The 5 Best BILL.com Alternatives in 2023

While BILL.com offers useful billing and invoicing features, its limitations frustrate users. According to customer reviews, the main pain points with BILL.com are poor customer service, an unintuitive interface, a lack of customization options, and problems with payment processing delays.

Specifically, users express great frustration over the inability to reach a real person for support via phone when issues arise. The interface is clunky and confusing when managing multiple invoices or bills. Customization options are limited, making BILL.com a poor fit for businesses with more complex needs. And the payment processing system inexplicably holds funds for an unacceptable period of time before deposits, according to users.

With increasing aggravation over these restrictive limitations, many BILL.com customers are now exploring alternative billing and invoicing platforms. They need systems with responsive phone support, flexible and easy-to-use interfaces, strong customization capabilities, and faster payment processing. As a result, options like Cashflow.io, Melio, and Stampli are gaining more attention for better serving customers in these important areas.

Alternative #1: Cashflow.io

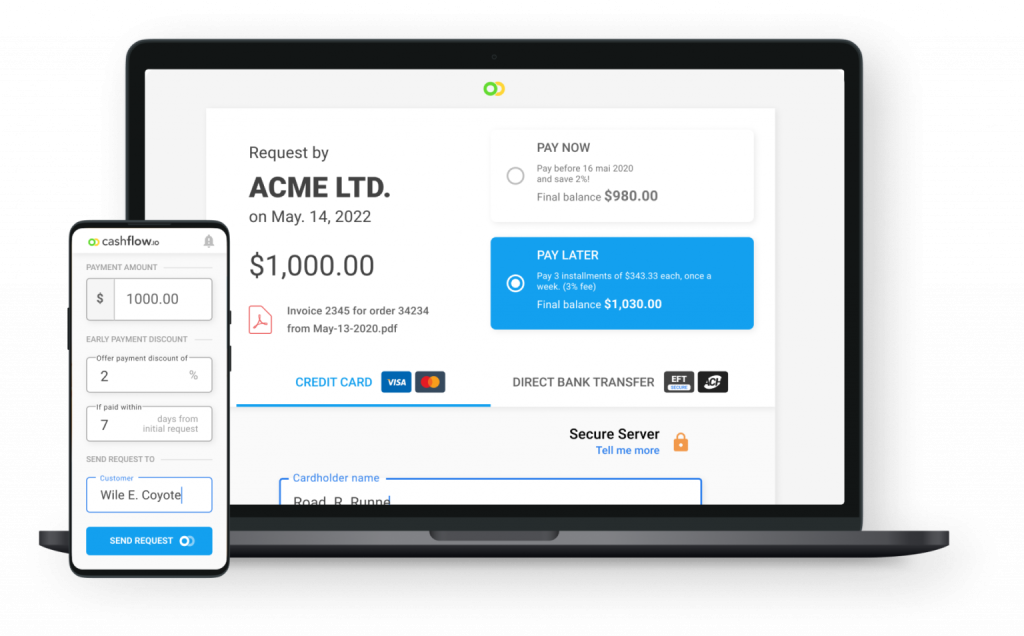

Businesses today need flexible tools to optimize cash flow and simplify financial operations. Rather than using a patchwork of different systems, many are turning to consolidated platforms that centralize payables, receivables, and financing. Cashflow.io stands out as an all-in-one solution that can streamline these critical processes.

With Cashflow.io, paying vendors is easy since you can forward invoices to a unique email to trigger automated transfers. This eliminates tedious manual payments across bank portals. On the receivables end, you can create custom payment schedules, send automatic reminders, and collect on time using pre-authorized debits from customers. These features boost cash flow by reducing late payments. Cashflow.io enables transaction financing to get quick approvals and same-day funding for large orders. Repayments are handled automatically as the customer pays down their balance.

By bringing payables, receivables, and financing together on one seamless platform, Cashflow.io delivers significant time savings and cash flow advantages. Consolidating these financial workflows is the future, and Cashflow.io leads the way.

Key Features

- Automate and simplify: Streamline your entire process, from quote to cash. Send, receive and finance customer orders more efficiently than ever.

- Bring your own payments: Quickly connect your own payment processor to start receiving digital payments with no disruption.

- No integration costs: Get started quickly – for free. Pay as you grow.

- Work from anywhere: Manage your business transactions on any device, using simple but powerful cloud-based tools.

- Built for teams: Set permissions for each user in your team to ensure they can access only what you want.

Streamline Payables with Ease

Cashflow.io offers a unique solution to automate payables through a consolidated platform. By forwarding invoices to a designated email address, automatic bank transfers are triggered, eliminating the tedious manual process. This streamlined approach saves valuable time, allowing your business to focus on more strategic tasks.

Responsive Customer Support at Your Service

With Cashflow.io, you can access an efficient customer support team ready to assist you through phone, chat, or email. Their prompt and effective resolutions to any issues ensure that your operations continue smoothly without extended interruptions. This level of support acts as a safety net, providing peace of mind for your business’s daily financial management.

Enhance Cash Flow with Tailored Payment Solutions

Cashflow.io provides the flexibility to design custom recurring payment plans for each client. Automated payment reminders and pre-authorized debits ensure timely payments, enhancing your cash flow. These features contribute to financial stability, allowing your business to receive payments confidently.

Immediate Financing for Expanding Opportunities

Accessing financing for substantial customer orders is made simple with Cashflow.io. Receive near-instant approval and same-day funding directly on the platform. This immediate access to capital empowers your business to confidently pursue larger opportunities, fostering growth and expansion.

