Government Contract Factoring Guide (Unlock Opportunities)

In modern business, effectively managing government contract payments can be quite challenging. For small and medium enterprises, delayed or pending payments from government contracts pose a significant hurdle in today’s economic climate. Government contract factoring is a pivotal solution to overcome this obstacle and optimize financial operations.

This comprehensive guide delves into the depths of this financial tool, offering a step-by-step roadmap to enable businesses to leverage the benefits of factoring. Covering crucial aspects such as mitigating financial risks, enhancing cash flow, navigating the application process, selecting the right factoring company, and capitalizing on technological innovations, this guide provides insights and strategies necessary for financial stability and growth.

What is Government Contract Factoring?

Government contract factoring, also recognized as government receivables financing or contractor factoring, is an advantageous financial solution for businesses supplying goods or services to governmental entities. Typically, the payment for such services often gets delayed, leading to prolonged waiting periods or cash flow constraints.

Under this arrangement, companies holding contracts with various government agencies, including the Federal Government, can leverage government contract factoring by selling their outstanding invoices or accounts receivable to a specialized company. Instead of enduring extended waiting times for payment, this approach provides immediate funding within days, eliminating the necessity to wait for the government’s net terms payment.

Once the factoring company acquires these invoices, it collects government agency payments. Upon receiving the payment, the business is relieved of further collection obligations. This financial tool offers a quick cash solution, enabling businesses to promptly meet operational and financial demands, thereby circumventing the prolonged payment cycles frequently associated with government contracts.

What are the Benefits of Government Contract Factoring?

| Benefit | Summary |

|---|---|

| Improved Cash Flow | Prompt access to funds, enhancing financial liquidity |

| Mitigating Financial Risks | Acts as a buffer against delayed government payments |

| Access to Immediate Funds | Direct and quick funding without accruing debt |

| Enhancing Creditworthiness | Strengthens financial profile, potentially improving credit |

| Streamlined Operations | Provides stable cash flow, enabling better operational planning |

| Growth and Expansion Opportunities | Enables seizing growth prospects and business expansion |

| Flexible Financing Alternative | Offers adaptable financial solutions, not bound by rigid terms |

1. Improved Cash Flow

Government contract factoring is a valuable financial strategy for businesses grappling with delayed accounts receivable payments. By selling their accounts receivable at a discounted rate, companies can promptly access funds that would otherwise be tied up, significantly bolstering their cash flow. This immediate liquidity empowers businesses to meet ongoing expenses, invest in growth initiatives, or seize business opportunities.

2. Mitigating Financial Risks

This financial tool acts as a protective shield against potential crises arising from delayed government payments. It acts as a buffer, protecting against financial instability caused by payment delays. This risk mitigation is crucial for small and medium enterprises, ensuring operational continuity without severe financial disruptions.

3. Access to Immediate Funds

Unlike traditional loans, government contract factoring doesn’t entail accumulating debt. Instead, it offers quick and direct access to funds, enabling businesses to efficiently meet their financial obligations, even amidst delays in government payments.

4. Enhancing Creditworthiness

Utilizing factoring for government contracts aids in strengthening a company’s financial profile. Prompt access to funds and timely bill settlements through factoring reflect positively on a business’s financial reliability, potentially enhancing its creditworthiness.

5. Streamlined Operations

Factoring government contracts facilitates streamlined operations by providing predictable and stable cash flow. This stable financial foundation allows businesses to better plan and execute their operations without worrying about fluctuations in revenue caused by payment delays.

6. Growth and Expansion Opportunities

The immediate injection of funds via factoring enables businesses to seize growth opportunities, such as expanding their operations, investing in new technologies (such as cash management tools), hiring additional staff, or exploring new market segments. It fosters flexibility and agility in pursuing growth avenues.

7. Flexible Financing Alternative

Government contract factoring offers a flexible financing alternative, allowing businesses to tailor their cash flow according to their specific needs. It’s not bound by rigid terms or prerequisites commonly associated with traditional lending options, providing more adaptable financial solutions.

How Government Contract Factoring Works

Invoice factoring for government contracts functions similarly to factoring for other types of invoices. The process begins when your business provides goods or services to a government entity and issues an invoice for payment. Instead of awaiting payment from the government agency, you sell the invoice to a factoring company in exchange for immediate cash. This company typically provides an advance payment of around 80% to 90% of the invoice value.

