture receiving payments in days, not months. Medical factoring swiftly accelerates cash flow, providing timely funds that empower providers to manage operational expenses without waiting for insurance disbursements.

- Fuel for Expansion: Armed with immediate liquidity, providers can advance their ventures. Whether expanding facilities, augmenting staff, or acquiring state-of-the-art equipment, medical factoring is the financial catalyst for realizing growth aspirations.

- Steadying Seasonal Peaks and Valleys: Fluctuating revenue during different seasons? Not a concern. Medical factoring ensures providers maintain consistent cash reserves throughout the year, mitigating the impact of slow periods and averting financial rollercoasters.

- Credit Blemishes? No Deterrent: In medical factoring, the hero is a robust claim. Providers can secure funding even with less-than-perfect personal or business credit, offering a financial lifeline for those with credit challenges.

- Farewell to Financial Pains: Medical factoring provides a seamless and stress-free alternative, unlike the burdensome debt and interest of credit cards or loans. It allows providers to offer payment plans to customers without the distraction of looming financial obligations.

In essence, medical factoring lets providers trade away the hassle of collecting from insurers in exchange for fast access to working capital. They can focus on delivering great patient care with consistent cash flow restored.

How The Medical Factoring Process Works

1. Provider submits claims to factoring company

Providers initiate the process by submitting new or existing claims to the factoring company. Unlike the typical bureaucratic ordeal, this step is designed for ease, focusing on claims that have secured approval but await payment from insurance.

2. Factoring company advances up to 90% of claim value

The factoring company takes action once the claims are in, advancing up to 90% of the claim value. The remaining portion is set aside in a reserve account. This efficient maneuver ensures that funds materialize in the provider’s account within days, not weeks.

3. Insurers pay claims per usual terms and timelines

The burden of dealing with insurers is lifted from the provider’s shoulders. The factoring company takes charge of all aspects of collections, ensuring that payments from insurers align with the usual terms and timelines. This hands-off approach lets providers focus on patient care rather than collecting money from late paying clients.

4. Factoring company pays the remainder minus a fee

While the factoring company does its magic, a nominal fee is typically 1-5% of the advanced amount. This transparent fee structure ensures providers understand the financial dynamics clearly, without hidden costs.

5. Provider receives the total claim value, accelerated by weeks/months

The magic unfolds at the end of the process. Providers receive the total value of their claims, accelerated by weeks or even months. Liberated from the typical waiting game with insurers, cash flow is swiftly restored, empowering providers to cover ongoing expenses without undue delays.

In practice, providers can submit claims as frequently as needed. There are no upfront costs, monthly minimums, or term limits associated with transactions. It’s a flexible financing solution that scales seamlessly alongside any size practice.

Is Medical Factoring Better Than Traditional Financing?

Medical factoring offers healthcare providers access to growth capital without the inflexibility in repayment terms or the dilution of equity associated with traditional financing options. This financial flexibility proves invaluable in navigating the ever-changing landscape of the healthcare industry.

Business Line of Credit – While lines of credit demand sustained revenue and robust business credit, medical factoring assesses claim creditworthiness, providing a more inclusive financing option.

Term Loan – Unlike loans with fixed repayment schedules, medical factoring adapts seamlessly to revenue fluctuations, scaling repayments directly with claims processed.

Equipment Leasing – Conventional equipment leasing ties up credit with hardware purchases, whereas medical factoring offers pure working capital, freeing resources for essential operational needs.

Credit Cards – High interest rates and fixed monthly payments characterize credit cards, making them less cost-effective. With its scalable payments tied to claims, medical factoring offers a more economical and flexible solution.

Private Equity – Opting for equity financing often involves surrendering partial company ownership. In contrast, medical factoring preserves ownership, providing growth capital without impacting control.

What Providers Should Look For In A Factoring Company

| Variable | Key Insights |

|---|---|

| Specialized Industry Experience | Partner with deep medical billing knowledge for smoother transactions and minimized claim processing discrepancies. |

| Quick Funding Turnaround | Choose a partner with fast (1-2 days) and automated funding processes for prompt addressing of immediate financial needs. |

| Simple Onboarding | Opt for hassle-free onboarding, including efficient claims uploading, for a swift initiation of factoring without delays. |

| Flexible Terms | Seek flexibility with no monthly minimums or lock-in periods, tailoring factoring terms to unique financial requirements. |

| Complete Transparency | Ensure transparent fee structures for informed decision-making and a clear understanding of costs in the factoring relationship. |

| Strong Customer Service | Prioritize responsive customer service for addressing challenges and questions, fostering a positive and collaborative factoring experience. |

| Top-Tier Security | Opt for partners with top-tier security protocols to protect patient data and adhere to industry standards and regulations. |

| Positive Reputation | Choose established factoring companies with positive reputations and satisfied healthcare clients for reliability and credibility assurance. |

| Leveraging Fintech Innovations | Explore partners integrating advanced algorithms, automation, and practice management software for enhanced operational efficiency and a modernized experience. |

- Specialized Industry Experience: A partner with specialized knowledge in medical billing nuances understands the complexities of healthcare reimbursement. This expertise ensures a smoother transaction process, minimizing potential challenges and discrepancies in claims.