Effortless Setup, Personalization, and Growth

Cashflow.io offers a seamless onboarding process and no-cost connection to your business bank accounts and payment processors. Its extensive adaptability suits your changing business requirements, scaling with you as your enterprise expands. This flexibility ensures the platform remains a perfect fit, regardless of how your business evolves.

Intuitive Tools for Efficient Management

Cashflow.io organizes your financial information into accessible dashboards on any device. This clear overview and user-friendly experience accommodate mobile business management, saving time and effort. The convenience of having financial data at your fingertips enhances decision-making and overall efficiency.

Unmatched Security for Uncompromised Safety

Security is paramount with Cashflow.io, employing robust measures such as AES-256-bit encryption and compliance with SOC and PCI guidelines. Using certified Level 1 PCI payment processors, your sensitive information is handled carefully. This commitment to security ensures that your business’s financial data remains protected, allowing you to operate with complete peace of mind.

Alternative #2: Melio

If you’re looking to save money on billing and invoicing, Melio is a more affordable BILL.com alternative. Melio offers free domestic bank transfers and debit card payments, only charging a 2.9% processing fee for credit card transactions. In contrast, BILL.com has paid monthly subscription plans starting at $39 per user.

Melio provides a basic but easy-to-use platform for accounts payable automation. You can conveniently pay vendor bills online and track payment status. However, Melio has fewer advanced features compared to BILL.com. For example, Melio only integrates with QuickBooks for accounting software, while BILL connects to many systems.

BILL.com is better if you need robust accounts receivable capabilities, customizable invoices, international payments, and extensive reporting. But if your needs are simple, Melio delivers core payment functions for free. Its straightforward interface works well for small businesses looking to cut costs.

So, weighing the two options, Melio is the way to go for basic bill payment automation on a tight budget. But BILL.com offers more complete financial management tools if you require advanced invoicing, global payments, and analytics.

Alternative #3: Tipalti

If you need to pay international suppliers or partners, Tipalti is a great BILL.com alternative. Tipalti offers ACH, wire transfers, PayPal, and check payments. In contrast, BILL.com’s international payment capabilities are more limited.

Tipalti also provides sophisticated accounts payable automation features like PO matching, global tax compliance, and supplier onboarding portals. BILL.com has a more basic invoice workflow. However, BILL.com offers full accounts receivable capabilities that Tipalti lacks. BILL.com also directly integrates with more accounting software options.

So in summary, for domestic-focused small businesses, BILL.com provides solid core billing and payment features. But Tipalti is ideal for larger or global organizations that must pay suppliers and partners abroad in local currencies. Its advanced AP automation and compliance make it worth the additional cost.

Alternative #4: Stampli

Stampli is a great alternative to BILL.com if you want advanced accounts payable automation. Stampli offers features like AI-powered data capture, customizable workflows, centralized communications, and advanced analytics. This provides more robust AP management versus BILL.com’s more basic invoice processing.

However, BILL.com has full accounts receivable capabilities that Stampli lacks. BILL.com also connects with more accounting software tools out of the box. In summary, for companies needing advanced automation on the payables side, Stampli is the superior pick. But BILL.com is better for end-to-end AR/AP management and broader accounting software integrations.

Stampli shines for organizations focused solely on optimizing and scaling payables workflows. But BILL.com offers a fuller financial management solution for those handling both accounts payable and accounts receivable.

Alternative #5: AvidXchange

AvidXchange offers an automated accounts payable solution, particularly for mid-market businesses. It offers automation of the purchase-to-pay process, intelligent invoicing, and automated payments and approval processes. While AvidXchange runs a quote-based system, BILL.com’s pricing is transparent. BILL.com is better suited for smaller ventures, offering an opportunity to set up recurring billing, while AvidXchange does not.

If you’re looking for a solution that caters to mid-market businesses with robust integration capabilities, AvidXchange might be the right choice. On the other hand, if you’re a small or medium-sized business seeking a transparent pricing model and quick setup, BILL.com could be the better option.

What is the best BILL alternative?

| Cashflow.io | Melio | Tipalti | Stampli | AvidXchange | |

|---|---|---|---|---|---|

| Key Features | All-in-one solution, Automated payments, Custom payment schedules, Immediate financing, Unmatched security | Basic accounts payable automation, QuickBooks integration | International payments, Advanced AP automation, Compliance | AI-powered data capture, Customizable workflows, Advanced analytics | Innteligent invoicing, automated accounts payable, purchase-to-pay process, and payment approval. |

| Best Suited For | Comprehensive financial management for mid-market businesses | Basic bill payment automation on a tight budget | Global organizations needing to pay abroad in local currencies | Organizations focused solely on optimizing and scaling payables workflows | Mid-market businesses |

| Pricing Considerations | Pay as you grow, No integration costs | Free domestic bank transfers, 2.9% for credit cards | Additional cost for advanced features | Not specified | Quote-based system |

| Integration & Support | Extensive adaptability, Responsive customer support | Limited integration | Advanced AP automation | Advanced automation, Limited AR capabilities | Robust integration capabilities, Automation of purchase-to-pay process |

Conclusion

In conclusion, if you’re frustrated with the limitations of .com and are exploring alternatives, several great options are available. After reviewing and comparing some top alternatives, we recommend Cashflow.io as the best all-in-one solution for comprehensive financial management. With its streamlined platform, responsive customer support, and an array of features to optimize cash flow, this platform stands out as the top choice.

To learn more about how Cashflow.io can benefit your business, visit their home page to request a demo or sign up for a free trial.