Following this, the responsibility for collecting payments from the government entity falls to the factoring company. As such, you won’t have to worry about collecting money from late paying clients. Upon receiving payment, the factoring company deducts its fee and other charges and then remits the remaining balance to you. This arrangement offers improved cash flow, greater flexibility, and reduced administrative burden, enabling you to cover daily expenses or fuel business growth as needed.

Requirements and Eligibility Criteria

It’s essential to note that there might be additional requirements or limitations when factoring government invoices, depending on the involved agency and contract terms. For instance, certain agencies might necessitate the factoring company’s registration or impose restrictions on the percentage of invoices eligible for factoring. Fortunately, Cashflow.io specializes in government factoring.

It’s crucial to thoroughly examine the contract terms and relevant regulations before initiating invoice factoring for government contracts. Collaborating with a reputable and experienced factoring company can significantly contribute to a smooth and successful arrangement.

What are the Limitations of Government Contract Factoring?

Government factoring has certain criteria for invoices to qualify. Typically, invoices must be less than 90 days old to meet the requirements for funding. However, there can be apprehensions among some government clients regarding factoring. It’s occasionally perceived as an indicator of financial instability.

Yet, in reality, numerous successful businesses view factoring as a strategic tool to optimize cash flow, simplify accounts receivable processes, and overcome cash flow shortages while scaling their business. Some past aggressive collection practices by specific factoring companies have created a negative impression of the process.

How to Pick a Government Invoice Factoring Company

When selecting the right factoring company, beyond considering contract terms, rates, customer service, and reputation, it’s crucial to delve deeper into specific details.

- Government Contract Experience: Seek a factoring company with a proven track record working with government entities. An experienced company understands the unique complexities and regulations associated with government contracts.

- Transparent Fee Structure: Ensure a clear understanding of all fees, including upfront costs, discount rates, and collection fees. Choose a company offering transparent and competitive rates.

- Flexibility in Services: Opt for a company that tailors its services to your specific requirements. Some may mandate factoring all invoices or set monthly minimums, while the best ones enable you to fund invoices selectively.

- Speedy Turnaround: Time efficiency is crucial in government invoice factoring. Look for a company that delivers prompt and efficient service, with a streamlined application process and funding within days.

- Reputable Track Record: Investigate the company’s reputation and review feedback from other businesses that have engaged with them. Choose a well-established company known for success and industry respect.

- Exceptional Customer Service: Prioritize a company that offers top-notch customer service, including dedicated account management and responsiveness to your needs. You should feel comfortable asking questions, and confident of receiving prompt and valuable assistance.

Comparison of Top Factoring Companies

| Company | Location | Industries Served | Factoring Amounts |

|---|---|---|---|

| Cashflow.io | Online | Government, Education, Medical, and more | Variable |

| Asset Commercial Capital | California | Business services, Construction, Government, Manufacturing, Staffing | $10,000 – $5,000,000 |

| Coeur Capital | Atlanta | Business services, Government, Manufacturing, Oil and gas, Staffing, Trucking | $10,000 – $2,500,000 |

| SouthStar Capital | Charleston, SC | Business services, Government, Manufacturing, Oil and gas, Staffing, Trucking | $50,000 – $5,000,000 |

| White Oak Business Capital | Bethesda, MD | Business services, Government, Manufacturing, Oil and gas, Staffing | $100,000 – $7,000,000 |

| Action Capital | Atlanta | Business services, Government, Manufacturing, Oil and gas, Staffing | $100,000 – $8,000,000 |

| Bankers Factoring | Dalton, GA | Business services, Government, Manufacturing, Oil and gas, Staffing | $10,000 – $9,000,000 |

- Cashflow.io: Top competitor that provides payment and invoicing solutions for government organizations. Offers customizable payment plans and links, automated payables management, and fast payments geared towards collecting payments for municipalities.

- Asset Commercial Capital: California factoring company provides invoice factoring and asset-based lending from $10,000 to $5,000,000. Serves business services, construction, government, manufacturing, and staffing.