- Quick Funding Turnaround: Rapid access to funds is essential for healthcare providers facing immediate financial needs. Choosing a factoring partner with automated approval processes and a fast funding turnaround of 1-2 days enables providers to address urgent expenses promptly. Notably, Cashflow.io provides instant financing options.

- Simple Onboarding: The onboarding process sets the tone for the entire factoring relationship. A partner offering a straightforward and hassle-free onboarding experience, including the efficient uploading of claims, allows providers to initiate factoring quickly without unnecessary delays.

- Flexible Terms: Every healthcare practice is unique, and flexibility in factoring terms is crucial. Opting for a partner that provides flexibility with no monthly minimums or lock-in periods accommodates the varying financial demands of healthcare providers, allowing them to tailor the arrangement to their specific needs.

- Complete Transparency: Transparency in fee structures is paramount. Providers should thoroughly understand all fees associated with the factoring arrangement to make informed decisions. A partner that provides clear and explicit details about fees ensures that there are no unexpected costs, promoting a transparent and trustworthy relationship.

- Strong Customer Service: Responsive and supportive customer service is invaluable. When healthcare providers encounter challenges or have questions about the factoring process, having a partner with dedicated and responsive representatives fosters a positive and collaborative experience. This level of support is essential for the ongoing success of the factoring relationship.

- Top-Tier Security: Given the sensitivity of patient information, data security is a non-negotiable aspect. Choosing a factoring partner with top-tier security protocols ensures the protection of confidential patient data, aligning with industry standards and regulations.

- Positive Reputation: A partner’s reputation speaks volumes about their reliability and credibility. Opting for established factoring companies with a positive track record and satisfied healthcare clients assures the partner has a history of delivering on commitments and maintaining successful relationships within the industry.

Providers should focus on these considerations and explore partners that leverage the latest fintech innovations in medical factoring. Advanced algorithms, automation, and integration with practice management software contribute to operational efficiency and an enhanced overall experience for healthcare providers.

Who are the Best Medical Factoring Companies in the US?

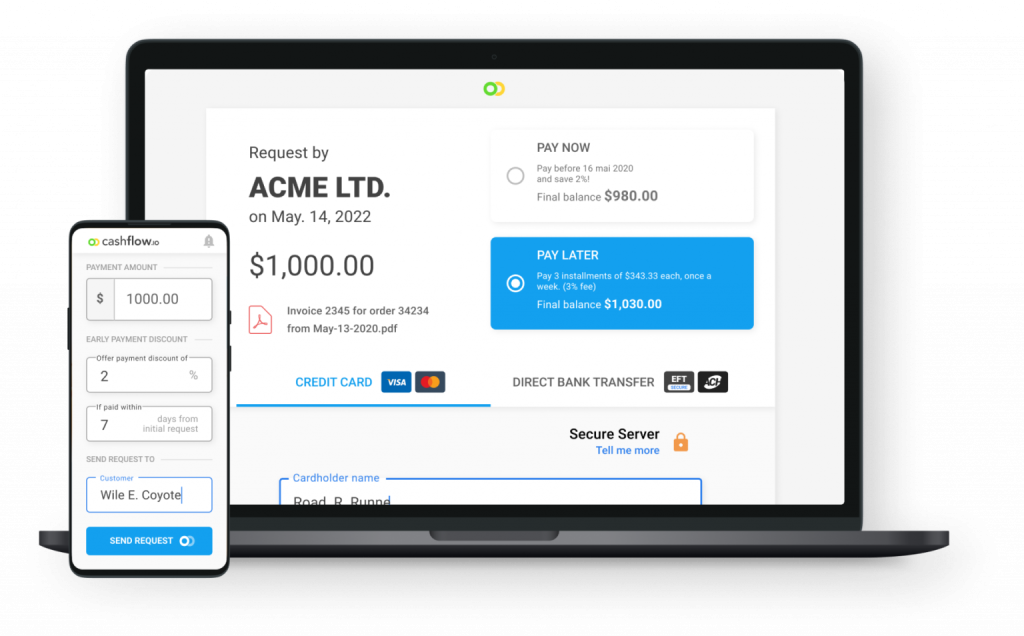

- Cashflow.io – Revolutionizes medical invoice factoring with cutting-edge features, empowering healthcare professionals to offer flexible payment plans through their eQuote tool. The platform’s automated billing streamlines backend processes, allowing medical professionals to prioritize patient care over manual billing tasks. Additionally, Cashflow.io facilitates effortless supplier and vendor payments, contributing to overall operational efficiency in medical practices.