- Coeur Capital: Atlanta factoring company offering working capital solutions and factoring services from $10,000 to $2,500,000. Serves business services, government, manufacturing, oil and gas, staffing, and trucking.

- SouthStar Capital: Charleston, SC factoring company providing working capital solutions. Serves business services, government, manufacturing, oil and gas, staffing, and trucking from $50,000 to $5,000,000.

- White Oak Business Capital: specializes in financing solutions for government contractors and other industries. Provides amounts from $100,000 to $7,000,000.

- Action Capital: Atlanta government factoring company founded in 1959. Focuses on financing businesses with needs of $100,000 to $8,000,000. Serves business services, government, manufacturing, oil and gas, and staffing.

- Bankers Factoring: Dalton, GA factoring company specializing in non-recourse factoring and purchase order financing. Provides amounts from $10,000 to $9,000,000 for business services, government, manufacturing, oil and gas, and staffing.

What is the Typical Application Process for Government Contract Factoring?

Step-by-Step Guide

- Contact Factoring Company: Contact the selected company to express your interest and initiate discussions about the factoring process. This step involves understanding the terms, conditions, and services offered.

- Submission of Essential Documents: Provide vital documentation required by the factoring company. This typically includes a comprehensive collection of invoices intended for factoring, financial statements demonstrating the business’s financial health, and specific details regarding government contracts.

- Review and Approval Process: The factoring company meticulously assesses the submitted documentation to evaluate the legitimacy and viability of the government contracts. Following this scrutiny, a decision is made by the factoring company to proceed with the factoring process.

Documentation Required

- Invoices: Present an extensive list of invoices intended for factoring, indicating completed or ongoing transactions with government entities.

- Financial Statements: Provide detailed financial statements, a key component in establishing the financial robustness and stability of the business. These statements serve as a tool for the factoring company to gauge the business’s fiscal health.

- Government Contracts: Provide evidence or details substantiating the fulfillment or completion of government contracts. This evidence acts as confirmation and validation for the authenticity of the invoices intended for factoring.

Tips for Successful Government Contract Factoring

Effective client relationships are the cornerstone of successful government contract factoring. Establishing and nurturing transparent communication channels ensures a smooth transition during the factoring process. This includes proactively engaging with clients to discuss the shift towards factoring and its implications.

Maintaining clear and open dialogue helps address any concerns or queries that might arise during this transition, fostering a sense of partnership between all involved parties. Additionally, aligning the expectations of the business and its clients is instrumental, emphasizing the benefits of factoring to all stakeholders. Demonstrating the value and impact of factoring on cash flow, operational fluidity, and financial stability reinforces the client’s confidence in the process.

Alongside relationship management, avoiding common pitfalls is imperative for a successful factoring experience. Being vigilant about potential drawbacks such as exorbitant fees, non-recourse clauses, and extended contract terms is essential. Mitigating these risks requires thoroughly understanding the factoring agreement terms and conditions. It involves scrutinizing the contract terms meticulously, negotiating where possible, and seeking favorable arrangements that are aligned with the business’s goals.

Finally, educating yourself about the nuances of the factoring process, its implications, and the associated costs can be instrumental in avoiding pitfalls.

What is the Best Tool for Government Receivables Financing in 2023?

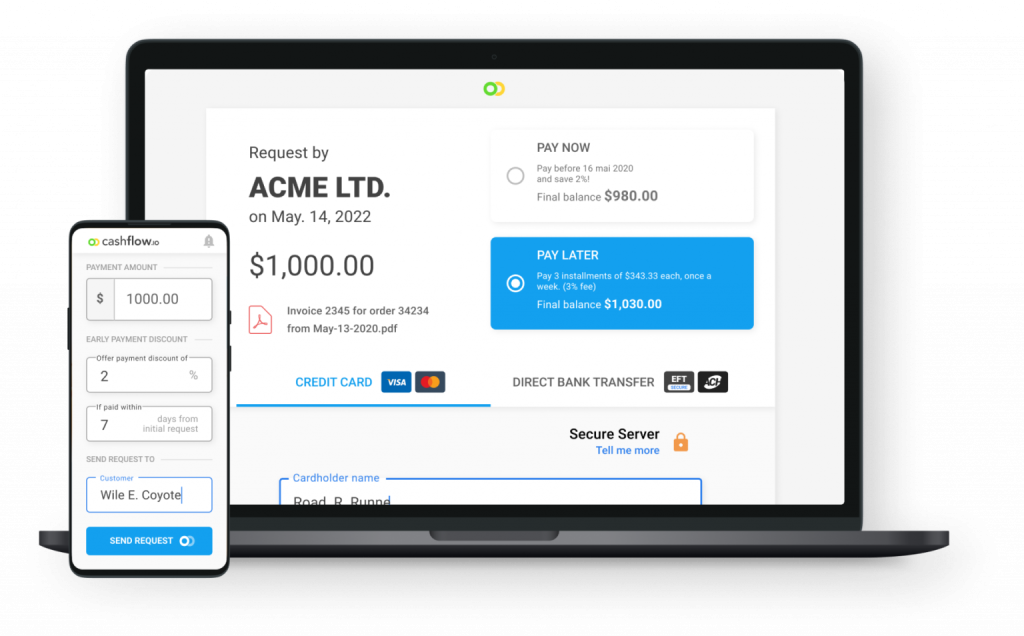

The optimum tool for streamlined government receivables financing is Cashflow.io, an all-encompassing financial platform meticulously crafted to efficiently manage financial transactions. It specializes in providing tailored services to meet the unique needs of businesses engaged in government receivables financing processes.

Efficiency Through Automated Citizen Payments

Simplify the collection of payments from citizens with Cashflow.io, streamlining the process by facilitating automated credit card and bank transfer transactions upon invoice receipt. This functionality ensures timely payments, fostering strong government-citizen relationships and optimizing cash flow for businesses engaged in receivables financing.

Customized Payment Plans for Empowering Citizens

Cashflow.io empowers government entities to create customized payment plans, assisting citizens who need assistance in catching up on payments. These personalized plans ensure citizens can meet their financial obligations, optimizing cash flow management and reducing disruptions in government receivables financing.

Empowering Financing Growth for Efficient Government Transactions

The platform provides swift and efficient financing solutions, expediting approval processes and enabling same-day disbursement of funds. These financial options facilitate capital accessibility, supporting growth opportunities for entities engaged in government receivables financing.

Dedicated Customer Support for Seamless Operations

Cashflow.io takes pride in its customer-centric approach, offering dedicated customer support through various channels. This support system ensures uninterrupted financial operations for entities involved in government receivables financing, providing peace of mind and smooth navigation through financial landscapes.

Seamless Integration and Scalability for Government Financing Needs

Cashflow.io seamlessly integrates with existing financial infrastructures, ensuring smooth operations for government receivables financing. Its scalability supports the evolving needs of entities handling government receivables, aligning perfectly with expansion plans and growing demands.

Enhanced Oversight and Security for Government Receivables Financing

The platform enhances oversight through mobile-friendly dashboards, allowing easy access to financial data on the go. Robust security measures fortify the protection of sensitive financial data, ensuring a reliable and secure environment for government receivables financing processes, with adherence to industry-standard guidelines.

Conclusion

Government contract factoring is a powerful financial tool for businesses, especially small to medium enterprises, seeking to optimize their cash flow and navigate the challenges of delayed government payments.

By carefully selecting the right factoring company, understanding legal and regulatory requirements, and proactively addressing potential challenges, businesses can unlock significant opportunities and ensure financial stability.

FAQs

What is the typical cost associated with government contract factoring?

The cost may vary depending on the factoring company and specific contract terms. Generally, it includes a discount on the total invoice amount.

Can a business opt for selective factoring of specific invoices?

Yes, some factoring companies allow selective factoring, where businesses can choose specific invoices to factor rather than factoring all outstanding invoices.

How long does the approval process for government contract factoring usually take?

The approval process duration can vary, but typically it ranges from a few days to a couple of weeks, contingent upon the completeness of the provided documentation and the chosen factoring company’s process.

Are there any risks involved in government contract factoring for businesses?

Potential risks are associated with government contract factoring, such as high fees, non-recourse clauses, and limitations in funding.

How can small businesses leverage factoring for sustainable growth?

Small businesses can leverage factoring for growth by enhancing their cash flow, taking on larger projects, and having immediate access to funds without incurring debt, ultimately fostering stability and expansion.