- Heartland Financial Services – A healthcare factoring company based in Missouri, offering financing solutions ranging from $20,000 to $1,000,000. Specializing in healthcare industries, they focus on quick funding turnaround, providing a lifeline to businesses nationwide.

- Xynergy Healthcare Capital – A nationwide financial services company in Boca Raton, FL, specializing in receivable financing for the healthcare industry. They offer factoring amounts from $100,000 to $5,000,000, providing a vital financial resource for small healthcare businesses.

- US MED Capital – Operating from North Miami, FL, US MED Capital tailors factoring facilities and financing solutions for the specific needs of small healthcare businesses. Their factoring amounts range from $100,000 to $5,000,000, addressing the cash flow challenges healthcare providers face.

- Alleon Healthcare Capital – Based in Englewood, NJ, Alleon Healthcare Capital is a New Jersey factoring company dedicated to providing healthcare factoring services nationwide. They offer factoring amounts from $100,000 to $10,000,000, supporting businesses with diverse financial needs.

- eCapital – A versatile factoring company located in Aventura, FL, eCapital is committed to accelerating access to capital for companies in the United States, Canada, and the UK. With factoring amounts ranging from $10,000 to $50,000,000, they offer financial solutions across various industries, including healthcare.

What is the Best Tool for Medical Invoice Factoring in 2023?

Medical professionals can now elevate their financial strategies with Cashflow.io‘s innovative eQuote with FINANCE, unlocking new possibilities in the realm of medical invoice factoring. This feature empowers medical practices to offer flexible payment plans to patients while seamlessly accessing advanced funds. Monetizing receivables with financing surcharges adds a strategic edge to the financial playbook of medical professionals.

Elevating Patient Affordability with Payment Plans

In the dynamic landscape of medical practices, affordability is key for patients seeking necessary treatments. Cashflow.io’s Payment Plans feature introduces a game-changing element, allowing medical professionals to offer tailored payment plans. This not only enhances patient accessibility to treatments but also adds a layer of financial flexibility to medical practices.

Automated Billing for Unparalleled Efficiency

Cashflow.io doesn’t just stop at patient-focused features; it revolutionizes the backend processes for medical professionals. The introduction of automated billing simplifies and accelerates billing processes. This automation ensures that medical professionals can redirect their focus from manual billing tasks to what matters most—caring for their patients.

Effortless Supplier and Vendor Payments

Managing the back-office aspects of a medical practice can be time-consuming. Cashflow.io steps in as a comprehensive solution, enabling medical professionals to pay their suppliers and vendors effortlessly. By streamlining this process, Cashflow.io saves valuable time and enhances the overall efficiency of back-office management.

Incorporating these advanced features into the medical invoice factoring landscape positions Cashflow.io as a transformative tool for medical professionals. The ability to offer payment plans, streamline billing processes, and manage vendor payments seamlessly adds a layer of financial intelligence to medical practices. Cashflow.io stands at the forefront as the healthcare industry evolves, providing the necessary tools for medical professionals to thrive in a dynamic and patient-centric landscape.

In Conclusion

Don’t let slow insurance reimbursements threaten your ability to run a practice. With medical factoring from Cashflow.io, you always have the working capital to focus on patients, not payments. Stop wasting time chasing claims and fighting cash crunches. Contact Cashflow.io today to revolutionize how you access working capital and keep your practice financially healthy.

What is medical factoring, and how does it benefit healthcare providers?

Medical factoring allows healthcare providers to sell approved claims to funding companies, gaining immediate access to working capital. This accelerates cash flow, facilitates growth, and helps manage expenses efficiently.

How does medical factoring differ from traditional financing options for healthcare providers?

Unlike traditional options such as loans or lines of credit, medical factoring focuses on the creditworthiness of claims rather than the provider’s credit. It offers flexible terms, scales with revenue, and avoids the fixed repayment schedules of loans.

What steps are involved in the medical factoring process, and how quickly can providers access funds?

The process involves submitting approved claims to a factoring company, which advances up to 90% of the claim value. Funds are typically available within a few days. The factoring company handles collections, and the provider receives the remaining balance once the claim is paid.

What should healthcare providers look for in a medical factoring company?

Providers should prioritize companies with specialized industry experience, quick funding turnaround, simple onboarding, flexible terms, transparent fees, responsive customer service, robust security protocols, and a positive reputation. Integration with practice management software is also a valuable feature.